Leadership needed amid ghost of 1998 crisis

Many Indonesians have not been able to get over the trauma they endured during the 1998 crisis.

Change Size

As the rupiah plunged last week to less than Rp 14,800 per the United States dollar, the memories of the 1998 Asian financial crisis resurfaced. (Shutterstock/File)

As the rupiah plunged last week to less than Rp 14,800 per the United States dollar, the memories of the 1998 Asian financial crisis resurfaced. (Shutterstock/File)

A

s the rupiah plunged last week to less than Rp 14,800 per the United States dollar, the memories of the 1998 Asian financial crisis resurfaced. As the rupiah continues to fall, it is understandable that many people have started worrying, speculating that another crisis like the one in 1998 is around the corner.

The crises in Turkey and Argentina have brought other emerging economies into the spotlight and under the heavy scrutiny of global investors. Along with Turkey and Argentina, India, Brazil and Indonesia have been dubbed the “fragile five” (FF) among analysts.

Their currencies have not only suffered the contagion of the lira and peso crises, but are also suffering a negative impact from the tightening US’ monetary policies.

The Argentine peso has suffered the most, depreciating 60 percent from the beginning of the year through the end of August. During the same period, the Turkish lira depreciated 40 percent, the Indian rupee 10 percent and the Brazilian real 20 percent. Meanwhile, the rupiah depreciated 8.8 percent, the smallest depreciation among the FF currencies.

Looking at the macroeconomic indicators of these five countries, it is not clear, which indicator has been the determining factor for investors to pull their money from these countries. As the depreciation of their currencies varies, it is also not clear, which indicator has had the greatest impact on the depreciation.

The gross domestic product (GDP) growth of these countries has no direct link to the severity of the currency depreciation. The Turkish economy grew 7.4 percent in 2018 while Brazil’s GDP growth was only 1.6 percent; yet the Turkish lira has depreciated twice as much as the Brazilian real.

India’s GDP growth hit 8.2 percent in June, the highest in the world, even surpassing China’s growth; but the rupee has depreciated more than the rupiah.

Fiscal deficits in the FF also do not give a clue as to the extent this factor influenced investor assessment of the countries’ vulnerability to the crisis. The Turkish budget deficit was only 1.5 percent of GDP, the best among the FF. Brazil’s budget deficit hit 7.8 percent of GDP, the worst among the FF, but the Brazilian real depreciation was only half the Turkish lira’s.

Current account deficits could be a factor that weighs heavily in investor assessment of a country’s risk. A current account deficit has to be financed externally, so investors would look at a country’s ability to service its debt. The fact that Argentina and Turkey suffered highest current account deficits among the FF (respectively 6.3 percent and 6 percent of GDP) seems to have a direct link to the extent of their currencies’ depreciation.

Inflation is another factor that seems to weigh heavily toward a country’s vulnerability to economic shock.

Argentina and Turkey have the highest inflation among the FF (31 percent and 14.4 percent, respectively), with the others all recording less than 5 percent inflation. Indonesia has 3.1 percent inflation and a 5.25 percent interest rate, both the lowest among the FF.

Argentina responded to increased inflation by raising its interest rate by 1,500 basis points to 60 percent, the highest among emerging economies. Turkey used unorthodox policies in responding to the lira’s fall and increased inflation by refusing to hike its interest rate.

Turkish President Recep Tayyip Erdogan has unnerved foreign investors by resisting calls for interest rate hikes to reign in the rampant inflation. “Interest rate is the mother and father of all evils,” he said.

The Turkish central bank only used trivial means to stem the slide of such as increasing the tax on foreign currency deposits while reducing tax on lira deposit. But these policies seem to have no significant impact.

External debts seem to be another important point for investors to consider in a country’s resilience to vulnerability. The higher a country’s external debt, the more exposed it is to changes in its currency’s exchange rate.

Unfortunately, most of the FF’s debts are denominated in foreign currencies, primarily in the US dollar. Argentina’s debts hit 57 percent of GDP, and 70 percent of that debt is denominated in foreign currencies. Turkish debts reached 50 percent of GDP and totaled US$453 billion.

Of this, a total $181.8 billion was due to mature within a year from March 2018. But Turkey only has $85 billion in its reserve, less than half of the debt that has to be paid.

Indonesia’s foreign debts totaled $355.7 billion or 34.8 percent of GDP as at June 2018, according to Bank Indonesia (BI). Of that total, only $45 billion are due to mature within a year. But BI currently has $118 billion in its reserve, equivalent to 262 percent of Indonesia’s short-term debt.

The extent of changes in a country’s currency value is the end result of the interplay of several economic indicators as perceived by investors. The fact that the rupiah depreciated the least among FF currencies reflects investor’s perception on the strengths and the weaknesses of the Indonesian economy.

Many Indonesians have not been able to get over the trauma they endured during the 1998 crisis. The public and business players generally see market turmoil and the rupiah’s slide as a ghost of the Asian crisis. To overcome this, it needs more than a technocratic solution.

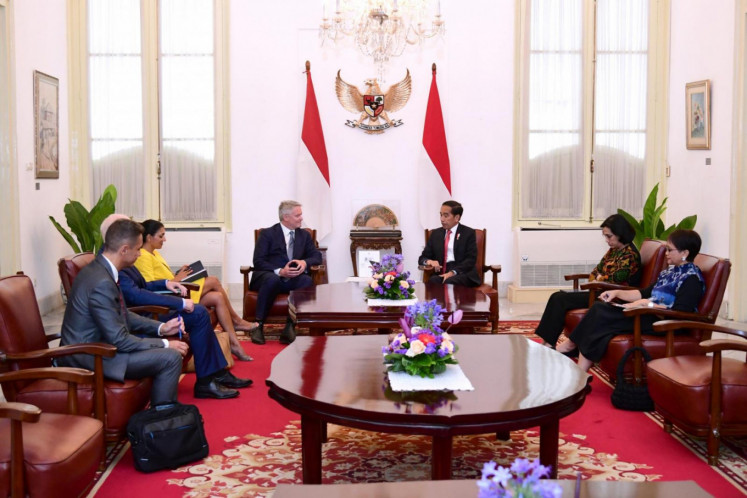

Economics Nobel laureate Paul Krugman wrote: “At such times, the quality of leadership suddenly matters a great deal. You need officials who have enough credibility that the market would give them the benefit of the doubt”. We will see if President Joko “Jokowi” Widodo and his officials are entitled to this benefit.

***

The writer is the commissioner of a publicly listed oil and gas service company.