Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFraud and other risks still holding back P2P lending business

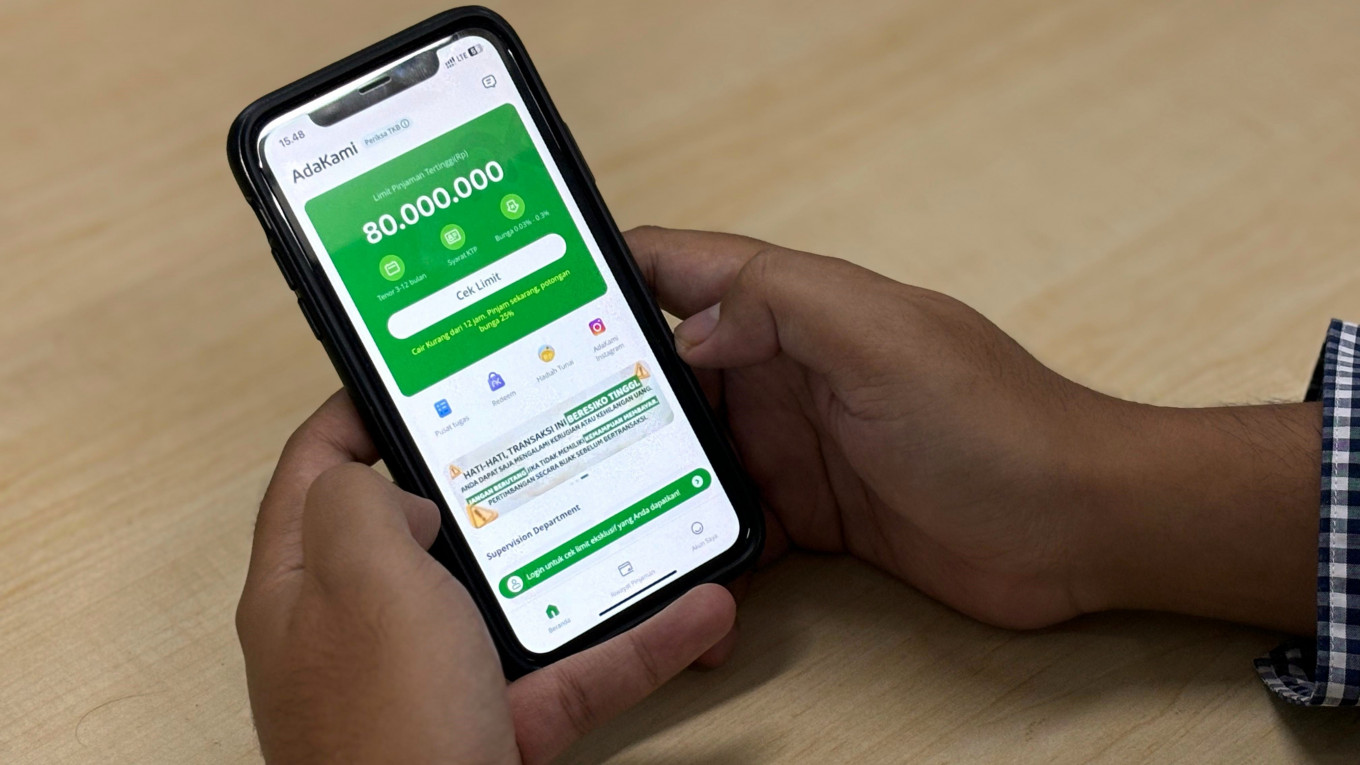

Despite a decade of tightening rules on what is allowed and what is not in Indonesia’s burgeoning peer-to-peer (P2P) lending industry, the fintech segment meant to improve financial inclusion is still riddled with risks for both lenders and borrowers.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s burgeoning peer-to-peer (P2P) lending business has been subject to increasingly tight regulations over the past decade, yet it continues to be riddled with risks for both lenders and borrowers, raising questions over its mission to improve financial inclusion.

A recent report from the Indonesian Consumers Foundation (YLKI) shows that financial services, including P2P lending, account for 33.7 percent of all complaints received by the nonprofit organization in 2024.

Within the industry, P2P services were subject to almost as many user complaints as the vastly larger banking segment.

Fifty-five percent of the complaints on P2P lending involved borrowers reporting misconduct in the debt collection process, followed by requests for relief in repayment at 11 percent and the handling of defaults at 6 percent.

Notably, licensed P2P lenders accounted for slightly more complaints than unlicensed, or illegal, ones.

Based on its report, the YLKI has called on the government to tighten oversight of the whole lending process on all platforms, in addition to clarifying the distinction between legal and illegal platforms.

Read also: Fintech P2P lending benefit limits: The good deed that backfires