BNI enhances mobile banking with brand new features

Change text size

Gift Premium Articles

to Anyone

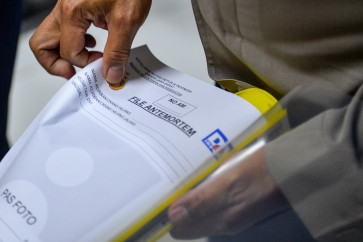

BNI presents new innovative features to meet customers’ needs in accordance with advancements in technology and business. (Photo: BNI)

BNI presents new innovative features to meet customers’ needs in accordance with advancements in technology and business. (Photo: BNI)

P

T Bank Negara Indonesia (Persero) Tbk., or BNI, is upgrading the quality of its services to provide a better, more comfortable customer experience.

BNI vice president Adi “Susi” Sulistyowati remarked that the company was committed to making changes to add value to its services, including mobile banking. One of the major priorities is continuous improvements to user experience.

BNI also presents new innovative features according to customers’ needs in accordance with advancements in technology and business.

“We hope that this new feature will help customers fulfill all their needs through services, whether transactions or investment. More importantly, this move is a demonstration of BNI’s determination to become the best banking institution in terms of services and performance,” she said.

Susi added that the company was pushing for the growth of its user acquisition and activation of transactions through different programs and promotions, both on BNI’s part and with partners such as e-wallets, BI FAST and monthly billing partners (PLN) and top-up (telco). The promotions can be utilized by all customers, especially with the added prizes and benefits they receive from transactions using BNI Mobile Banking.

“We hope that this will attract and satisfy more customers while increasing the use of BNI Mobile Banking. Moreover, there is fierce competition in the transaction business. All industries are focused on giving the most reliable and comprehensive service though digital banking channels,” she explained.

BNI Mobile Banking currently has over 12.4 million applicants, which showed growth from 34.7 percent year on year (yoy) with transactions growing by 34.8 percent yoy. The BNI Mobile Banking application also has excellent ratings on both Google Play and the App Store.

The number of transactions as of June 2022 between banks and interbank in BNI channels, especially BNI Mobile Banking, showed a 32.3 percent increase in transactions and 28.5 percent increase in transaction amount yoy. VNI Mobile Banking transactions have dominated 50 percent of the total transactions and even exceeded transactions through automatic teller machines (ATMs) — an indicator that BNI customers have been actively making transactions through the digital channel anywhere and anytime.

“We can see that stronger transactions-based current account savings accounts [CASAs] will promote more sustainable business growth. Therefore, we need to continue with improvements to BNI Mobile Banking’s capabilities,” Susi concluded.