PLN to secure $761m in loans from Chinese banks in June

State utility firm PT PLN is set to secure another US$761 million in loans from Chinese banks next month to help finance its 10,000 megawatt (MW) electricity project, president director Fahmi Mochtar said Monday

Change text size

Gift Premium Articles

to Anyone

State utility firm PT PLN is set to secure another US$761 million in loans from Chinese banks next month to help finance its 10,000 megawatt (MW) electricity project, president director Fahmi Mochtar said Monday.

Fahmi said PLN would receive a loan amounting to $468 million from the China Development Bank for the Adipala power plant in Cilacap, Central Java. PLN would receive another $293 million loan from the Export-Import Bank of China to finance the Pacitan plant in East Java.

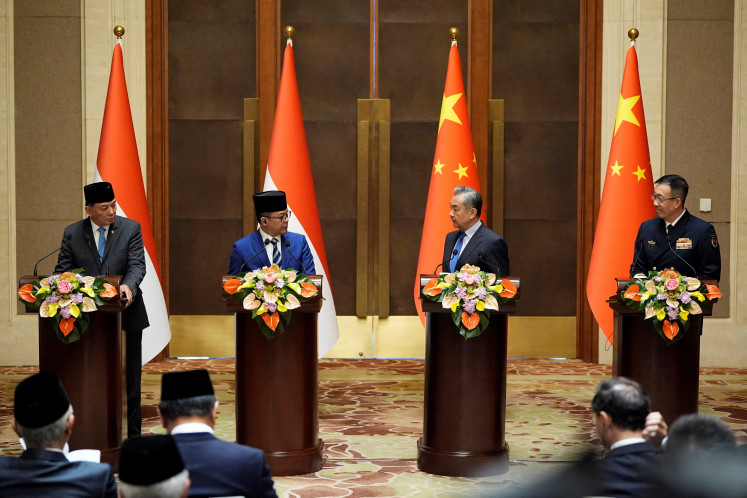

"The loan agreements will be signed on June 10 during the inauguration of the Suramadu Bridge. Pak President (Susilo Bambang Yudhoyono) will attend the signing ceremony," Fahmi said.

The Adipala power plant has a capacity of 660 megawatts, while the Pacitan power plant has a capacity of 2x315 megawatts. Fahmi said the loan agreement in June would secure all the dollar investment required by the two power plants.

Fahmi said PLN had earlier secured Rp 1.46 trillion in loans from Bank Bukopin for the rupiah portion of the loans required for the Pacitan power plant development. "Now, we are still looking for another Rp 1.89 trillion loan for the rupiah portion of the Adipala power plant development," he said.

Adipala and Pacitan are two power plants built under the 10,000 MW crash program, launched in 2006. The program covers the construction of 33 power plants, 10 of them in Java and Bali, with 23 located off the two main islands, said Rudiantara, PLN's vice president director.

According to Rudiantara, the project needs a total of $5.9 billion and Rp 32.30 trillion for power plants and transmission wires. "We have so far secured $3.3 billion and Rp 27.8 trillion."

Chinese banks have so far signed financing commitments for a total of $2.53 billion

Finance Minister Sri Mulyani Indrawati has urged PLN to renegotiate with the Chinese banks the possibility to swap PLN's dollar-denominated loans for China's yuan to help reduce foreign exchange costs.

Indonesia and China have recently agreed to swap up to Rp 175 trillion or 100 billion yuan (about $15 billion) in support of trade deals to lessen exposure to the US dollar, according to the cental bank.

Fahmi said PLN had been in talks with the lenders about the loan swap. But, the swap proposal was apparently not as easy as it might be. "The lenders seem reluctant, as the swap deals are only valid for three years, while PLN's loans are for thirteen years," he said.