PLN announces triple-tranche, dual-currency bond issuance

Change Size

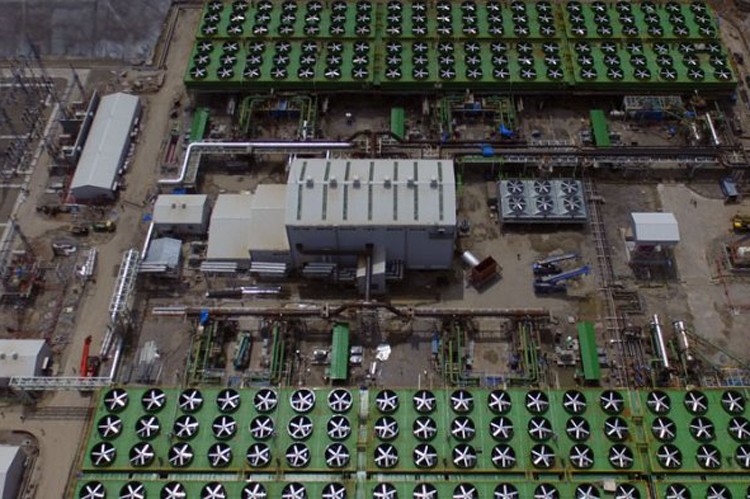

An aerial view of the Sarulla geothermal power plant in North Tapanuli regency, North Sumatra, is seen in this file photograph. (Courtesy of/Sarulla Operations Ltd)

An aerial view of the Sarulla geothermal power plant in North Tapanuli regency, North Sumatra, is seen in this file photograph. (Courtesy of/Sarulla Operations Ltd)

S

tate-owned electricity company PLN has issued on Oct. 18 around US$1.5 billion in global bonds to finance the 35,000-megawatt power plant project, it said in a press statement received on Tuesday.

PLN finance director Sarwono Sudarto said the bonds were issued in two currencies – US dollars and euros – and in three tenors, or triple tranche: US$500 million in bonds carrying a tenor of 10 years and 3 months at 5.37 percent interest, $500 million with a tenor of 30 years and 3 months (6.25 percent interest) and 500 million euro with a seven-year tenor (2.87 percent interest).

Sarwono added that PLN believed that issuing the global bonds was the proper way to raise funds for the project, because most of its components and equipment were imported.

"The bonds issuance's [positive response] indicates that the world trusts Indonesia and PLN that we will manage their funds prudently. It also shows that the world is confident in the strength of our economy," he said in the statement.

With the issuance, PLN has become the first state-owned enterprise (SOE) to issue dual currency bonds in the international market, as well as the first SOE to issue a triple-tranche bond. (bbn)