Indonesia’s venture capital progress hinges on new rules

A minimum-capital requirement has proven a tall order for many ventures capital companies (VCs) in Indonesia, and this is just one of several regulations believed to be discouraging investment into the country’s digital industries.

Change Size

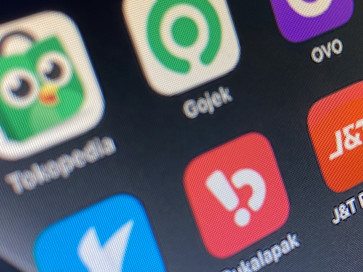

Apps of Indonesia's six unicorns are displayed on a screen on Aug. 3, 2021. The six are ride-hailing company Gojek, e-wallet OVO, online travel agency Traveloka, logistics company J&T Express as well as e-commerce platforms Tokopedia and Bukalapak. (JP/Norman Harsono)

Apps of Indonesia's six unicorns are displayed on a screen on Aug. 3, 2021. The six are ride-hailing company Gojek, e-wallet OVO, online travel agency Traveloka, logistics company J&T Express as well as e-commerce platforms Tokopedia and Bukalapak. (JP/Norman Harsono)

A

Rp 50 billion (US$3.4 million) minimum capital requirement imposed by the Financial Services Authority (OJK) has proven to be a tall order for many venture capital companies (VCs) in Indonesia and is one of several regulatory problems believed to be holding back investors from putting money into the country’s burgeoning digital economy.

According to OJK data, only half of the 61 VCs registered with the agency meet the requirement, as reported by Kontan in July. That is a far cry from the OJK’s aim to get all companies to comply by the end of 2020, five years after the rule was introduced.

To remain in the industry, firms unable to meet the requirement could look to merge with other VCs so as not to have their permits revoked by the OJK.

Venture Capital and Start-up Indonesia Association (Amvesindo) treasurer Edward Ismawan Chamdani told The Jakarta Post on Monday that the required capital was deemed too high, as neighboring countries demanded as little as Rp 10 billion or even Rp 1 billion for VCs to get their permits.

Due to the provision, he said, foreign VCs were reluctant to open permanent offices in Indonesia and were even asking investors to follow them to their headquarter jurisdictions.

“[Founders of] start-ups that want to obtain [additional] funding are often asked to establish their holding company in Singapore,” Edward said, adding that the minimum capital requirement was one of numerous regulatory problems making investors reluctant about taking further steps in Indonesia.

Read also: Venture capital rare bright spot in sluggish recovery