BI to keep eye on rupiah amid risks

Change Size

Lower than expected: A bank staff member counts banknotes at a bank in Jakarta on Sept. 26. Bank Indonesia sees Indonesia's economic growth in the third quarter as unlikely to be as strong as previously expected and only reach 5 percent year-on-year (yoy). (Antara Photo/Muhammad Adimaja))

Lower than expected: A bank staff member counts banknotes at a bank in Jakarta on Sept. 26. Bank Indonesia sees Indonesia's economic growth in the third quarter as unlikely to be as strong as previously expected and only reach 5 percent year-on-year (yoy). (Antara Photo/Muhammad Adimaja))

B

ank Indonesia (BI) will keep a close eye on the rupiah amid rising risks as the central bank claims recent currency volatility has directly impacted the domestic foreign exchange (forex) market.

In a press conference on Thursday, BI deputy governor Perry Warjiyo said it would remain focused on the stabilization of the rupiah, among other things. BI also announced that it would hold the seven-day reverse repo rate at 4.75 percent during the press conference.

“The impact [of the currency movement] is what has been more pronounced,” he said, commenting on the latest global market rout.

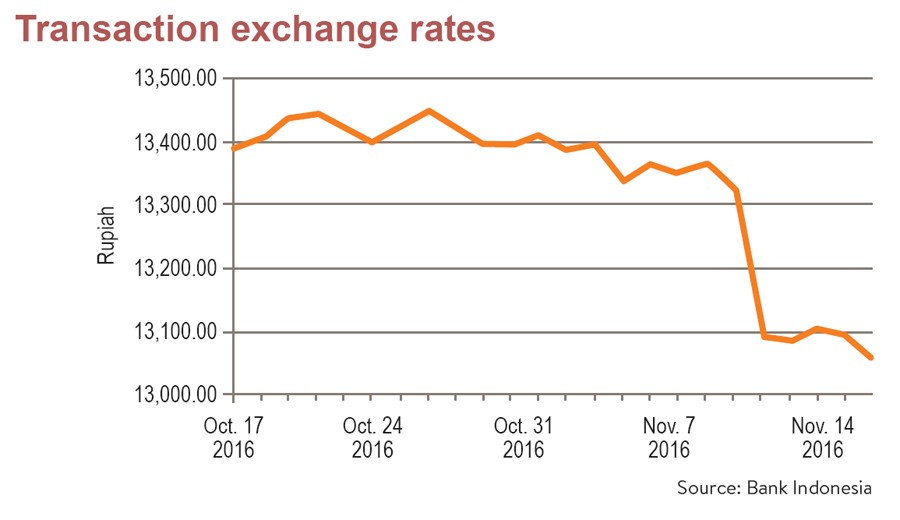

The rupiah was hit recently following growing concerns over the future policies of United States’ president-elect Donald Trump.

The currency sank as low as Rp 13,865 per US dollar last Friday, the lowest point since June 24, on speculation that Trump might push up fiscal spending after taking office.

Higher spending may translate into higher inflation and interest rates in the US, which is not good news for Indonesia and other emerging markets that rely heavily on foreign funds, as some of those funds would return to the US.

Market intervention by BI propped up the currency, enabling it to end at Rp 13,383 to the greenback.

BI governor Agus Martowardojo attributed the latest sharp currency depreciation to speculative transactions by foreign exchange (forex) traders in Singapore’s market of non-deliverable forward (NDF) contracts.

The NDF derivative contracts, unlike FX forwards, are settled in dollars determined by reference to daily fixing, which in some jurisdictions is set by a survey of lenders.

BI declined to mention the exact amount of US dollars it used for its recent market intervention in the domestic FX market.

Indonesia’s FX market has a relatively small daily transaction volume of about US$2 billion, or around $4 billion to $5 billion if corporate transactions are included.

“In Singapore’s FX market, the daily transaction volume is about $350 billion, while in Malaysia $10 billion. With a small volume in Indonesia, we don’t need to intervene with a large amount,” said BI senior deputy governor Mirza Adityaswara.

Despite its commitment to keep a close watch on the forex market, BI insists that Indonesia will still have a floating exchange rate regime and it will only maintain “a flexible rupiah according to its fundamental value”.

Global volatility, especially triggered by the US election result, took center stage during Thursday’s announcement.

BI said it had already taken into consideration the possibility of Fed Fund Rate hikes — once in December, twice in 2017 and three times in 2018 — in its decision to keep its BI’s benchmark rate on hold.

UOB economist Ho Woei Chen said in a research note that it now expected the US dollar-rupiah to trade higher toward 13,600 by the end of the fourth quarter of 2016 and 13,900 by the end of the second quarter of 2017.

“We view that the ‘soft’ Trump scenario, in which not all of his campaign promises are fulfilled [about 50% of his pledges and mostly non-radical measures] is likely most plausible for now. This still means that there will be some negative impact on Asian economies,” she wrote.

The US rate hike trajectory and the risks of capital outflows from Indonesia — given the large foreigner participation in the rupiah government bond market at 40 percent — will be the key drivers for the US dollar-rupiah rate, according to UOB.