ANALYSIS: A look at sensitivity analysis of rupiah volatility

Change Size

The logo of Bank Indonesia is patched at the main gate of the central bank's headquarter in Jakarta. (Antara/File)

The logo of Bank Indonesia is patched at the main gate of the central bank's headquarter in Jakarta. (Antara/File)

B

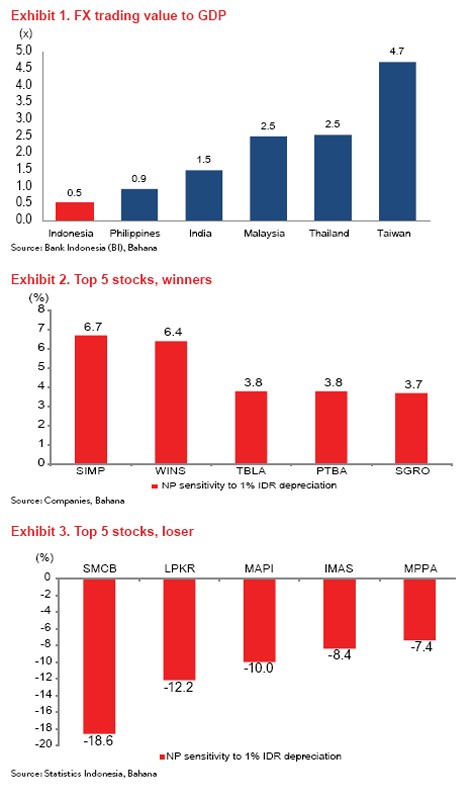

ased on year-to-date (ytd) data from Bank Indonesia, the average daily turnover for the rupiah spot market was only US$1.7 billion, which is shallow by regional standards at just half the gross domestic product (Exhibit 1).

The one-month non-deliverable forward (NDF) market is even less active, trading just $0.7 billion a day ytd. Unfortunately, the NDF market sometimes influences the spot market, as became particularly obvious following the recent US election.

However, given such illiquidity, we advise investors to remain calm, particularly as we believe the fundamentals in Indonesia remain largely unchanged.

We note that, through years of balance sheet repair since the 1998 financial crisis, the Indonesian stock market’s net gearing has improved from more than 150 percent back then to 27.3 percent in the first nine months of this year.

Furthermore, we believe Indonesia is currently in a good position, given that its third quarter current account deficit at 1.86 percent is the lowest since the first quarter of 2012.

In fact, we think the current situation presents buying opportunities for investors, as we expect the rupiah to become stronger by next year. It is worth pointing out that there should still be around $10 billion to come in from tax amnesty repatriation between now and the end of 2016.

Given the recent rupiah volatility, we present our latest currency sensitivity analysis on the rupiah against the US dollar in an effort to aid investors in gauging their investments in Indonesia.

Our study, based on 87 non-financial stocks under our coverage, which represent 62 percent of the Jakarta Composite Index (JCI) market capitalization, shows that every 1 percent of rupiah depreciation could lower the earnings per share (EPS) of our covered stocks by 0.9 percent overall.

That said, it is not a surprise that a recent 3 percent negative swing in the NDF market spooked investors, as it could translate into a 2.7 percent wipeout in 2017 market EPS growth.

A stronger dollar should in general spell good news for sectors with dollar revenue, such as coal, metals, oil and gas and plantations (Exhibit 5). By stock, our sensitivity analysis indicates that Salim Ivomas Pratama (SIMP), Wintermar Offshore Marine (WINS), Tunas Baru Lampung (TBLA) and Sampoerna Agro (SGRO) should be the major beneficiaries of rupiah deprecation within our basket of stocks (Chart 2).

Against the backdrop of a weaker rupiah, sectors with large US dollar costs and borrowings should suffer, which would include poultry, property and consumer discretionary goods. Losers of a stronger dollar include heavily leveraged companies under our coverage: Holcim Indonesia (SMCB), Lippo Karawaci (LPKR) and Mitra Adiperkasa (MAPI) (Exhibit 3).

For investors seeking shelter from currency volatility, we point to the construction and telecommunications sectors. In terms of stocks, Jasa Marga (JSMR), Surya Citra Media (SCMA), Industri Jamu dan Farmasi Sido Muncul (SIDO) and Waskita Karya (WSKT) should see their earnings least affected by foreign exchange swings.

______________________________________

The writer is senior associate director and head of strategy and research at Bahana Securities.