Indonesians declare $8.9b of Singapore assets for tax

Indonesians have declared Rp 117.3 trillion (US$8.9 billion) of assets held in Singapore under the government’s tax amnesty, though only a small proportion of that figure has been brought back home, Indonesia’s Finance Ministry said Friday.

Change text size

Gift Premium Articles

to Anyone

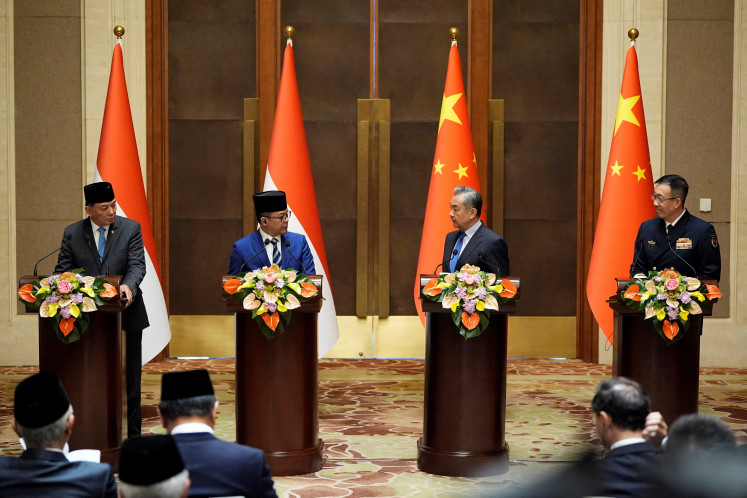

Neighboring city-state Singapore at sunset. (Shutterstock/File)

Neighboring city-state Singapore at sunset. (Shutterstock/File)

Indonesians have declared

Rp 117.3 trillion (US$8.9 billion) of assets held in Singapore under the government’s tax amnesty, though only a small proportion of that figure has been brought back home, Indonesia’s Finance Ministry said Friday.

Of the total Singapore assets declared to the Indonesian government as of Sept. 15, only 14.1 trillion rupiah, or about 12 percent, has been repatriated, the ministry said.

Under the amnesty launched in June, Indonesians can pay a tax rate starting at 4 percent on declared assets that they choose to leave overseas.

The rate increases in stages to 10 percent as the amnesty draws to a close in March. Indonesians who agree to repatriate their assets, for a period of at least three years, are offered a rate of only 2 percent, as well as a range of possible investments.

Indonesia is banking on securing Rp 165 trillion of tax revenue from the amnesty, which would help offset traditionally poor tax collection rates while keeping the budget deficit under a mandated 3 percent threshold.

Last month, the central bank said it was getting ready to stop the rupiah from strengthening too much on the back of funds coming home as part of the amnesty.

In an indicator that the collection program might be faltering, Indonesia’s Finance Ministry earlier this week removed a progress bar it was using to compare amounts received against the Rp 165 trillion target from the website it set up to provide information on the tax amnesty.

The government has received

Rp 22.7 trillion so far, the ministry said Friday.

“Indonesia’s ambitious tax revenue and fiscal deficit targets look to be under threat given the anemic tax amnesty inflows so far,” analysts at Australia & New Zealand

Banking Group Ltd. said in a report Friday.

Jakarta also faces political backlash from the amnesty, which has been criticized by the Organisation for Economic Cooperation and Development as offering rates that are unfair to law-abiding taxpayers.

On the other hand, Indonesia’s Constitutional Court could clear up some doubts about the future of the program when it rules on petitions brought by civil society groups that are seeking to nullify the amnesty.

A positive ruling “should remove the uncertainty that may be hampering more participation”, said Euben Paracuelles, a Singapore-based economist with Nomura Holdings Inc., in a report Friday. “We also see it likely that as the number of participants increases, this could snowball and encourage even more participation.”

Earlier this month, two of Indonesia’s wealthiest men said they will participate in the tax amnesty to clear their past omissions, boosting the credibility of the program.

James Riady, the son of Lippo Group’s founder, arrived at the Jakarta tax office on Sept. 2 to take part in the plan.

Tahir, the founder of PT Bank Mayapada International who goes by one name, said by phone his family will submit documents this month to support the program.

Meanwhile, the Monetary Authority of Singapore (MAS) said Thursday it is advising banks in the city-state to encourage their clients to make use of the tax amnesty.

The MAS said that, contrary to media reports, participation in the program will not attract criminal investigation in Singapore.