Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsRegulators to play in ‘sandbox’ with infant fintech firms

Change text size

Gift Premium Articles

to Anyone

F

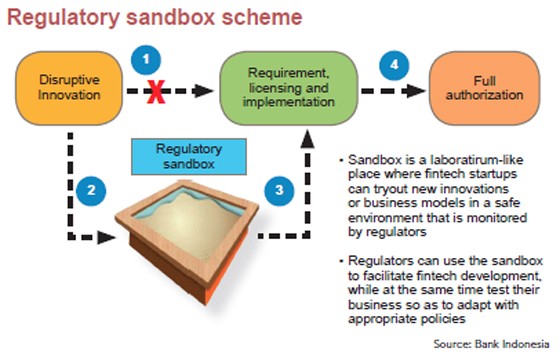

inancial technology (fintech) startups offering payment services will be invited to a safe space where they can test any service they want to offer to consumers under the supervision of the central bank before it issues regulations and allows full authorization.

The safe space, globally known as a “regulatory sandbox”, has been adopted in many countries around the world including Singapore and the UK to foster the infant but booming fintech industry.

“[A sandbox] is used by business players to test out innovative products or business models. It is a tool for regulators in facilitating innovation development and in testing policies that will be issued,” Bank Indonesia (BI) wrote in its presentation slides to journalists on

Friday.

The central bank will also set up a designated fintech office to overlook the sandbox and deal with any review and research, as well as the facilitation of fintech players to network and innovate.

The plan comes as fintech industry-offered payment services have begun to mushroom in Indonesia, with players already on stream offering e-wallets, online payment services and interbank transactions free of charge.

Regulatory sandbox scheme((Bank Indonesia)/-)

Regulatory sandbox scheme((Bank Indonesia)/-)

Fintech companies offering lending, capital market and non-bank financial services such as crowdfunding and peer-to-peer lending products will be regulated under the Financial Services Authority (OJK).

Both BI and the OJK have recently unveiled plans to issue rules before the end of the year to regulate fintech players’ activities so they can operate safely as the burgeoning industry has facilitated an estimated Rp 40 trillion (US$3.04 billion) in transactions over the past two years.

The Indonesian Fintech Association applauded the planned sandbox approach as it will serve as a tangible platform for all fintech initiatives and innovations to be tested into the regulatory system.

“Thankfully, when everyone is on the same page, any developments in fintech can be easily adopted into regulation. This concept is a good and supportive one as shown by many countries implementing it toward success,” the industry group’s secretary-general Karaniya Dharmasaputra said.

He added that fintech’s innovative struts in the country’s financial industry had always been struggling to be accommodated into proper regulation.

With the collaborative sandbox, regulators and fintech players can come together to test the capabilities when they are regulated.

Around 61 percent of local fintech players describe the current regulatory process as lagging behind and lacking clarity, according to a recent survey from global consulting

firm Deloitte in conjunction with the Indonesian Fintech Association.

They have demanded clear regulations and partnerships with

regulators.

CEO of QR-code based fintech service DimoPay, Brata Rafly, commented that the upcoming sandbox would be a good thing for the industry as every step they would take would have the possibility of being standardized, making fintech industry players more aware of what to do.

“Especially because trust is something that is crucial for fintech firms here, and with any initiatives from the regulators of course the public trust in the industry will grow,” he said.

Go-Jek CEO Nadiem Makarim, whose Go-Pay e-wallet serves customers of all its services, which range from motorcycle taxis and food delivery, to beauty and cleaning services, said what players wanted was an open environment in which to experiment.

“We need an open enough environment to allow startups to fail in a controlled way, experiment and keep innovating,” he told attendants of the first-ever 2016 Indonesia Fintech Festival & Conference last week.