Amnesty confusion mounts

Change Size

Ken Dwijugiasteadi (Antara/-)

Ken Dwijugiasteadi (Antara/-)

R

enowned English philosopher Francis Bacon once claimed that knowledge is power, but in the case of the tax amnesty, too much knowledge can leave people powerless.

Fitria Nursanti, an employee, only became more perplexed after reading the latest regulation issued by the Directorate General of Taxation on Monday.

“It says I can just choose to correct my SPT [tax form], but that will mean I am not free from future tax probes. However, why should I avail of the amnesty and pay a redemption fee if I have met all my tax obligations?” she said on Tuesday.

Meanwhile, Teddy, not his real name, said he had perused the same regulation, but could not find the answer to his taxation problem, let alone answer the bigger question as to whether he should even be taking part in the program.

“The regulation still doesn’t provide any clarity on nominee issues,” he said, referring to a system whereby a foreigner purchases a plot of land using an Indonesian’s name.

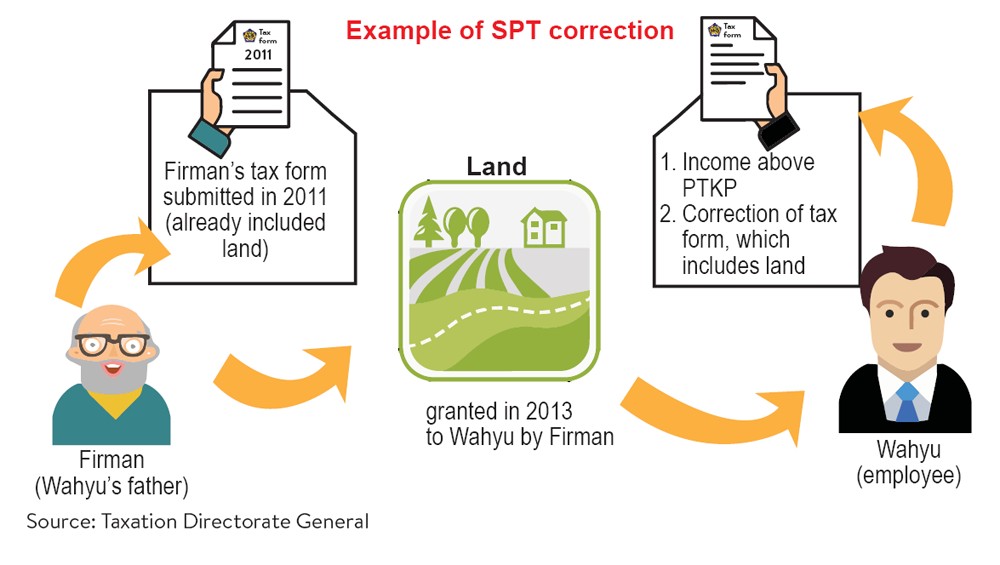

The regulation only addresses issues such as inheritance, grants and SPT correction, but Teddy said the more he read, the more he became confused.

For both Teddy and Fitria, the regulation, and other information that is currently circulating, has not given them — or millions of other small taxpayers — peace of mind, a fact acknowledged by experts.

The government has so far issued a law, five Finance Ministry regulations, four Directorate General of Taxation regulations and three Directorate General of Taxation general circulars, but Danny Darussalam Tax Center partner Bawono Kristiaji argued that simplicity should be of the essence.

He said the lack of clarity had resulted in public wariness as reflected in social media, adding that the government should provide information that could easily be understood by the public and provide practical simulations for them in filling in the tax amnesty form.

The tax amnesty program, which was initially believed to be aimed at wealthy Indonesians with hidden assets stashed overseas, has sparked concern among small and medium taxpayers, who feel “targeted” by the program and its complicated procedures.

An online petition, filed at change.org on Aug. 26, had already been signed by 7,737 supporters as of Tuesday evening. It demands that the government stick to its initial track.

The hashtag #stopbayarpajak [stop paying taxes] has also been trending on Twitter, challenging the amnesty, which many regard as pardoning major tax crimes while victimizing smaller taxpayers.

Indonesian Tax Consultant Association (IKPI) secretary Kismantoro Petrus said the numerous regulations, whatever they might be, would not help in attracting people to avail of the amnesty if tax officials themselves did not comprehend the regulations’ content. “The government needs to conduct training among tax officials,” he said.

Meanwhile, Director General of Taxation Ken Dwijugiasteadi told a press briefing that he had issued the latest regulation to answer the public’s questions on the matters that had gone viral on social media.

At the same time, he reiterated the government’s commitment to pursuing the “big fish”, instead of focusing on small taxpayers. The government says it has created a task force to handle the big taxpayers and monitor them on a daily basis.

Data from the directorate general on Tuesday showed that the government was still far below its targets regarding the amnesty’s penalty payments, declared assets and repatriated funds.

Penalties had only reached 1.6 percent of the target, while the declared assets and repatriated funds amounted to only 3.2 percent and 1 percent of their goals, respectively.

Finance Minister Sri Mulyani Indrawati said the government would wait on the big taxpayers as it seemed that they needed more time to submit their tax amnesty applications. The program will end in March 2017.

________________________________________

Key points of Taxation Directorate General Regulation No. 11/2016:

* Taxpayers not required to avail of tax amnesty:

- Individual taxpayers whose income is below the non-taxable income (PTKP) of Rp 54 million (US$4,072) per year or Rp 4.5 million per month, including:

* Farmers, fishermen, domestic workers

* Pensioners who rely solely on pension payments

* Inheritance that does not generate additional income above the PTKP

* Recipients of inheritance who do not receive fixed incomes or earn less than the PTKP

- Individual taxpayers who opt to correct their annual tax form (SPT)

- Individual taxpayers whose assets have been documented on the SPT of a family member

- Indonesian citizens who live overseas for more than 183 days within one year and who do not obtain an income from Indonesia

* The Taxation Directorate General will not challenge or correct the value of assets assessed and reported by taxpayers when availing of the tax amnesty

JP/Swi

______________________________

To receive comprehensive and earlier access to The Jakarta Post print edition, please subscribe to our epaper through iOS' iTunes, Android's Google Play, Blackberry World or Microsoft's Windows Store. Subscription includes free daily editions of The Nation, The Star Malaysia, the Philippine Daily Inquirer and Asia News.

For print subscription, please contact our call center at (+6221) 5360014 or subscription@thejakartapost.com