Bank Indonesia hints at rate hike on Wednesday

Change text size

Gift Premium Articles

to Anyone

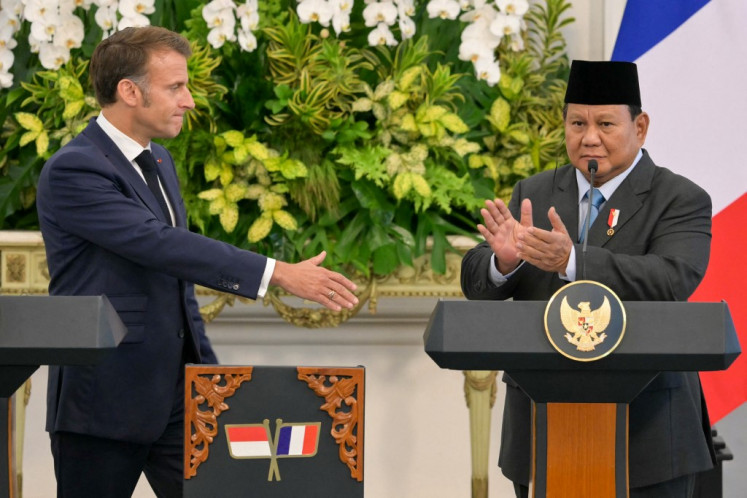

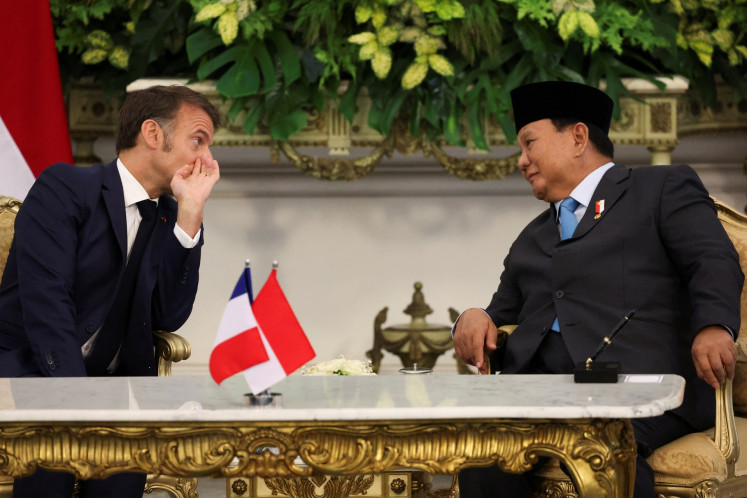

Bank Indonesia Governor Perry Warjiyo (Antara/Hafidz Mubarak)

Bank Indonesia Governor Perry Warjiyo (Antara/Hafidz Mubarak)

B

ank Indonesia Governor Perry Warjiyo indicated on Monday that the central bank could raise its benchmark seven-day reverse repo rate (7DRRR) during its Board of Governors meeting on Wednesday in an aggressive move to maintain rupiah stability.

Perry said the central bank would prioritize short-term stability, particularly through its interest rate policy, adding that BI wanted to be ready to anticipate a further hike in the United States Federal Reserve rate.

“We want to be ahead of the curve prior to the FOMC [Federal Open Market Committee] meeting. That is the reason why we will hold an additional Board of Governors meeting on Wednesday,” he said at a press briefing on Monday in Jakarta.

The FOMC meeting is scheduled to be held between 12 and 13 June in which the Fed is expected to increase its reference rate after it hiked the rate in March.

At the previous two-day Board of Governors meeting on May 16 and 17 that was chaired by then-BI governor Agus Martowardojo, the central bank decided to raise its benchmark interest rate by 25 basis points (bps) to 4.5 percent and hinted at future hikes to stabilize the rupiah.

Perry emphasized that the policy transmission from the interest rate hike would take around 1.5 years to expand the gross domestic product (GDP), adding that the current monetary tightening policy it had undertaken would have a minimal impact on economic growth this year.

Aside from the monetary policy, Perry said BI would continue to optimize its dual intervention policy in the foreign exchange and bonds markets to ensure that forex liquidity would be maintained amid the current volatility. (bbn)