State firms more confident in hedging their forex debts

Change Size

(JP/Oxford Economics, BIS, ADB)

(JP/Oxford Economics, BIS, ADB)

E

ight SOEs inked the US$1.92 billion agreement with three state banks that will allow them to hedge their foreign exchange (forex) liabilities, shielding themselves from forex volatility.

The eight companies are fertilizer producer PT Pupuk Indonesia, gas firm PT Perusahaan Gas Negara (PGN), the State Logistics Agency (Bulog), banknote printing firm PT Peruri, miner PT Aneka Tambang (Antam), cement maker PT Semen Baturaja and port operators PT Pelindo II and PT Pelindo III.

The state banks, meanwhile, were Bank Mandiri, Bank Rakyat Indonesia (BRI) and Bank Negara Indonesia (BNI).

Under the agreement, BRI will provide $750 million worth of forex line facilities, while BNI and Bank Mandiri will provide $619 million and $555 million facilities, respectively.

The eight firms add to the big names in the SOE sector that have finally ventured into hedging, such as national carrier PT Garuda Indonesia, electricity firm Perusahaan Listrik Negara (PLN) and oil and gas firm Pertamina.

The SOEs were left in limbo for years over the possibility of losses incurred from hedging being considered “state losses”.

However, Bank Indonesia (BI), the government and several other agencies, including the Corruption Eradication Commission (KPK), provided a legal certainty for them with the issue of a joint regulation in 2014.

During the agreement signing ceremony, SOE Minister Rini Soemarno said she could clearly remember times when she was working in a private firm.

She claimed that her past decisions to hedge various assets had been correct, and had helped companies where she worked survive until today. “I want state enterprises to also manage their business and forex risks in a prudent and comprehensive manner,” she said.

The rupiah has depreciated by almost 60 percent compared to five years ago, making hedging even more important.

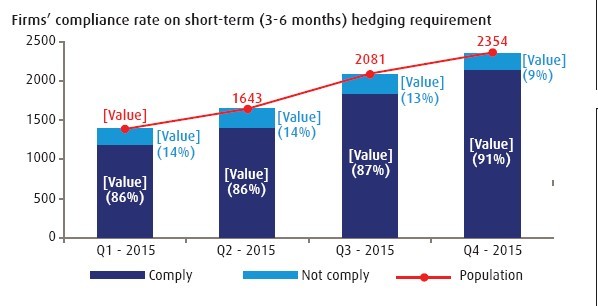

By the fourth quarter of 2015, more than 2,000 companies — out of 2,354 firms with forex liabilities – had already hedged their short-term forex obligations, as required by BI.

“This level of compliance is okay,” said BI governor Agus Martowardojo.

Antam finance director Dimas Wikan Pramudhito said the miner needed the hedging facility even though “natural hedging ” was already in place, thanks to its forex-denominated revenues that covered for its forex-denominated costs.

“However, some overhead costs are still paid in rupiah. So this hedging is positive for us,” he said in a press conference.