Bank Indonesia increases reference rate to 4.75 percent

Change Size

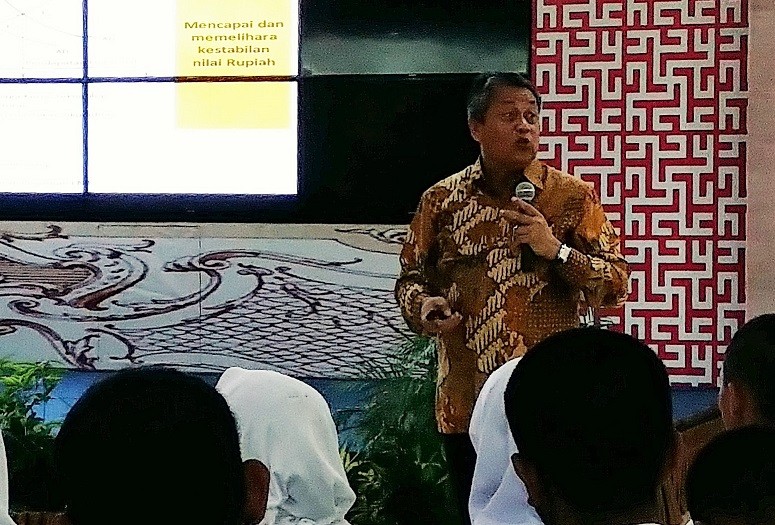

Bank Indonesia governor Perry Warjiyo (thejakartapost.com/Anton Hermansyah)

Bank Indonesia governor Perry Warjiyo (thejakartapost.com/Anton Hermansyah)

B

ank Indonesia (BI) has decided to raise its seven-day reverse repo rate to ensure stability against volatility that is expected to rise out of the United States Federal Reserve’s planned interest rate hike.

The central bank raised its policy rate by 25 basis points (bps) to 4.75 percent during an additional BI board of governors meeting held on Wednesday.

It also decided to raise lending and deposit facility rates by the same amount to 5.5 percent and 4 percent, respectively.

“The policy was part of a preemptive move [...] from Bank Indonesia to ensure stability in the exchange rate against the projection of higher-than-expected interest rate hike in the US, as well as increasing risks in the global financial market,” BI governor Perry Warjiyo said after the meeting.

It was the second hike the central bank has made this year, after it decided to raise its policy rate by 25 bps on May 17 in a meeting chaired by then-BI governor Agus Martowardojo.

In addition, Perry said the central bank has also changed its monetary policy stance from “neutral” to “tight bias”, indicating further hikes were possible to provide further stability for the rupiah.

“Going forward, Bank Indonesia will continue to calibrate domestic and global developments to utilize the room for a measurable interest rate increase,” he said. (bbn)