Indonesia to regulate taxes for global firms’ subsidiaries

Change Size

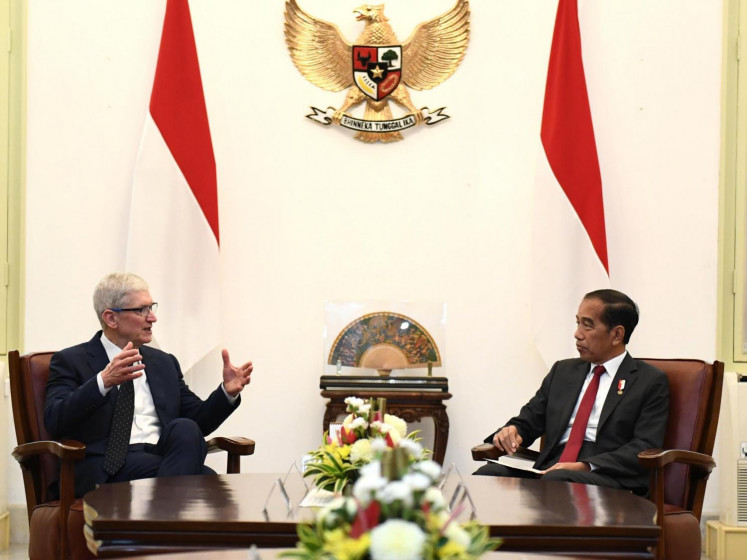

Director General of Taxation Robert Pakpahan. (kompas.com/Yoga Sukmana)

Director General of Taxation Robert Pakpahan. (kompas.com/Yoga Sukmana)

The Directorate General of Taxation has issued a regulation on taxes for subsidiaries of global companies, an official has said.

Finance Ministry Regulation No. 29/2017 on country-by-country (CbC) reporting is based on Finance Minister Regulation No. 213/03/2016 on anticipating tax avoidance through transfer pricing.

Foreign corporations that become parent companies of business groups with a gross turnover of Rp 11 trillion (US$770 million) are required to produce, maintain and release CbC reports, according to the regulation signed by Director General of Taxation Robert Pakpahan as reported by kontan.co.id on Tuesday.

In addition, subsidiaries will also be required to conduct CbC reporting as long as the countries in which the corporations are based do not have a cooperation with Indonesia, or they do not require the business entities to create CbC reports, according to the tax office’s spokesman, Hestu Yoga Saksama.

He added that the requirement was needed because the government does not have access to the necessary information on these businesses.

Hestu said the tax office would list the related countries on its official website.

At least 200 companies will have to conduct CbC reports, including those from Singapore, which does not require CbC reporting. (bbn)