Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInside China's plans for world robot domination

Change text size

Gift Premium Articles

to Anyone

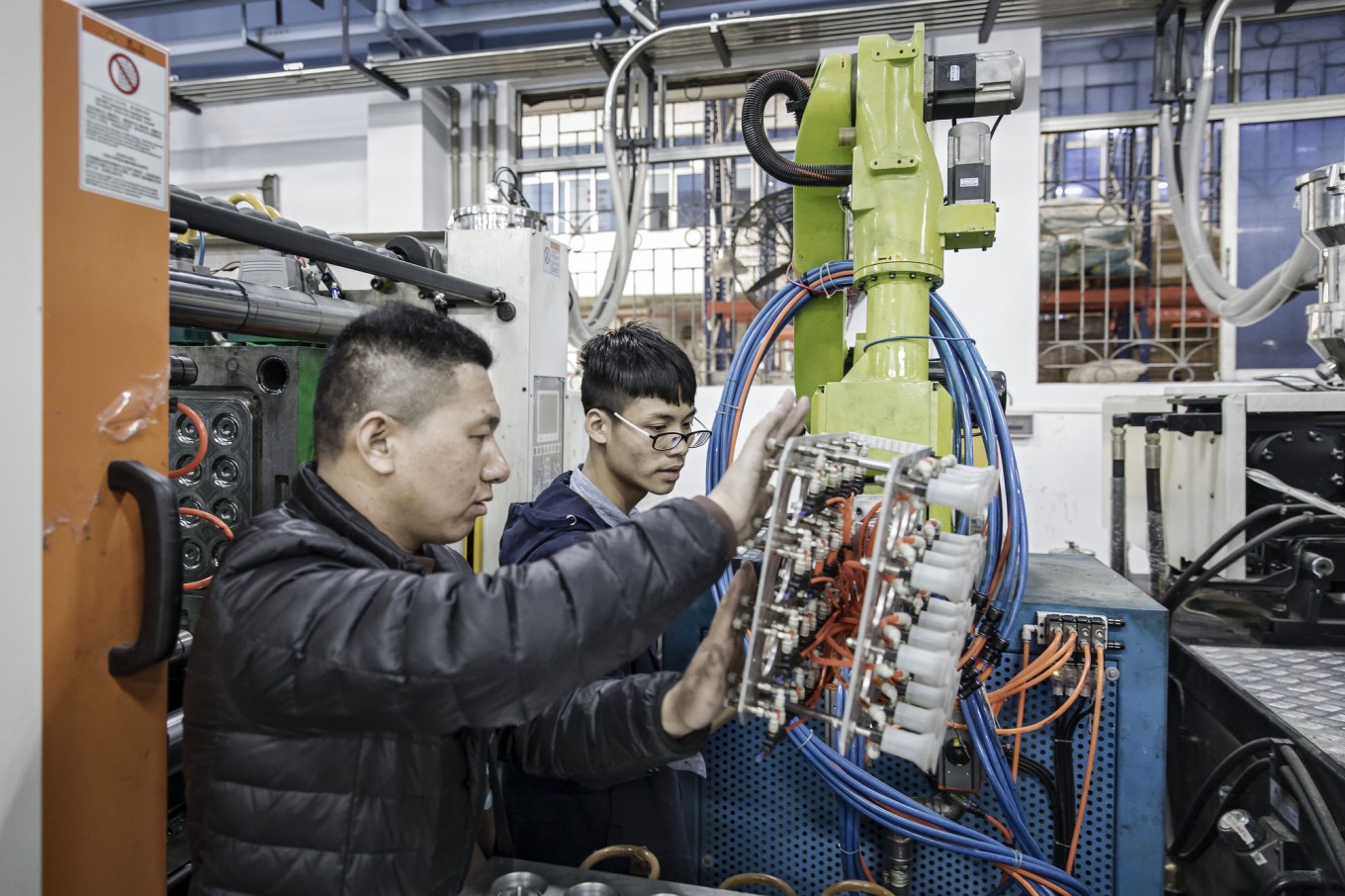

Inside JD.com’s logistics base in Shanghai. (Bloomberg/Qilai Shen)

Inside JD.com’s logistics base in Shanghai. (Bloomberg/Qilai Shen)

S

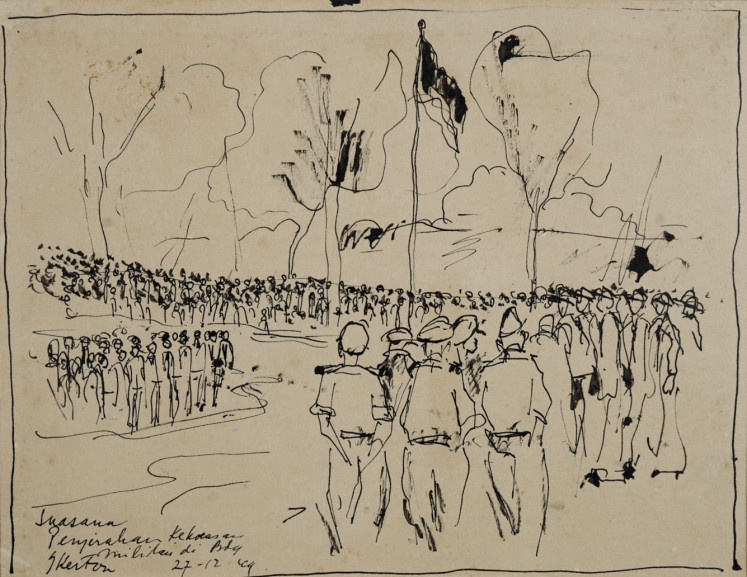

cenes from China’s quest to dominate the robotic future: At startup E-Deodar, a human-looking droid serves coffee to employees who are building $15,000 industrial bots that are about a third cheaper than foreign brands and are being used to automate assembly lines across the Pearl River Delta manufacturing hub.

Some 1,900 kilometers (1,200 miles) to the north, inside a lab at Beijing-based e-commerce giant JD.com Inc., a spider-like robot plunges down from its frame, seizes a book on a conveyor belt with its suctioned claws and hurls it into a crate. The machine can sort 3,600 objects an hour, four times as many as a person -- just one piece of the robotic technology the company’s developing to automate warehouses.

China is embracing robotics with the same full-on intensity that’s made it a force in high-speed rail and renewable energy. Beijing economic planners view it as a stepping stone to a broader strategic goal: dominating emerging markets for artificial intelligence, driver-less vehicles and digitally-connected appliances and homes. “China has a great history of being an effective fast follower,” said Colin Angle, chief executive officer of Bedford, Massachusetts-based vacuum and defense robot maker iRobot Corp. “The question will be “‘Can they innovate?’”

Standing in the way are established robotics superpowers like Japan, South Korea, Germany and the U.S. Yet China has three big advantages--scale, growth momentum and money. It’s home to the world’s fastest-growing robotics market and vast manufacturing sector where companies are under pressure to automate. China overtook Japan in 2013 in unit sales domestically. Guangdong province, for example, announced in 2015 plans to offer 943 billion yuan ($137 billion) in subsidies to about 2,000 local companies, including both robot makers and those making autos, home appliances, and construction materials, that are looking to automate their plants.

That creates a big opening for Chinese start-ups. “The mantle of leadership is wide open,” said Justin Rose, a partner and manufacturing expert with Boston Consulting Group in Chicago. “China has the ability to rise to prominence.”

To get there, China has a two-pronged strategy. President Xi Jinping’s government wants local industrial robotics makers like E-Deodar Robot Equipment Co., Anhui Efort Intelligent Equipment Co., and Siasun Robot & Automation Co. to take on foreign players including Japan’s Fanuc Corp. or California-based Adept Technology Inc. for leadership in the $11 billion market. Chinese corporate demand is expected to power double-digit demand for factory bots, according to Gudrun Litzenberger, General Secretary of the International Federation of Robotics. In 2016, China installed 90,000 new robots. That’s one-third of the world total and 30 percent more than the year before.

Yet China’s ambitions go beyond factory robots that bolt and weld. Earlier this year, officials deployed a pollution-monitoring robot in the Zhengzhou East Railway Station, one of China’s busiest, and a Chinese deep-sea robot broke a new record, descending to 6,329 meters (21,000 feet) in the Mariana Trench in March. Xi, who in 2014 called for a “robot revolution,” was greeted by a droid when he visited a top science academy in Anhui province last year. “I’m very happy to see you, dear President. I wish you happiness every day,” said Jia Jia, who is also known as "robot goddess" for her good looks, the China Daily reported.

Right now, China lags rival nations when it comes to robot adoption. China had only 49 robots per 10,000 workers in 2015, versus 176 for the U.S., Germany’s 301 and South Korea’s world-leading 531. Yet if China’s robot build-out succeeds, it may be able to stanch the flow of factories moving overseas.

Under a sweeping proposal called “Made in China 2025,” as well as a five-year robot plan launched last April, Beijing plans to focus on automating key sectors of the economy including car manufacturing, electronics, home appliances, logistics, and food production. At the same time, the government wants to increase the share of indigenous-branded robots in China to more than 50 percent of total sales volume by 2020 from 31 percent last year.

Robot makers and the companies that automate will be eligible for subsidies, low-interest loans, tax waivers, and rent-free land. “Fair or unfair, you can expect Chinese companies will get a lot of preferential treatment and funding,” said Rose with Boston Consulting. “They actually have a comprehensive plan to get there. And their track record isn’t terrible either.”

Industrial automation is crucial for China, home to an aging population and shrinking labor force. Manufacturing wages have more than doubled in the last decade. Also, younger Chinese workers, “don’t want to do repetitive work,” said James Li, President of ABB Robotics China, the local unit of Switzerland’s ABB Ltd. and one of the first robot companies to set up in China. It supplies machines that spray paint cars and man electronics assembly lines. “Robotics is hot,” said Li, who notes that local governments are investing heavily in industrial parks to develop the technology.

The Chinese productivity push is being watched with trepidation by global competitors. “They’re putting a lot of money and a lot of effort into automation and robotics in China. There’s nothing keeping them from coming after our market,” said John Roemisch, vice-president of sales and marketing for Fanuc America Corp.

Read also: Uber nearly removed from App Store by Tim Cook

Demand for robots in China is clear enough. Less certain is whether Chinese robotics companies have the tech savvy to compete globally. Lured by tax breaks and cheap land, some 800 Chinese robotics companies have set up shop. Trouble is, some startups buy key components from Siemens or Fanuc, put them in a robot shell with an arm, and then slap on a Chinese brand name, says Chai Yueting, director of the National Engineering Laboratory for E-Commerce Technologies at Tsinghua University.

“China has lots of robot companies. But their technology often is from the Japan or U.S.,” said Chai. “China’s own specific robot technology is still very limited.”

Overcrowded field

Chai predicts that at least half of China’s robot makers will eventually shut their operations. An overcrowded field is a challenge the government has also acknowledged. China risks being inundated with low-end robotics, Xin Guobin, the vice minister of industry and information technology, was quoted as saying in state media in March.

Still, with China’s huge demand, its financial heft, and the government’s clear desire to develop, Chai predicts a handful of globally competitive Chinese robot makers are likely to emerge.

E-Deodar aims to become one of them. Launched in 2015 by Ningbo Techmation Co., the startup has lured Chinese engineers and software developers by recreating a Silicon Valley-style work climate.

“I want employees to feel like they are coming to Starbucks, not an office,” said Max Chu, the general manager who sports short-cropped hair and a casual sweater vest.

The two-year-old Foshan-based company in southern Guangdong province has already mastered the three basic building blocks of sophisticated automated machines: servomotors, drivers and control panels. Most Chinese companies acquire these components from foreign rivals.

Landmark deal

Having its own proprietary technology brings down costs and drives sales of about 40 robots a month. This year’s revenues are expected to reach 50 million yuan ($7.27 million), five times that of 2016, he said. “People ask me, how long can you make robots? I say, it’s simple, we will make robots until there’s no more people in factories,” said Chu.

Chinese home appliance-maker Midea Group Co. has opted to buy its way into the robotics game. In early 2017, it closed its 3.7 billion euro ($4 billion) acquisition of Augsburg, Germany-based Kuka AG, a specialist in transport and automotive robots. The deal, which faced political opposition in Germany, allows Midea to automate and boost productivity in its white goods business, while “grabbing the opportunity” in the robotics industry that’s expanding exponentially, said Andy Gu.

“We need to leverage each other’s strengths to expand our business with each other,” said Gu, the Cornell-educated vice president who led the acquisition.

The Foshan company has started to build a research center in Louisville, Kentucky, and hopes to leverage the expertise of engineers at Kuka’s Robotics Research and Development Center in Austin, Texas, said Gu.

Meanwhile, Midea’s huge sales and distribution network can help Kuka, already one of the top three robot brands globally and in the Chinese market, move into new businesses. “We are going to expand into more industries to be more diversified,” said its German CEO Till Reuter in a March interview. “Midea will help us to open the doors.”

Jointly-developed robotic vacuum cleaners will be an early priority, followed by robots to meet the healthcare needs of China’s rapidly aging population, according to Midea’s Gu, who sees a big future market for machines designed for home use. Sales of domestic service robots in 2015 increased 16 percent to 5.4 million units, propelling a $2.2 billion market, according to the International Federation of Robotics. “If the base is big enough, and the costs really come down, then there is an opportunity to really move these products,” said Gu.

The biggest robotics market of them all in China may be logistics. While Amazon took the lead with its purchase of robot maker Kiva in 2012, JD.com is now rushing to automate its business, which is still reliant on tens of thousands of warehouse workers and deliverymen on trucks and motorcycles. It is using its own self-developed test drones to deliver packages in remote, rural regions of China and is experimenting with robots that deliver packages on college campuses.

The goal is near human-less warehouses. Eventually packages will be delivered via drones or driver-less vehicles, and facial recognition software will be used to prevent delivery errors, according to JD.com Chief Technology Officer Chen Zhang. “For the new wave in intelligent robots who can learn, who can get better faster,” the developments are just beginning, said Chen. “We are all just starting out really.”

The technology gap that must be overcome by Chinese robot-makers is still substantial, and it’s hard to imagine so many startup companies surviving long-term. However, foreign executives see China producing some globally competitive robotic companies eventually.

“As they learn how to compete, they’ll be a force to be reckoned with,” said Stuart Shepherd, CEO of Gudel Inc., the U.S. unit of the eponymous Swiss robot manufacturer.