Mandiri puts more emphasis on retail and e-banking

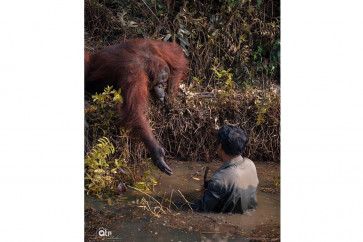

Mobile bankers: State-owned Bank Mandiri’s director of technology and operations Kresno Sediarsi (left) and Bank Mandiri’s director for micro and retail banking Budi G

Change Size

M

span class="inline inline-center">Mobile bankers: State-owned Bank Mandiri’s director of technology and operations Kresno Sediarsi (left) and Bank Mandiri’s director for micro and retail banking Budi G. Sadikin hops into a Ferrari taxi during the introduction of new mobile banking service for the users of iPhone and Android smartphones in Jakarta on Tuesday. (JP/Nurhayati)

PT Bank Mandiri (BMRI), Indonesia’s largest lender by assets, on Wednesday introduced 72 new branches to provide lending and transaction services for small and medium enterprises (SMEs), and launched new electronic banking services for iPhone, BlackBerry and Android-based phones.

The moves are aimed at boosting growth in the retail segment, which the bank views as a fast-growing and resilient sector, Bank Mandiri’s president director Zulkifli Zaini said. “We will continue to grow sectors that are related with SMEs, micro and retail, to complement our corporate and wholesale banking so that our growth is balanced,” Zulkifli said during the launch ceremony of the new SME-serving branches across the country.

Indonesian lenders are currently putting more focus on the retail segment as large corporations shift to debt-market financing instead of bank loans, and in recognition of its immense potential. “We hope that this segment can be one of the engines of growth for Bank Mandiri in the long term,” Zulkifli added.

Bank Mandiri wants to increase its proportion of retail loans to between 40 and 45 percent of overall loans in 2015, compared to between 28 and 29 percent at present.

To develop the retail segment, Bank Mandiri will increase the number of SME branches from the current 343 to 354 across the country by the end of this year and to 500 by 2014. “We want to be the main transaction banker for the SME segment,” director for commercial and business banking Sunarso said.

Bank Mandiri aims to have channeled Rp 73 trillion (US$7.7 billion) in credit to SMEs by 2014, after disbursing loans of Rp 33.1 trillion to 37,000 small and medium entrepreneurs up to June this year, up 28.4 percent from the same period last year. Bank Mandiri’s SME loans range from Rp 200 million to Rp 10 billion.

Meanwhile, the new customer-friendly electronic and handphone banking (e-banking) services are expected to boost transactions and increase the number of active users to 1 million by the end of this year, up from about 600,000 last year.

Bank Mandiri’s e-banking application aims to enable customers to do the same transactions that are traditionally done at ATM counters or branches, with services ranging from checking balances, transfer, mobile card top-up, bill payment, interest rate information and a map menu to locate Bank Mandiri’s ATMs and branches.

“Our customers are still very much dependent on ATMs, but the goal is that within two or three years, customers e-banking will catch up,” Bank Mandiri’s senior vice president head of electronic banking, Rico Frans, told reporters.

Indonesia is home to the world’s third-fastest growing number of internet users, with 18 percent of Indonesians owning more than one mobile phone. About 43 percent of internet access is done through mobile phones.

Bank Mandiri’s e-banking will make it more convenient for customers to conduct bank transactions, which, in turn, could encourage them to bank with Mandiri due to ease of transaction procedures, helping boost the lender’s third-party funds.

The bank also saves costs in reaching out to its clients through e-banking services, as no major costs are required to set up the infrastructure, compared with Rp 1 billion needed for every branch opened, Rp 70 million for every ATM and Rp 3 million for electronic data capture (EDC) tools, according to Bank Mandiri’s director for micro and retail banking Budi G. Sadikin.