Indonesia’s wooing of China pays off

Change Size

Chinese 100-yuan (RMB) bank notes being counted at a bank in Huaibei, in eastern China's Anhui province. (AFP/File)

Chinese 100-yuan (RMB) bank notes being counted at a bank in Huaibei, in eastern China's Anhui province. (AFP/File)

I

ndonesia’s wooing of China seems to have paid off as Chinese investments continue to perch on the list of top-five realized foreign direct investments (FDI) this year.

Indonesia-China economic relations are getting warmer, a trend not seen in previous years.

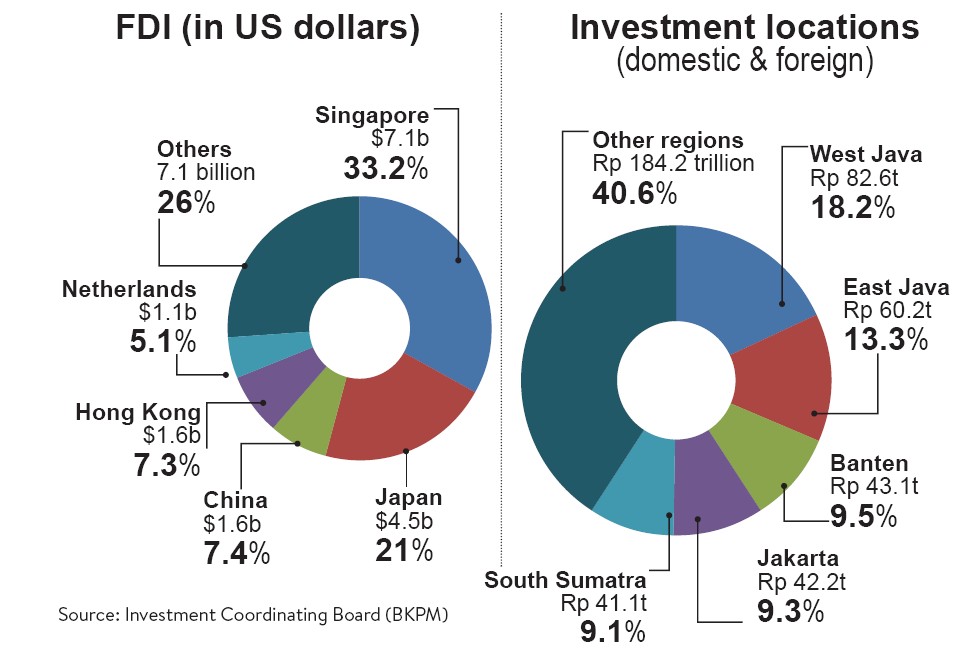

According to the latest data from the Investment Coordinating Board (BKPM), the realized investments from China and Hong Kong hovered in third and fourth place in the January-to-September period, whereas a year ago, Hong Kong only sat in ninth place and China sat in 10th place.

Since taking office in October 2014, President Joko “Jokowi” Widodo has stepped up his administration’s attempt to court China into making various business deals in the archipelago.

In less than two years, Jokowi has met five times with Chinese President Xi Jinping.

He has also held a string of meetings with Chinese businesspeople, with one of the most notable being Jack Ma, the chairman of the Chinese online marketplace Alibaba Group Holding Ltd. Jokowi even made Ma an advisor to Indonesia’s steering e-commerce committee.

The efforts have not stopped at meetings.

The Investment Coordinating Board (BKPM) has created a special desk as well to facilitate Chinese investors. The Chinese desk — as it is dubbed — offers online services using mobile application platforms WeChat and WhatsApp to assist with the investment-application process and provide investment regulation updates in the Chinese language.

The results have been satisfactory. By the end of September, China was already working on 1,205 projects, worth US$1.6 billion, while Hong Kong was working on 758 projects, worth $1.6 billion.

In total, the amount of foreign direct investment (FDI) stood at Rp 295.2 trillion ($22.66 billion), equal to almost 77 percent of the full-year target of Rp 386.4 trillion. Singapore remains Indonesia’s top foreign investor and the steel and mineral processing industries remain the most preferred sector of foreign investors.

China, in particular, has most of its investments parked in the steel and mineral processing sectors, with smelters in Sulawesi included as part of its investment. One example is PT Virtue Dragon Nickel Industry, which processes ferronickel in Konawe, Southeast Sulawesi province.

BKPM investment monitoring and implementation deputy chairman Azhar Lubis attributed the high investment in those sectors to the ban on mineral ore exports.

“Companies have no choice but to build smelters. However, at the same time they feed other industries, such as the automotive industry,” he said on Thursday.

Chinese investors are also going large in the cement and automotive industries, signaling a commitment to Indonesia’s infrastructure sector, namely by Chinese cement maker Anhui Conch Cement Co. Ltd., which has built cement plants in Kalimantan and the Papua islands.

BKPM chairman Thomas Lembong pointed to tourism as another sector that Chinese investors could move into.

“Chinese investments in tourism are small, but we see more and more Chinese tourists visit Indonesia. It can be an opportunity for them to cater to the tourists,” he said, adding that it was also upbeat that it would be able to achieve its full-year target in the remaining months.

Separately, Chris Kanter, an advisory board member of the Indonesian Chamber of Commerce and Industry (Kadin), said opportunities were robust for Chinese investors, citing large demand from the Indonesian market.

“Sometimes commitment does not translate into full realization, so it takes time for a project to be complete. To see the completion, the government simply has to consider their detailed demands,” he said.

Samuel Asset Management economist Lana Soelistianingsih acknowledged the positive results, but called on the BKPM to dig deeper into the investors’ claims and avoid labeling first steps such as land acquisition to build factories as “realization”.

__________________________

To receive comprehensive and earlier access to The Jakarta Post print edition, please subscribe to our epaper through iOS' iTunes, Android's Google Play, Blackberry World or Microsoft's Windows Store. Subscription includes free daily editions of The Nation, The Star Malaysia, the Philippine Daily Inquirer and Asia News.

For print subscription, please contact our call center at (+6221) 5360014 or subscription@thejakartapost.com