Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOil, gas sector continues to look bleak

Change text size

Gift Premium Articles

to Anyone

T

he future of Indonesia’s oil and gas sector continues to look bleak with latest estimates showing oil lifting rates plunging by almost half from current levels by 2020, with no new discoveries amidst low oil prices.

Due to the continued depletion of oil reserves, ready-to-sell oil production will decline to 480,000-550,000 bopd by 2020 if no new discoveries are made, according to estimates from the Upstream Oil and Gas Regulatory Special Task Force (SKKMigas).

Indonesia’s oil reserves dropped to 3.6 billion stock tank barrels at the end of 2015 from 3.62 billion the previous year.

The projected oil lifting figure is almost half of the current 820,000 bopd, which is already insufficient to meet domestic demands of around 1.6 million bopd. This has raised concerns of how the local oil and gas sector can fulfill increasing demands in the future, especially as oil fields enter a natural decline while low oil prices discourage non-conventional production methods.

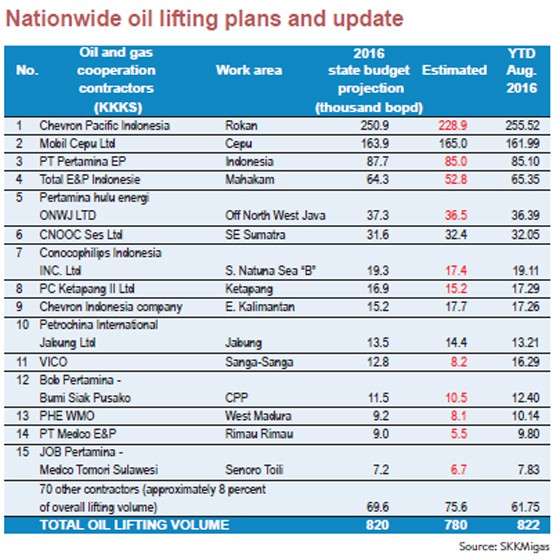

Nationwide oil lifting plans and update((SKKMigas)/-)

Nationwide oil lifting plans and update((SKKMigas)/-)

“Furthermore, there are no large projects or plans of development [POD] that will be on stream until 2020,” SKKMigas chief Amien Sunaryadi said during a hearing at the House of Representatives Commission VII overseeing energy affairs on Monday.

The lack of large oil projects is worrisome, especially since there will be 35 fields whose production-sharing contracts (PSC) will be terminated by 2026. The termination of Total E&P Indonesie’s Mahakam block PSC and Vico’s Sanga-sanga block PSC at the end of 2017 is estimated to contribute to a loss of 26,600 bopd next year.

Only two small oil fields expect to start operating next year: the Madura BD block, operated by Husky Oil, and the Jangkrik block, operated by Eni Muara Bakau.

Arief also said global oil prices have yet to fully recover from its initial plunge at the end of 2014, which would continue to affect production activities for the medium term. Global crude oil prices are expected to hover around US$40 to $50 per barrel next year, from the peak of $115 per barrel in 2014.

For next year, SKKMigas has targeted oil lifting rates at a measly 780,000 barrels of oil per day (bopd) in 2017, from this year’s 820,000 bopd target.

The largest drop will come from Chevron Pacific Indonesia’s Rokan block due to its maturing characteristics and the postponement of the North Duri Development (NDD) Area 14 project as caused by low oil prices. As a result, the Rokan block’s oil lifting rates will drop by 22,000 bopd to 228,900 bopd next year.

Eight other oil blocks are also experiencing a natural decline, including PT Medco E&P Rimau in South Sumatra, with a drop of 3,500 bopd to an estimated production rate of 5,500 bopd in 2017.

Enhanced oil recovery (EOR) is one method operators could implement to increase the amount of crude oil extracted from an oil field. However, Chevron Pacific Indonesia and Medco E&P Rimau, both of which have been running EOR pilot projects, have said it is still economically unfeasible to implement the method on a larger scale, even though it had been proven effective.

Medco E&P Rimau executive director Ronald Gunawan said they had stopped conducting their pilot project, which used the surfactant polymer flooding method, in 2014 when global oil prices dropped.

“We will be able to do it again if global oil prices reach $80 per barrel,” he said.

Despite the low oil prices, however, companies have not completely stopped production activities. SKKMigas have estimated that there will be 343 oil well drillings, 1,005 work overs and 32,094 well service activities next year.

Despite the low oil prices, however, companies have not completely stopped its production activities. SKKMigas has estimated that there will be 343 oil well drillings, 1,005 work overs and 32,094 well service activities next year.

Chevron Pacific Indonesia will conduct the most activities with 132 drillings, 187 work overs and 16,695 well service activities in 2017.

“We will reach [our lifting target] through the development of 120 wells in 2016 and around 14,000 well service activities. Our 2016 activity is the basis of our work plan in 2017,” Chevron Pacific Indonesia president director Albert Simanjuntak said during the hearing.

In the meantime, ExxonMobil Cepu Limited, a subsidiary of ExxonMobil Indonesia, has announced that it will submit a proposal to increase the production rate of its Cepu block in East Java to 200,000 bopd next year.

Although the increase could help the country’s lifting rate, SKKMigas had previously rejected a similar proposal due to environmental and subsurface considerations.