Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBread gains popularity in rice state

Change text size

Gift Premium Articles

to Anyone

W

hat’s on the menu today? In many homes across Indonesia, rice is high on the top of the list, but nowadays noodles and bread have as equal a chance to be served as staples on the table.

Indonesians, known for a long time as among the world’s top rice eaters, are undergoing a shift in what they eat as staple foods.

Consumption of wheat-based products such as noodles and bread has been rising significantly in the past 10 years — making the country the world’s second-largest wheat importer — while per capita rice consumption has stagnated, according to recent research by Dutch lender Rabobank.

Baked goods grew 11.7 percent on average in value and 5.5 percent in volume as more companies expanded their capacity and opened new stores in smaller cities, the research found.

“The growing middle class and changing lifestyles provide a big opportunity for bakery companies, as these consumers have strong buying power, while they embrace modern, Western lifestyles,” Rabobank consumer foods analyst Haris Rahmanto wrote in the research report.

Eight to 9 million people are expected to enter the middle class every year until the total reaches 141 million in 2020, according to the Boston Consulting Group.

This has supported the mushrooming of cafes and restaurants that sell baked products for dishes such as sandwiches and many dessert cakes, as well as to accompany the rising culture around drinking coffee.

Artisanal bakeries contribute to almost half of Indonesia’s total bakery market value, followed by industrial bakeries (33 percent) and private labels (18 percent). Artisanal bakeries bake their products at the points of sale, including those with central kitchens.

The name BreadTalk may ring a bell to many. Established in 2003, the Singapore franchise boutique bakery currently has 162 stores nationwide from Jayapura, Ambon, Gorontalo and Singkawang to Madiun, Pekanbaru and Jambi — not to mention in Jakarta, Bali, Surabaya and Medan, among other places.

“The rising demand for bread in the country can be seen by the increasing number of our stores,” BreadTalk brand manager Tessa Adriani told The Jakarta Post. It is planning to open 20 to 30 stores this year.

In capital city Jakarta, bakery boutiques are widespread in shopping centers and as standalone shops. Customers such as Richard Gumulya, 24, are helping boost sales as his family can spend Rp 500,000 to

Rp 700,000 per month on bread at Union brasserie, bakery and bar.

On a normal day, Union’s Pondok Indah outlet in South Jakarta can sell more than 100 cakes. The figure could double during weekends, said an unidentified staff member.

Artisanal bakeries in bakery shops and cafes are the favorites of the upper middle class, while for the lower income earners and the middle class, the burgeoning modern markets are helping boost industrial bread consumption.

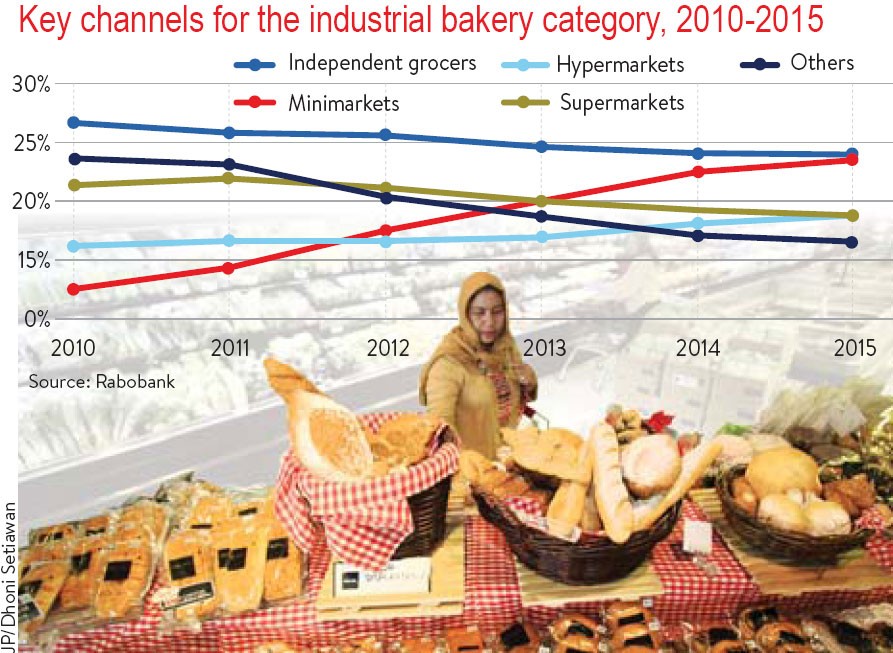

“In five years, the minimarket contribution to the industrial bakery category has grown significantly at the expense of supermarkets and independent grocers,” Rabobank’s Haris said.

Minimarket giants such as Alfamart and Indomaret have more than 20,000 stores across the country, making them the most important channel for the growth of the industrial bakery business.

“The sales of bread in Indomaret have shown an increasing trend,” said Haliman Kustedjo, president director of Indoritel Makmur International, the parent company of Indomaret operator Indomarco Prismatama. Indomaret has seen bread sales increased 25 to 30 percent per year in the past five years both in value and volume.

In 11,000 Alfamart stores throughout the archipelago, sales of its own private label bread has surged by 81.3 percent in the January to March period of this year from the same period a year ago. Sales of other brands that include industrial bread like Sari Roti and Mr. Bread soared even higher by 84.2 percent.

Publicly listed bread maker Nippon Indosari Corpindo, the company behind the Sari Roti brand, is a market leader in mass produced bread, with 10 factories spread across Indonesia.

Sales of Sari Roti products almost doubled in three years to Rp 2.17 trillion in 2015 from Rp 1.19 trillion in 2012. “The increase in sales happened because of the development of the company’s distribution system,” Nippon Indosari spokesperson Stephen Orlando told the Post.

But for other producers to reach Sari Roti’s point in terms of distribution and nationwide presence will be the top challenge. The Rabobank report noted: “Short shelf life is a classic problem for the bakery business and an even bigger problem for a country with a geographical profile as unique as Indonesia.”

Industrial baked goods are only good for about five days, while transporting goods from Java to other islands could take three days or more. Poor infrastructure and expensive logistics exacerbate this problem, with logistics costs at 24.64 percent of GDP being far above Malaysia (13 percent) and Singapore (8 percent).

“But opportunities are arising from these challenges,” Haris said, citing technologies such as frozen dough, long shelf life products and modified atmosphere packaging as potential problem-solvers for bakery businesses that are ripe for growth in Southeast Asia’s largest economy. (adt/vny/win)