Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBanks unperturbed amid tightening liquidity

Change text size

Gift Premium Articles

to Anyone

T

he domestic banking industry is thought to have sufficient liquidity to support loan expansion if the economy improves next year as predicted despite weak growth in third-party funds.

Bank loans have grown just 7.7 percent year-on-year (yoy) as of July this year due to weak demand and as such, third-party funds have run at a slower pace of 5.9 percent in the same period.

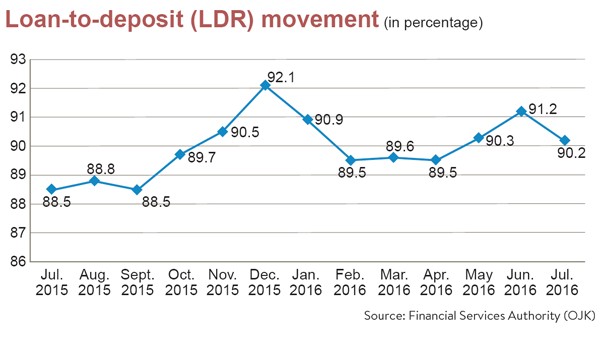

This has resulted in a slight decrease in the nationwide loan-to-deposit ratio (LDR), which measures the proportion between funding and lending in a bank, to 90.1 percent in July from 91.1 percent in the previous month.

With the growth of third-party funds predicted to remain sluggish for the rest of the year, bank liquidity is predicted to tighten slightly, particularly in the final quarter when loan demand traditionally grows.

However, economists and banking authority officials believe this situation will remain manageable as increases in loans will also trigger a rise in third-party funds.

Deposit Insurance Corporation (LPS) economist M. Doddy Ariefianto said banks usually address tight liquidity by issuing debt papers in order to seek funding from alternative sources.

“The risk in liquidity is not that big. Some major banks will issue securities or seek overseas loans, or they can reduce loan expansion,” he said on the sidelines of a seminar held by LPS on Thursday.

State-owned lenders Bank Rakyat Indonesia (BRI) and Bank Mandiri are two of several banks that have already issued debt papers, or are currently in the process of issuing papers, as they hope to reduce the mismatched condition between short-term funding and long-term loans.

BRI has raised Rp 1.8 trillion (US$138.6 million) from the issuance of a medium term note (MTN) and the bank is currently in the process of issuing a Rp 20 trillion continuous bond offering (PUB) plan over two years, with half of the figure to be issued in 2016.

Meanwhile, Bank Mandiri is partnering with government-backed secondary mortgage firm Sarana Multigriya Finansial (SMF) in the issuance of Rp 500 billion in asset-backed securities with a form of participant letter (EBA-SP). The bank is also in the process of issuing a Rp 5 trillion bond from a total Rp 14 trillion continuous bond offering plan.

(-/-)

(-/-)

Nelson Tampubolon, commissioner for banking supervision at the Financial Services Authority (OJK), said a slight tightening in bank liquidity would be different compared to the 2008 global financial crisis, when massive capital outflows occurred, as undisbursed loans stood at a high level of roughly Rp 1.2 quadrillion.

The large amount of undisbursed loans means that the banking industry has ample liquidity due to the low usage of credit from the business world, he said.

“If loans grow well [near the end of the year] and the government’s tax amnesty program helps increase growth in third-party funds, the LDR will be maintained well,” he said.

He also argued that banks would be helped even further if the central bank once again reduced the primary reserve requirement (GWM) in the future as this would create

additional liquidity in the banking market.

The central bank has lowered the GWM by 150 basis points (bps) as of today and has generated extra liquidity worth Rp 40 trillion in the banking system.

Executives of medium-sized banks expressed a similar view, namely that BI’s monetary easing had helped them reduce interest rates as they usually compete with one another and their bigger counterparts in raising third-party funds.

“Decline in lending rates will help banks reduce the non-performing loan ratio, which has been rising lately, because loans will be more affordable for customers,” said MNC Bank president director Benny Purnomo.

Bank Mega president director Kostaman Thayib, meanwhile, said BI and the government had performed well in carrying out the monetary easing policy.