Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

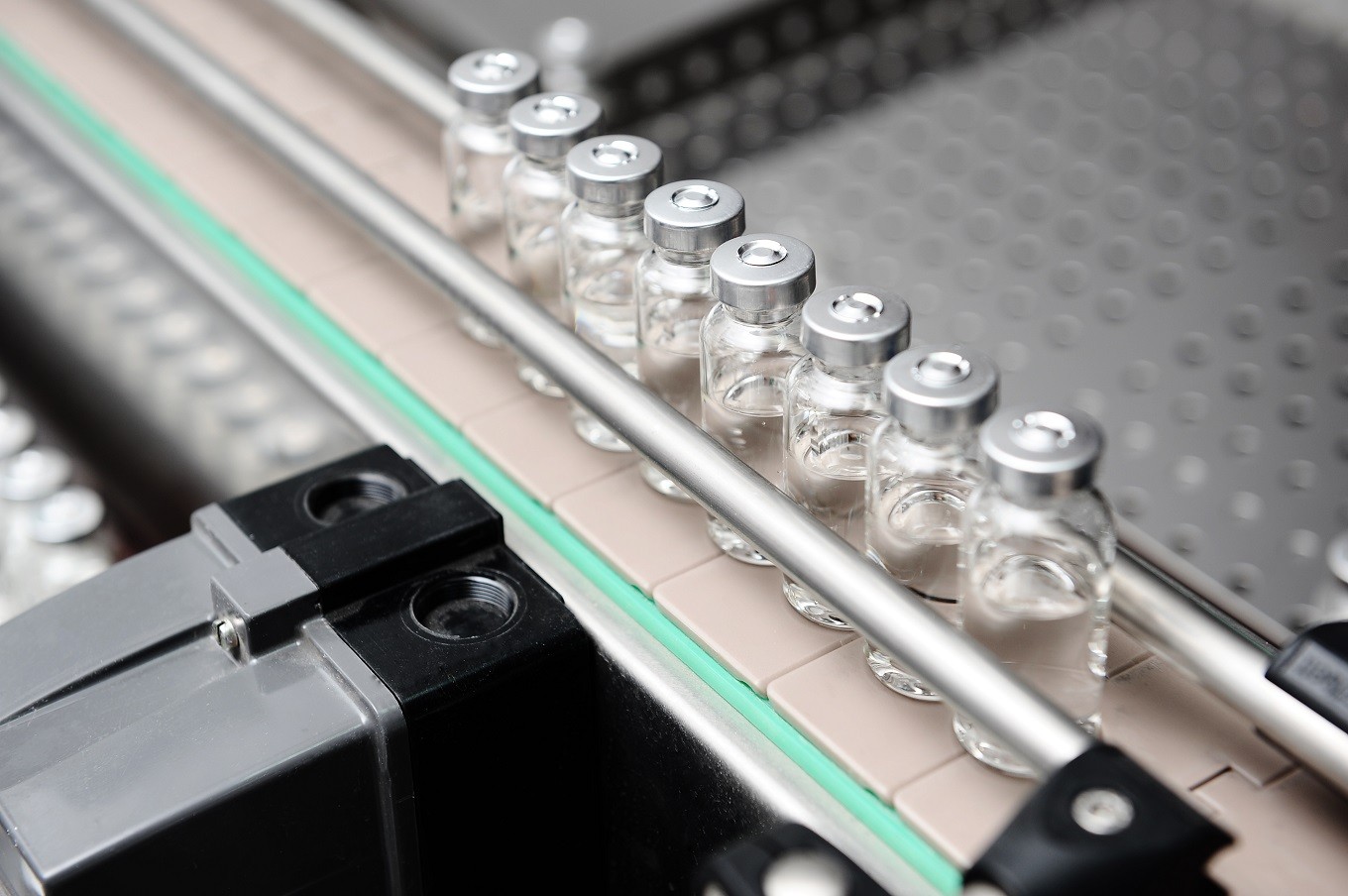

View all search resultsBig moves in further developing pharmaceutical industry

Aside from opening up more employment opportunities and strengthening capital for the purposes of development, the change also encourages domestic businesses to compete and secure prominent positions in both the domestic and global markets. However, is fully opening up the industry enough to attract investors? To answer this question we must go into the minds of investors and see what would attract them to invest in the domestic raw materials sector.

Change text size

Gift Premium Articles

to Anyone

I

n a bid to encourage investors to invest in Indonesia’s raw materials sector for medicine, the government recently announced that it would revise the Negative Investment List (DNI) to allow businesses to be 100 percent owned by foreign investors.

The move was part of the 10th economic stimulus package, another set of deregulations the government released to make Indonesia’s business climate more attractive. From a foreign investment policy perspective, the revision of the DNI is arguably the most significant stimulus package, demonstrating that the government is committed to comprehensive economic policy reforms.

Aside from opening up more employment opportunities and strengthening capital for the purposes of development, the change also encourages domestic businesses to compete and secure prominent positions in both the domestic and global markets.

However, is fully opening up the industry enough to attract investors? To answer this question we must go into the minds of investors and see what would attract them to invest in the domestic raw materials sector.

First, an investor would analyze the investment climate of the country they are looking to invest in. The government’s decision to open the sector to foreign investors may not be in line with their investment goals. Academicians may categorize the government’s decision as a top-down or bottom-up approach.

The top-down approach is when an investor decides to invest and is required to abide by the terms stipulated by the government, such as a requirement to have a manufacturing facility located in the country in order to register their products in the domestic market. In this case, the investors are, to some extent, forced to invest should they wish to enter or remain in the market.

Whereas the bottom-up approach is when the government supports investors to make the market conducive for business.

Providing incentives, capable manpower, eliminating regulatory barriers and issuing supporting policies are some examples of the efforts the government should make in the bottom-up approach to get investors to invest in or expand their businesses — thus, ultimately, this can create more growth for the industry as a whole.

The latter would be the best option to attract foreign investors. An example of a country that has successfully attracted foreign investment to its domestic life science industry is Ireland.

The nation has made it so attractive that there are even companies wanting to move their operational headquarters and manufacturing facilities there, to take advantage of the tax incentives.

Second, an investor would also like to know the direction the government plans to take in the pharmaceutical industry as a whole.

There are three paths the government may take, namely toward a generic pharmaceutical industry; establishing a life science industry that is research and development based; or exploring Indonesia’s biodiversity to identify naturally occurring substances that could be used as active pharmaceutical compounds.

Referring to the Industry Ministry’s road map for the pharmaceutical industry as well as the government’s goal to be less dependent on imports, it looks like we are heading toward a generic industry. However, the question of whether this is the right direction remains.

Investors are now seeing a generic industry as a low-margin, high-volume investment and, therefore, it may not be attractive to them. The international supply-chain market for raw materials is already dominated by India and China and, in fact, the import rate for raw pharmaceutical materials for the US is around 60 percent.

It would be a miracle if Indonesia was able to compete with the likes of India and China as well as make itself self-sufficient in the production of raw pharmaceutical materials. In recent years, there has been a steady increase in clinical trial activities in Southeast Asia. Compared with its Southeast Asian neighbors, Indonesia at present conducts significantly fewer studies.

According to the US National Institute of Health, despite having considerably smaller populations, countries like Malaysia, Thailand and the Philippines conduct six to eight times more clinical trials than Indonesia. Even though we are lagging behind, developing a life science industry holds the most opportunity for Indonesia to be competitive under the new ASEAN Economic Community framework.

Global research and development investments amount to US$100 billion annually and 50 percent of the investments are spent on clinical trials! Indonesia should make its best effort to participate in global clinical trials. Using President Joko “Jokowi” Widodo’s terminology, these are the low-hanging fruits in the pharmaceutical sector.

Last, any investor would like a certain level of assurance that their return on investment is safe. An effective intellectual property system is indispensable for the development of the pharmaceutical industry and leads to economic growth and improved social welfare.

Of the four incentives provided by a patent system, namely to invent, to disclose, to invest and to “invent around”, the incentive to invest is the most important. With this, to attract experts to develop our pharmaceutical industry we need a strong intellectual property rights regulation that supports and protects investors’ interests.

All in all, the government has made great efforts to make Indonesia more attractive. However, the development of the pharmaceutical industry still requires a holistic effort — the amendment of the DNI is just one of the steps needed to attract foreign investors.

***

The writer is the executive director of the International Pharmaceutical Manufacturers Group, a non-profit organization comprising 24 international, research-based pharmaceutical companies operating in Indonesia. The views expressed are his own.

---------------

We are looking for information, opinions, and in-depth analysis from experts or scholars in a variety of fields. We choose articles based on facts or opinions about general news, as well as quality analysis and commentary about Indonesia or international events. Send your piece to community@jakpost.com.