Fintech talk: Maintaining market share of social commerce

In general, consumers understand that e-commerce is a new form of transaction that is experiencing trends of limitless development, from which new and large players in the industry have been born, including Lazada and Tokopedia.

Change text size

Gift Premium Articles

to Anyone

Fintech Talk (JP/File)

Fintech Talk (JP/File)

In general, consumers understand that e-commerce is a new form of transaction that is experiencing trends of limitless development, from which new and large players in the industry have been born, including Lazada and Tokopedia.

Moreover, large retailers that have previously operated conventionally — such as MAP, Matahari and Ramayana — are now participating in the e-commerce platform to maintain pace in the development of their brands.

However, a survey compiled by Tech in Asia demonstrates that the market share of e-commerce is only 20 percent of the total online shopping market.

Social commerce — as a more traditional method in which a transaction is done on a social media platform such as Facebook, Instagram, Line and WhatsApp — instead dominates 80 percent of the market with 2.7 million transactions conducted each day.

However, this is not surprising as a survey undertaken by the Indonesian Internet Providers Association (APJII) reports that the average duration of smartphone use for social media activities is 2 hours and 51 minutes.

Facebook Indonesia notes that Indonesian mobile users are on average checking their mobile phones more than 80 times per day. Their most common activity while using a smartphone is social media networking.

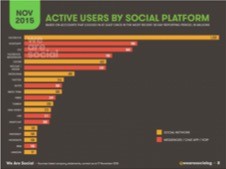

Facebook has identified Indonesia as its fourth most active user in the world.

Indonesian consumers value direct and efficient transacting as demonstrated above and it is indicated as a driving force behind the massive quantity of online trade in goods and services, as well as total trade values via social media.

This is reciprocated by growth in the availability of goods and services. Social commerce has significant potentials in opening access to more than 50 million small and medium sized enterprises.

The enterprises are estimated to absorb as much as 96 percent of the total Indonesian work force, who supply these products and services.

The activities of small and medium enterprises are estimated to contribute as much as 58 percent of Gross National Income and are important contributors to the national economy.

(Read also: The emergence of fintech: disruptive or collaborative?)

Social commerce at its foundation is a gateway through which the Indonesian community can interact with the online spending culture. At the advent of the internet over the last few decades, social media has been one of the first mediums impacted, from which new business concepts have emerged, including online shopping.

Up until today, the position of social commerce remains unchanged. The general public prefers to shop via social media rather than from other websites and this has enabled the industry to educate consumers about online shopping through methods to which they are already accustomed.

The vast scale and potentials of the social commerce industry have been adopted as the foundation of ecommerce business attitudes, which inform their placement of significant investments and in further developing their businesses within this platform.

Despite leading the online shopping world — it’s different with ecommerce, which generally is supported by sophisticated automated systems — social commerce faces challenges with limited infrastructures.

For example, relying on social media as a sales catalogue for a shop, using messenger services as a method for placing orders and using personal banking accounts to record and receive payments.

Other challenges include norms regarding consumers providing cash-on-delivery payments or bank transfers. These manual processes are time consuming and create a reliance on human resources.

The average duration for serving a client is about 5 to 10 minutes from making the sale to receiving receipt of payment in an account.

Social commerce needs to maintain the confidence of consumers, providing a sense of security and comfort, while upholding the reputation of the retailer. This is central to online spending activities to anticipate various malicious and fraudulent activities against consumers.

Businesses in the social commerce industry are aware that to maintain their market share, they must adapt their business models to create innovation and optimize business productivity in a number of ways.

For payment process efficiency, financial technology solutions such as Payment Request features, which are being developed by Uangku, could be the answer. Retailers operating in the social commerce domain only have to send a payment request to the consumer who can then make the payment via their smartphone.

This feature is complete with Buyer Protection and Auto Confirmation, so that the consumer has a guarantee that their money will be refunded if the order is not received.

The consumer is not required to provide proof of payment to the vendor as confirmation of payment will be provided automatically. Fintech service providers, as a third party, may also serve as a payment intermediary, so that the consumer feels secure and the vendor does not have to undertake manual checks.

It is hoped that Fintech may become a solution in increasing the effectiveness of the social commerce supply chain to help and encourage consumers to transact online more securely, effectively and efficiently.