Trump’s impact on Indonesia trade not immediate

Change Size

Trump effect: Trade Minister Enggartiasto Lukita (right) gives his opinion about how the victory of Republican Donald Trump, who promoted a protectionist trade policy during the 2016 US presidential election, will affect US-Indonesia trade relations in a press conference in Jakarta on Nov. 11. The Trade Ministry’s directorate general for international trade negotiations Imam Pambagyo (left) accompanied the minister at the event. (JP/Winny Tang)

Trump effect: Trade Minister Enggartiasto Lukita (right) gives his opinion about how the victory of Republican Donald Trump, who promoted a protectionist trade policy during the 2016 US presidential election, will affect US-Indonesia trade relations in a press conference in Jakarta on Nov. 11. The Trade Ministry’s directorate general for international trade negotiations Imam Pambagyo (left) accompanied the minister at the event. (JP/Winny Tang)

U

S president-elect Donald Trump’s expected protectionist policy will not immediately impact on Indonesia’s trade, but long-term effects may arise from its relations with China, experts say.

Since Trump won the presidential election on Nov. 8, all eyes have been fixated on the US and its new leader’s moves, especially on promises made during his campaign.

Trump has previously asserted that decades of free-trade policies are responsible for the collapse of the American manufacturing industry and he plans on erecting trade barriers after being sworn in as president.

However, Maybank Indonesia economist Juniman said on Tuesday that the impact—if Trump proceeds with his plans—may only be felt in the second half of 2017.

“It won’t affect us in the near future. Suppose he intends to implement such a policy, Trump will need time to negotiate with the US Congress,” Juniman told The Jakarta Post.

The US has traditionally been one of Indonesia’s major trading partners and the latest data from the Central Statistics Agency (BPS) shows that the US topped the list of non-oil and gas export destinations throughout this year.

The volume of non-oil and gas exports to the US almost reached US$13 billion from January to October, an increase of 0.5 percent annually. The products exported included apparel, rubber, fish products, minerals, coffee, wood and cocoa.

Juniman said Indonesia had a competitive advantage as many of its exported products could not be produced by the US domestically, adding that people should not worry over the future of Indonesia-US trade relations.

However, an indirect impact could come from China, which is Indonesia’s other major trading partner. “If the US really sets high tariffs on China’s imported goods, China’s economy will face a slowdown and so will our economy,” Juniman said.

Bloomberg reported Trump’s threats to slap tariffs of up to 45 percent on Chinese imports cast a shadow over China’s stability and the world’s most crucial trade relationship.

Indonesia’s relations with China have also been strong. China sat at the second position in terms of exports a with value of $11.39 billion from January to October, rising by 3.4 percent year-on-year.

Indonesian Institute of Sciences (LIPI) economist Latif Adam concurred with Juniman, saying Indonesia had been a part of China’s production network, including by supplying raw materials for the production of various key commodities in China.

Indonesia exported $1.17 billion worth of commodities to China from January to October, including coking coal, palm oil and ferronickel, according to the BPS.

“If the protectionist policy is implemented by the US, Indonesia will be affected in the long run, especially in the sectors of mining, plantation, palm oil, rubber and cocoa,” Latif said.

One way to solve the problem was to find new export destinations and strengthen the domestic market, he added.

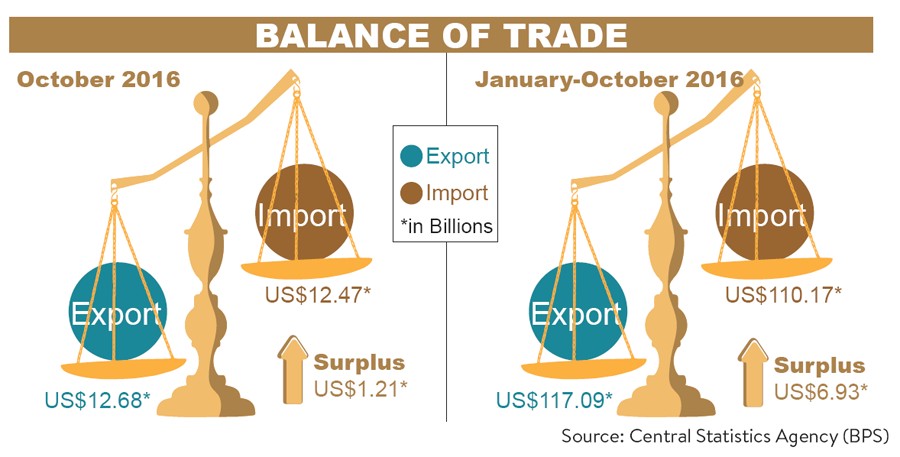

Meanwhile, BPS deputy head for distribution and statistics Sasmito Hadi Wibowo said he was optimistic that the value of Indonesia’s exports could surpass $140 billion by year-end, from $117.09 billion as of October, considering the recent hike in global commodity prices.

A gauge of Indonesian miners has risen 21 percent this quarter, compared with a 4.6 percent decline in the Jakarta Composite Index (JCI) , as output curbs in China pushed up coal prices and nickel was supported by an environmental crackdown in the Philippines, the world’s top supplier, Bloomberg reported on Monday.

Mining and agriculture were the only two of nine industry gauges on the JCI to climb on Friday as the measure plunged 4 percent in its biggest drop in three years.

The price of power-station coal at Australia’s Newcastle port also surged 34 percent in October, the most since February 2009, and has more than doubled this half to almost $110 a ton.