Integration scheme to ease e-payments

Change Size

It remains to be seen how the TPP will influence future regulation in the field of e-commerce. (shutterstock/-)

It remains to be seen how the TPP will influence future regulation in the field of e-commerce. (shutterstock/-)

C

onsumers want to conduct daily payments cheaply and without hassle, presenting regulators with the task of ensuring that each player in the banking and IT sectors works together for the benefit of consumers.

More and more Indonesians are becoming accustomed to electronic and digital payments, which they regard as less complicated and more efficient in terms of cost and time. Ria Martati, 29, is one of these.

She believes that more payment options will eventually help facilitate consumers, but most of the time, she laments the fact that many service providers lack the provision for electronic payments, thus discouraging consumers from paying electronically.

“I often feel disappointed when staff at many convenient stores don’t understand the usage of electronic money or other prepaid cards even though there are many electronic data capture [EDC] machines and readers placed at the check-outs,” she said.

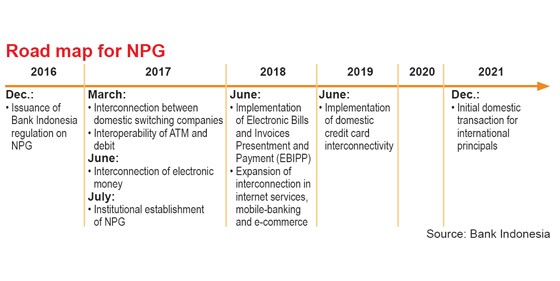

As Ria and other consumers continue to use electronic and digital transactions, Bank Indonesia (BI), as the country’s payment system regulator, will issue a regulation on the National Payment Gateway (NPG) in December to enable interoperability and interconnectivity among all electronic payment systems in the country.

However, discussions with the Indonesia Payment System Association (ASPI), which is the mastermind of the upcoming umbrella regulation, have been protracted. It has taken the ASPI a long time to harmonize the different goals of its members, such as banks and telecommunications companies.

The NPG concept itself will pave the way for the establishment of a central institution, called the “domestic principal”, which will oversee interoperability between switching companies. The new body will resemble China Union Pay, which links all ATMs in mainland China.

According to the upcoming rule, interoperability between ATM and debit cards by March 2017 will be required and banks must be interconnected to a minimum of two switching companies.

BI will then widen the regulation’s scope in June 2018 to cover internet-based services, mobile-banking and electronic commerce.

There has been no decision yet on which switching company will take the lead in the NPG.

State-run lenders under the Association of State-Owned Banks (Himbara)—comprising Bank Mandiri, Bank Rakyat Indonesia (BRI), Bank Negara Indonesia (BNI) and Bank Tabungan Negara (BTN)—have submitted a proposal to BI to create their own switching company, but no definitive decision has yet been made.

Gatot Trihargo, deputy for financial services at the State-Owned Enterprises Ministry, said the formation of the state banks’ switching company would be preceded by the integration of at least 10,000 ATMs and 60,000 EDCs before year-end as part of its integrated ATM and EDC system called “Himbara Link”.

“We are still in the process of establishing a legal entity [for the switching company] and waiting for a permit from BI,” he said.

Meanwhile, the future domestic principal will also oversee credit card payments, whose transaction settlements are still managed overseas by foreign principals, such as MasterCard and Visa.

MasterCard Indonesia director Tommy Singgih has downplayed the possible impact that the NPG will have on its operations.

“Of course we want to be involved and contribute [to the concept] because many people have benefited from our technology in the past 50 years. We are intensively discussing with BI and have offered our solutions, so that we can also play a role in it,” he said.

He added that the company supported the future policy as it would help boost efforts to widen electronic payment usage throughout the country.