Indonesia imposes extra capital requirements on important banks

Change Size

OJK deputy commissioner for integrated monitoring and control affairs Yohannes Santoso Wibowo (left) and OJK financial system stability department head Rendra Idris prepare to speak at a press briefing in Jakarta on Feb. 1. (JP/Anton Hermansyah)

OJK deputy commissioner for integrated monitoring and control affairs Yohannes Santoso Wibowo (left) and OJK financial system stability department head Rendra Idris prepare to speak at a press briefing in Jakarta on Feb. 1. (JP/Anton Hermansyah)

I

ndonesia ordered the nation’s biggest lenders to set aside additional capital to bolster their ability to absorb losses and protect against any bank failures.

The Financial Services Authority, known as OJK, told the country’s systemically important banks to create a tier-1 capital surcharge of between 1 percent and 3.5 percent of risk-weighted assets, depending on the size and perceived riskiness of the lender, the regulator said in a statement on its website Tuesday. Banks have until Jan. 1 to meet the additional requirement, it said.

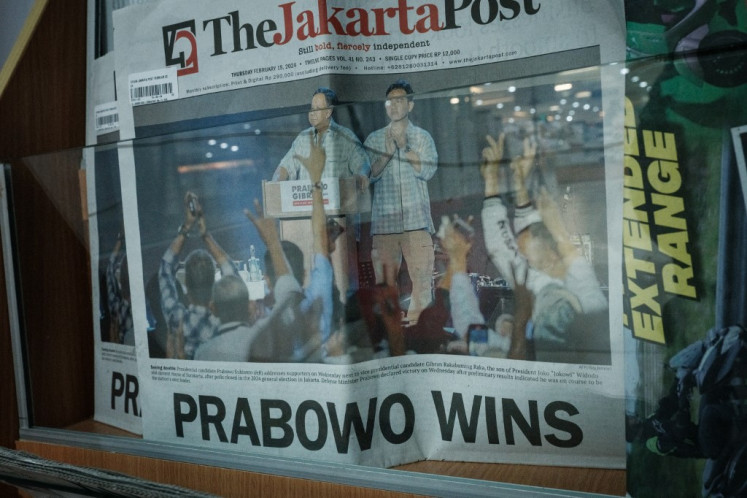

The move may conflict with government efforts to reverse a slowdown in lending and bolster the economy. Credit growth in Southeast Asia’s largest economy has fallen to single digits in the past two years from a more than 20 percent average in the decade before, as weak private investment weighs on demand for loans. President Joko Widodo early this month urged banks to take more risks as he seeks to accelerate economic growth before a re-election bid in 2019.

“While we can understand the intention of Indonesian regulators to safeguard the system, they should also consider the impact this stricter capital rule might have on the lenders’ ability to extend loans at a time when the country needs lots of financing for its infrastructure development,” said Taye Shim, head of research at Mirae Asset Sekuritas Indonesia.

OJK classified the country’s systemically important banks into five categories when deciding the size of the new capital surcharge. Together with Bank Indonesia, the regulator will revise the classification in March and September every year based on the lenders’ performance data, OJK said. The methodology used to identify systemically important banks will be revised at least once every three years, the authority added.