Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFintech Talk: Encouraging investment through P2P lending scheme

Change text size

Gift Premium Articles

to Anyone

T

he majority of Indonesians are still highly reluctant to invest. They would rather keep their money in time-deposit accounts as opposed to in investment instruments. This is exhibited by that fact that out of approximately 60 million Indonesians who have savings accounts, only 3.8 million have time-deposit accounts. Meanwhile, only 1 million individuals have investment accounts with the Indonesia Stock Exchange (IDX).

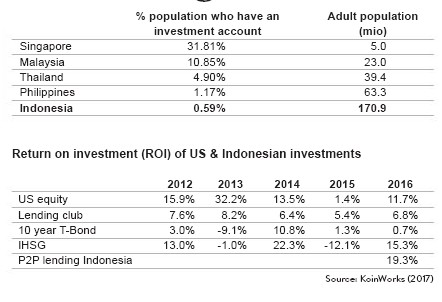

Compared to other ASEAN nations, the ratio of local investors in Indonesia is among the lowest.

There are three reasons why Indonesians are reluctant to invest: They do not understand the objectives of investing, they do not have disposable income to be allocated for investments and they cannot tell the difference between investing and saving money.

The reluctance of most Indonesians to invest is also caused by a relatively low financial literacy rate about investment instruments, especially capital markets. Thus, Indonesians need to be provided with access to basic knowledge regarding the virtues and investment instrument options that are currently available. This will help them make sound decisions about the investments that would fit them best in terms of yield and risk management.

(Read also: Fintech Talk: Improving banks’ competitiveness with fintech)

Financial technology (fintech) business players that provide peer-to-peer (P2P) lending schemes can be ideal initial mediums of investment that need to be considered. They offer simple access to investment options with affordable entry scales. People can also learn the basics of investment through these platforms.

P2P lending companies provide technological platforms that are digitally integrated, in which people in possession of capital can allocate that capital to borrowers as an investment.

A major reason that makes investment with P2P lending firms promising is the competitive levels of return and relatively low volatility. Normally, the rate of return and risk of P2P lending are positioned between the rates of equity and sovereign bonds. In 2016, the rates of net return offered by four local P2P loan providers (KoinWorks, Investree, Modalku and Amartha) were between 17 percent and 20 percent. The levels are considerably more competitive than the return of investment (ROI) in the local capital market.

Investment landscape(JP/File)

Investment landscape(JP/File)

Investing through P2P lending is also relatively cheap and affordable. The investment subscription varies between Rp 100,000 (US$7.50) and Rp 1 million and often does not require a minimum amount of retained portfolio.

Another benefit is the simplicity in the management of investment activities. Investors have the freedom to invest passively or actively. If an investor chooses to be a passive participant, P2P lending firms offer an auto-invest feature that is based on personal preferences. With this, investors do not need to constantly participate in all lending transactions manually. Investors have the luxury to access the investments only on a periodic basis to monitor the movement of their portfolio.

P2P lending firms also provide assistance in risk analysis so that investors only need to look at two variables: type of lending and diversification. Investors can choose the type of lending that fits the risk profile and rate of return that makes them comfortable. The higher the risk, the higher the projected rate of return. Risk versus return is a rule of thumb in the world of investing.

In terms of diversification, P2P lending platforms will constantly educate investors to spread their financing portfolio over several different industries. Investors are advised to participate in at least 20 lending transactions, even with a small amount of investment.

Investors will also learn about financial analysis and investment habits. The majority of P2P lending companies will include risk assessment ratings for all lending transactions, along with a fact sheet that contains a summary of information regarding the commercial activity, as well as the financial and loan performance data of all borrowers. With this information investors can learn to assess the factors that contribute to a risk profile of a commercial activity.

Since loan payments are made monthly, P2P lending platforms provide notifications for active investors so that they may opt to reinvest the return they receive. If no reinvestments are committed, then there will be unproductive capital so that the rate of return they receive will decline.

In most extreme scenarios, the rate of return investors receive may dip to as low as half of its actual projection. By maintaining an active portfolio, investors will learn to appreciate the concept of the compounding effect that may have significant repercussions in the years to come.

Investing through P2P lending may gradually assist Indonesians to understand the fundamental principles of investing. People will eventually get familiar with investment activities and would be ready to experiment with other investment instruments, such as stocks, mutual funds and bonds.

Apart from offering competitive rates of return, fintech firms operating in P2P lending businesses will serve as platforms to open up access for communities to capital. Thus, investors will contribute to a more equal distribution of the country’s economic growth.