Indonesia is truly a big country blessed by Almighty God with abundant natural resources and great potential human resources. There is no reason for such a big country not to be independent, always working hard to be free of dependence on other nations.

Presented by Ministry of Communication and Information Technology

The tax amnesty is an instrument used by the government not only as a source of revenue, but also as a mode to transfer wealth from the well-to-do to the less advantaged in society, transferring or returning wealth from another country to Indonesia through repatriation, and new investment, which will help grow the national economy.

Economic growth is a gateway to new business opportunities and will create a lot of employment. The increase in work activities will improve the people’s purchasing power, thus, boosting demand. The increase in demand will lead to new subjects and objects to tax, thus, ensuring increased revenue from taxes in the future.

The tax amnesty appeals to all Indonesians to repatriate their wealth. It will take a mountain of funds to fully develop the nation, but by relying on the country’s own abilities, there is no reason to look overseas for assistance.

The tax amnesty calls for high-minded people to report the wealth that they may not have yet the time or opportunity to include in their annual tax assessment (SPT). This is no fool’s errand as the reporting and revealing of wealth are protected by law. Taxpayers receive a guarantee that the data they submit will not be rechecked and they will also receive a certificate letter of tax amnesty to ensure legal certainty.

Following long deliberation and three draft bill revisions since 2015, Indonesia officially enacted the Tax Amnesty Law on June 28. President Joko “Jokowi” Widodo immediately launched a tax amnesty program early last month, with high hopes that the flagship policy will bring multiplier benefits.

Even the chief himself has been promoting the tax amnesty in big cities all over the country to show the government’s commitment, stressing that the government will go all out with the program.

The tax amnesty aims to not only increase tax revenue but also to improve tax compliance and transition to the new taxation system, in addition to capital repatriated from safe havens, which will spur economic growth, Director General of Taxation Ken Dwijugiasteadi told thejakartapost.com

During a conversation at the Directorate General of Taxation in Jakarta on June 26, Ken, who took over the helm of the tax office in March, explained that the program, initiated by President Jokowi and endorsed by the House of Representatives, had both budgetary and regulatory purposes.

The budgetary purpose is to inject additional tax revenue of Rp 165 trillion to state coffers as stipulated in the revised 2016 state budget. In the regulatory purpose, the tax amnesty aims to encourage the repatriation of Indonesian assets stashed overseas.

“The investment flow [from repatriated assets] will drive economic growth. With faster economic growth, and investment flow, we will be able to reduce unemployment. These workers will increase people's purchasing power so that production keeps rolling. The final goal is that the program will lead to a new tax base that will boost tax revenue in following years,” Ken explained.

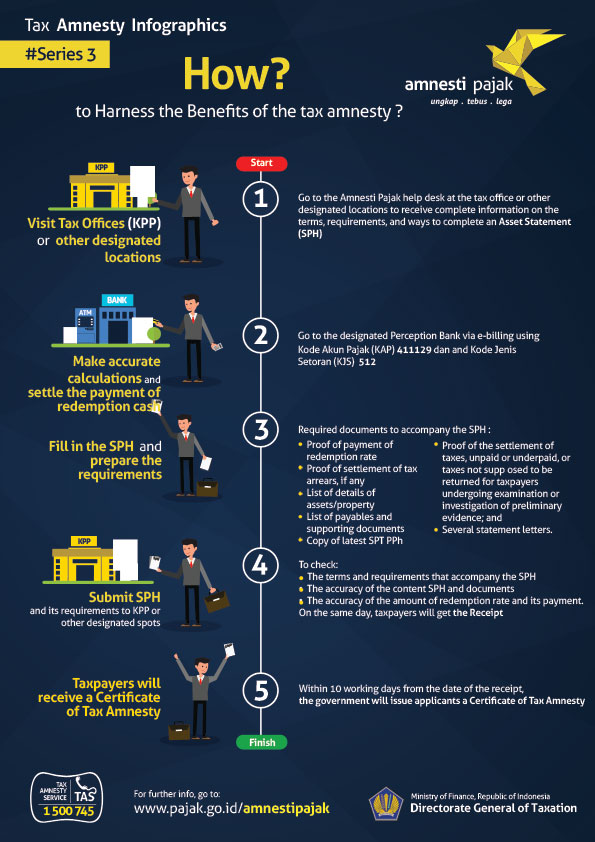

With the tax amnesty, the government appeals to all Indonesians living and working in the country to reveal and report the wealth they have not yet reported in their SPT and redeem this with the new tax payment slip (SSP) at the appointed reception banks/post offices.

The tax amnesty is a great opportunity to redeem any oversights taxpayers may have made in their previous tax reports as it is effective until 31 March 2017. Should the tax office discover any oversight which the taxpayers themselves have failed to report, they run the risk of facing taxation actions based on the regulations and of getting penalties in the form of increased fines of 200 percent from income tax (PPh) the taxpayers have not paid.

Limited-time opportunity

The program, running from July 18 to March 31, 2017 is a limited-time opportunity for Indonesians to pay a redemption fee in exchange for a pardon from tax liabilities –including interest and penalties -- related to a previous tax period without fear of criminal prosecution.

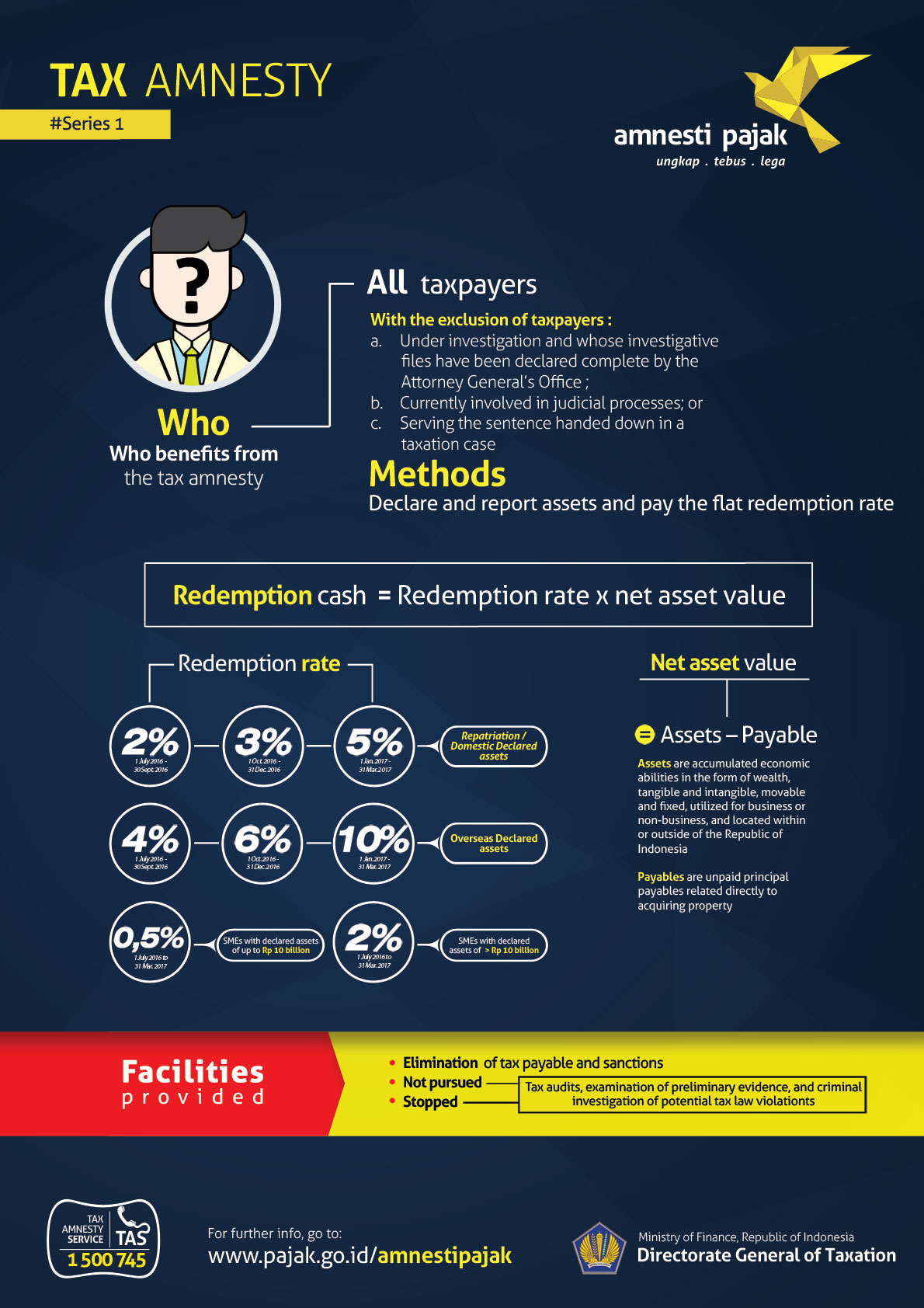

Currently, individual taxpayers are subjected to a progressive tax rate with a maximum rate of 30 percent and corporate taxpayers are subject to a flat rate of 25 percent. Under the amnesty program, the redemption fee is calculated by multiplying the relevant rate by the amount of declared additional net assets.

The redemption charges are set between 2 and 5 percent for those declaring and bringing back assets to Indonesia.

The following are the redemption charges based on the phase of the program.

- July 1 - Sept. 30 is the first phase of the program with the redemption charge set at only 2 percent of the wealth declared.

- Oct.1 - Dec.31 is the second phase with a redemption charge of 3 percent of the wealth declared.

- Jan.1 - March 30 is the third phase with a redemption charge of 5 percent of the wealth declared.

In general, the benefits for taxpayers who avail of the amnesty are waiver of outstanding taxes, administrative sanctions and criminal sanctions accruing on or prior to 2014 or 2015. The taxpayers will also be exempted from tax audits, preliminary evidence tax audits and tax investigations for all tax obligations for fiscal years up to and including 2014 or 2015. Any ongoing tax audits on them will also be terminated, as well as preliminary evidence tax audits, tax crime investigations for all tax obligations.

“Data confidentiality is guaranteed [….] the data input from taxpayers cannot be used for prosecution purposes unless another data source is found,” Ken said.

To support the program, the tax office has launched a dedicated website with basic information and contact details. Taxpayers, however, are advised to visit tax offices to get further information about the amnesty program.

The tax office expects the amount of declared and repatriated assets to reach Rp 1 quadrillion, thus generating revenue Rp10 to Rp 40 trillion from redemption fees, while the amount of wealth declared would be Rp 3.5 quadrillion to Rp 4 quadrillion.

“As of June 26, more than Rp 1.019 trillion worth of assets stashed offshore have been repatriated, with redemption fees amounting to Rp 25 billion,” Ken said.

The government has appointed 18 banks, 18 investment managers and 18 securities companies as gateways for the expected trillions of rupiah in repatriated assets in the tax amnesty program.

The law stipulates that repatriated assets are to be placed in investment instruments in the country for three years. In order to absorb possible excessive liquidity during the tax amnesty program, the government and financial authorities have prepared several instruments, namely government bonds, state-owned enterprises’ bonds, corporate bonds, Islamic bonds (sukuk), time deposits and savings accounts at designated banks, mutual funds, collective investment contracts, real estate investment trustees (REITs) and property investment through a private equity scheme (RDPT).

Meanwhile, those who opt to declare their wealth only will face penalty rates of 4 to 10 percent, depending on which period the taxpayers avail of the amnesty.

For those who declare offshore funds in the first three months of its implementation to Sept 30, a 4 percent tax rate applies. For those who declare their assets between Oct. 1 and Dec. 31, a 6 percent tax rate applies. Last, for those who declare their assets between Jan. 1 to March 31, a 10 percent tax rate applies. For small and medium enterprises, lower rates of 0.5 to 2 percent apply.

Sabotage

Within a week after its implementation, Indonesian businesspeople claimed that Singapore, considered a safe haven for rich Indonesian to stash assets, was introducing policies to thwart the amnesty program. Singaporean banks have been accused of luring Indonesian customers with a special offer – 4 percent versus 2 percent interest -- to stop them from declaring and repatriating their assets between July and September.

Responding to Singapore’s reported attempt to stymie Indonesian assets from leaving the city-state, Cabinet Secretary Pramono Anung disclosed that the government was preparing several advanced instruments to ensure that the assets of Indonesian citizens parked overseas, especially in neighboring Singapore, would be repatriated, stressing that Singapore's move to cut tax rates and offer facilities to keep Indonesian assets from leaving the country would not hamper the implementation of the tax amnesty.

"The government is preparing instruments to anticipate attempts by countries hosting Indonesian assets to discourage them from participating in the tax amnesty. Of course, there will be further steps," Pramono said at the State Palace.

He added that President Jokowi had been leading the campaign to promote the program and would revise several laws, including the General Taxation System (KUP) Law, to make the Indonesian taxation system more credible and attractive.

"The taxation system will be improved so that people will keep the money they earned in Indonesia in local vaults," he added.

However, the Singaporean Ministry of Finance (MOF) and the Monetary Authority of Singapore (MAS) quickly denied the accusation in a joint statement on July 23, stating that recent claims in the Indonesian media that Singapore was introducing policies to thwart Indonesia’s tax amnesty program were untrue.

“Singapore has not cut tax rates or changed any of our policies in response to Indonesia’s tax amnesty,” the statement said.

The statement also claimed that the city-state thrived on being a clean and trusted financial center by subscribing to international standards for combating money laundering and for the exchange of information.

“If there is any case of suspected cross-border tax evasion, concerned authorities can approach Singapore – we have assisted and will continue to assist in line with the international standards,” it stated.

Despite Singapore's denial of the accusation, it is believed that Singaporean private agents have been approaching businesspeople to use these facilities, said the executive director of Centre for Indonesia Taxation Analysis (CITA), Yustinus Prastowo.

“I’ve heard from businesspeople in Makassar that they have been approached by agents of Singaporean banks to keep their assets in their country. This kind of thing must be anticipated by providing incentives and legal certainty on the program,” he said.

Incentives and certainty

The government expects to book additional tax revenue of Rp 165 trillion from the total Rp 1.53 quadrillion tax revenue in the revised 2016 state budget. Without incentives and certainty, Yustinus is pessimistic that the government will meet its tax revenue target.

“We predict it will only reach Rp 80 trillion as a result of taxpayers’ enthusiasm for this program in the first three months, because it offers the lowest redemption rate,” he said.

If the government insists on aiming for the ambitious target, he recommended that the government extend the period of lowest redemption rate of only 2 percent of total assets repatriated. However, to do so the government would need to adjust the Tax Amnesty Law.

“We will have to consider the nine months of implementation. On the other hand, there is huge enthusiasm on the part of taxpayers. The government could issue a government regulation to adjust the penalty period. Politically, it is feasible,” he added.

Newly appointed Finance Minister Sri Mulyani said the ministry would do whatever it took, including issuing a supporting regulation and building public trust in the program in a bid to meet the ambitious tax revenue target set in the revised 2016 state budget.

“We are trying. During July to September, we will build people’s trust and convenience, and eventually succeed in developing the taxation system,” the former World Bank managing director said, adding that the program was not a stand-alone objective but was a part of a comprehensive fiscal policy and prudent state budget.

No place to hide

In a related development, Sri Mulyani reminded those who have been keeping their wealth overseas and evading their tax liabilities. "Today I want to tell you that you have been comfortable keeping your money under the mattress or overseas to evade paying tax,” she told 10,000 participants in a seminar on the tax amnesty held at JIExpo, Kemayoran, Jakarta recently.

“You should be aware that today all finance ministers across the world are making extra efforts to increase tax revenues. Those sought in the US run to the UK, sought in the UK run to Italy, sought in Italy run […] on and on,” she said.

She said that today businesspeople are very adept at evading paying taxes but finance ministers, too, are also adept. "The world’s finance ministers are committed to conducting automatic exchanges of tax data,” she said.

“Those who have been evading taxes anywhere they are in the world can no longer do so with this data exchange,” Sri Mulyani reminded her audience.

"The world has now a commitment. Those of you who have been feeling untroubled hiding your money, be aware that we are now implementing an automatic exchange system," she added.

Indeed, starting 2018 there will be an automatic exchange of data in the world for the sake of taxes. “So, no one can secretly stash their wealth overseas without running the risk of detection,” she said.

That’s why, Sri Mulyani said, she further advised the people who have yet to correctly report their wealth in their SPT, to join the tax amnesty program. The reason is a low tax redemption charge.

"Take advantage of this opportunity now because the [redemption] charge is small,” she said. “Until late September the lowest rate is only 2 percent," she said.

Obviously, taxpayers who avail themselves of the amnesty will enjoy the aforementioned great benefits. But most importantly, by joining the program, you will not only do good to the country but also to the less advantaged in society. The added revenue will support government plans to increase spending on a number of projects to help boost growth, which translates into a lot of employment. Thus, you will lead a meaningful life. So, why wait?