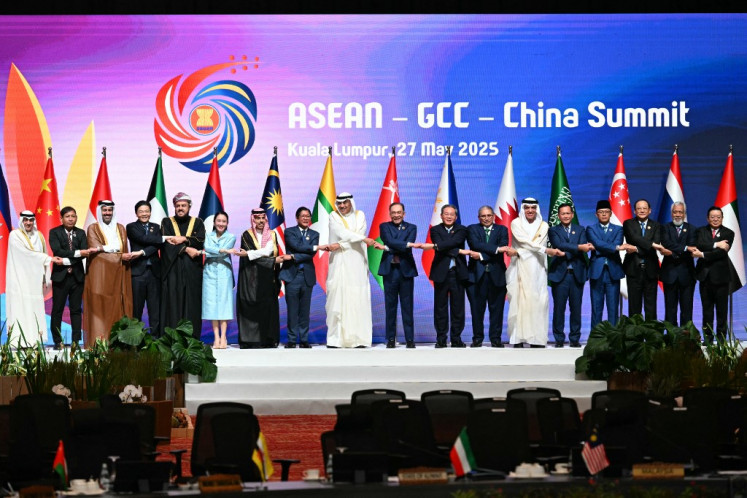

No collateral involved in $3b loans from China

The government has stated that the US$3 billion loan commitment from the China Development Bank (CDB) to three state-owned lenders does not involve any agreement that could lead to the acquisition of those domestic banks

Change text size

Gift Premium Articles

to Anyone

T

he government has stated that the US$3 billion loan commitment from the China Development Bank (CDB) to three state-owned lenders does not involve any agreement that could lead to the acquisition of those domestic banks.

The government said that the loan commitment for Bank Mandiri, BRI and BNI was made under a business-to-business agreement and therefore did not require a government guarantee.

'We did not offer anything as a guarantee. And the two parties made the agreement without pressure from anybody,' the State-Owned Enterprises Ministry's deputy for business services, Gatot Trihargo, said on Tuesday at a hearing with members of the House of Representative Commission VI, overseeing industry and state companies.

Gatot added that the government needed the fund to accelerate its infrastructure projects, which he said would cost around Rp 395 trillion through to 2019.

'The question on whether we need this loan is related to whether or not we need to speed up our infrastructure projects,' Gatot said, adding that the 10-year tenure was in line with the government's long-term commitment for the projects.

BRI president director Asmawi Syam said that in order to get the loan, the three banks only needed to show proposals that mentioned projects to be financed with the funds.

He also said the government required a long loan tenure of more than five years to avoid a mismatch between the project realization and the maturity of the loan.

'The 10-year tenure of the loan is in line with the government's long-term commitment,' he said, adding that other international lenders normally only offered a maximum five-year tenure.

'Actually, this is not the first time we have borrowed money. We have, for example, borrowed money from other international lenders in which they only offered between one to five years of tenure.'

Bank Mandiri president director Budi Gunadi Sadikin gave a similar response when asked why the lender had borrowed money from the CDB, saying that the money would be solely used to finance infrastructure projects.

According to him, it was not possible to use funds from his bank to finance infrastructure projects because the majority of the funds invested in the bank had short-term tenure.

'Our cashflow could get stuck. There is only one percent of a third party's fund whose tenor is above one year,' he explained.

Budi further said that the CDB loan could also stimulate investors to see through the government's commitment to build infrastructure and fix the economy.

'So, it also becomes something for investors to see so that they will trust our commitment,' he added.

On Sept. 17, the ministry assisted three state-owned lenders: Bank Mandiri, Bank BRI and Bank BNI sign a loan contract worth $3 billion from the CDB. The agreement allows the three banks to secure $1 billion each on a 10-year tenure, with 70 percent of the loan made in US dollars, while the remaining 30 percent in Chinese renminbi.

Asmawi said previously that the agreement, which was expected to strengthen the partnership between Indonesia and China, was part of a long-term loan commitment worth $30 billion from the CDB.

News about a government guarantee for the loan spurred public criticism because of the size and productivity of the three banks.

Mandiri, for example, currently has a number of branch offices overseas, including in Shanghai, Hong Kong, Singapore and the UK.

BNI, which is also among Indonesia's largest banks by assets, is currently expanding its presence overseas, including in mainland China. BNI currently has overseas offices in London, Tokyo, New York, Singapore and Hong Kong.

In July, BRI opened a new Rp 30 billion ($2 million) offshore branch in Singapore, which adds to BRI's four existing overseas offices: the BRI New York Agency, the BRI Cayman Islands Branch, the BRI Hong Kong Representative Office and the BRI Remittance Office.