Waiting for hidden potential in Indonesian bond market

Change Size

A trading floor of Indonesia Stock Exchange (IDX) building. (thejakartapost.com/Wienda Parwitasari)

A trading floor of Indonesia Stock Exchange (IDX) building. (thejakartapost.com/Wienda Parwitasari)

I

ndonesian bond markets in the last week of August dropped in line with global uncertainty due to global expectations of an increase in the US Federal Reserve fund rate that led to foreign outflow, making the bond selling price decline.

However, data showed the potential for increasing demand of bonds until 2017.

According to Indonesia Bond Pricing Agency (IBPA) data, the government and corporate bond index dropped from Aug. 22 to Aug. 29 along with foreign fund outflows from the Indonesian bond market worth Rp 6.63 billion during the week.

Gopal Nurfalah, an investment manager at PT Tugu Reasuransi Indonesia, revealed that the bond market correction was affected by the uncertainty of the Fed’s decision. This also encouraged capital outflows last week.

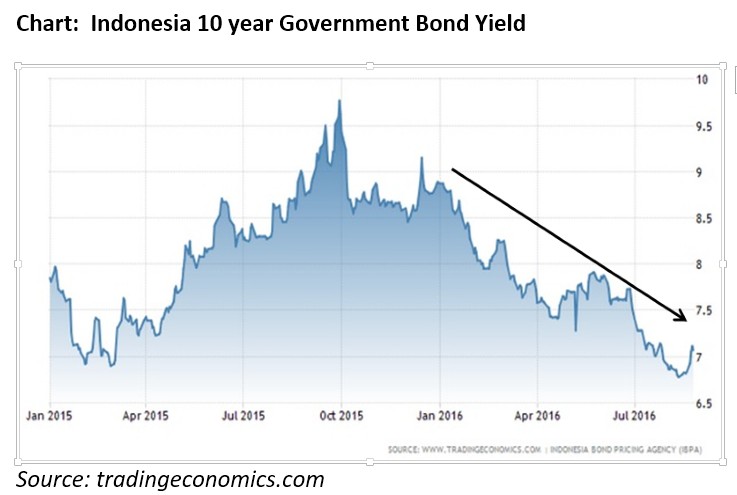

"Yields of Indonesian bonds will certainly rise if the Fed increases interest rates," he said on Monday in Jakarta.

The yield movement was in contrast to the bond prices. The rising yields indicate a decline in prices due to lower market demand. To anticipate that, issuers will have to increase the bond coupons or interest they offer during the period to attract investors.

Currently, the 10-year government bond benchmark yield stands at 7.07 percent, down dramatically from the beginning of the year in the range of 9 percent. Gopal said the 20 percent drop in government bond’s yield showed that current bond prices were quite high.

Gopal, who has almost 10 years of experience in the capital market, assessed that investors were currently in wait-and-see mode until there were any further developments in the Fed's decision.

Potential upsides

However, potential upsides remain open. One supporting factor is the policy of the Financial Services Authority (OJK), which sets a minimum investment limit for insurance companies and pension funds to be placed in government bonds.

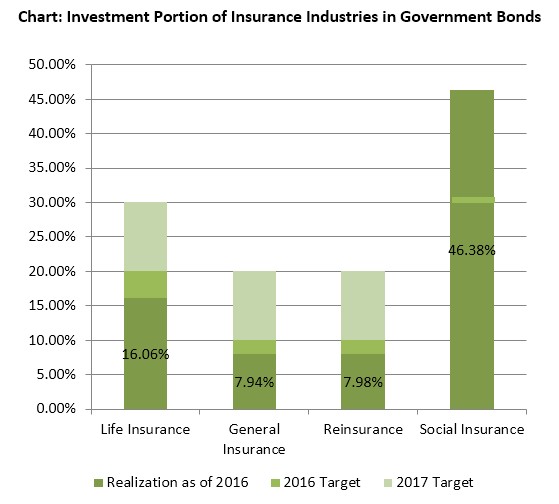

Effective since January, the regulation obliges a minimum investment limit of 10 percent for general insurance and reinsurance industries into the bond market, while the limit for the life insurance industry and social insurance was set at a minimum of 20 percent this year.

Although the target must be met by the end of 2016, the amount is still below the limit. Social insurance is the only industry that can meet the target before the due date, as it is managed by the government.

As of June 2016, investment in government bonds from the life insurance industry was only 16 percent of total investments, far below the 30 percent target that must be achieved by the end of 2017. At the same time, general insurance recorded less than 7.94 percent of investment in government bonds, while reinsurance booked 7.98 percent.

The figure is still far from the target set for 2017, which requires life insurance companies to put their funds in government bonds with up to 30 percent of their portfolio. Meanwhile, general insurance and reinsurance industries have to allocate 20 percent of their investments to sovereign bonds by next year.

Life insurance companies, with total assets under management of Rp 313 trillion, continued to increase investments in government bonds. The investment of life insurance companies in government bonds rose 13 percent in five months, from Rp 44 trillion in January to Rp 50 trillion in June.

Higher growth could be seen in general insurance and reinsurance. From January until June, the value of funds invested in government bonds increased 76 percent to Rp 4.6 trillion for general insurance and 127 percent to Rp 792 billion for reinsurance. (ags)

Source: Bareksa.com