Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsResponsible investment on rise as IDX launches ESG-based indexes

The Indonesia Stock Exchange (IDX), in collaboration with the Indonesian Biodiversity Conservation Trust Fund (Kehati) Foundation, has launched two indexes based on environmental, social and governance (ESG) scores to cater to increasing demand for responsible investment products.

Change text size

Gift Premium Articles

to Anyone

T

he Indonesia Stock Exchange (IDX) has two new indexes that are based on environmental, social and governance (ESG) scores, catering to growing investor interest in the performance of companies beyond their corporate financials.

The two indexes were launched on Monday in collaboration with the Indonesian Biodiversity Conservation Trust Fund (Kehati) Foundation.

While the ESG Sector Leaders IDX KEHATI consists of companies with the highest ESG scores in their respective sectors, the ESG Quality 45 IDX KEHATI reflects 45 companies with top scores in both ESG and financial performance.

To determine their ESG scores, Kehati Foundation assesses companies based on their sustainability reports and financial reports of the past five years. The foundation excludes companies in nine sectors, which include tobacco, pesticides and genetically modified organisms (GMO).

The ESG scores reflect companies' responsibility regarding energy use, greenhouse gas emissions and consumer rights, among other assessment criteria.

“These indexes can become the underlying reference for other investment products, such as mutual funds or exchange-traded funds [ETFs],” IDX president director Inarno Djajadi said during the launch ceremony on Monday.

Assets under management (AUM) of ESG-based mutual funds and ETF products more than quadrupled to Rp 3.38 trillion (US$236.6 million) in October from Rp 730 billion in 2017, according to Financial Services Authority (OJK) data.

With the two new ones, IDX now has four ESG-linked indexes. The first two are the IDX ESG Leaders and the Sustainable and Responsible Investment (SRI)-KEHATI, which was also released in collaboration with the Kehati Foundation.

“We release the new indexes based on market demand for a more diversified ESG-based index. There are 25 companies in the SRI-KEHATI index, and we want to have more,” Kehati Foundation executive director Riki Frindos said at the launch event.

Released in 2009, the SRI-KEHATI index was the first and only of its kind on the IDX and in the Southeast Asian stock markets at the time. Meanwhile, the IDX released the IDX ESG Leaders index only last year.

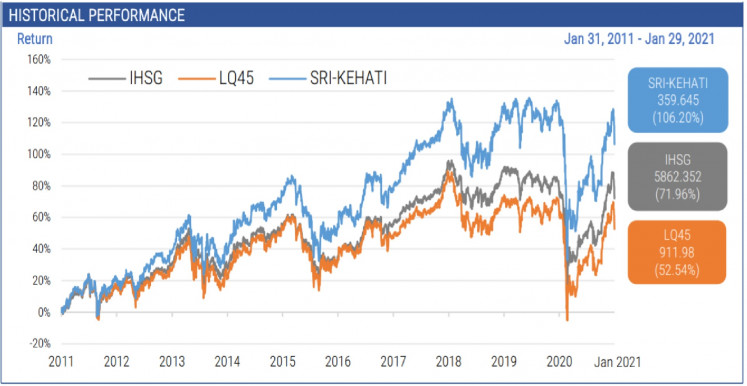

According to data provided on the IDX website, the SRI-KEHATI index outperformed both the IDX Composite, which is the main gauge of Indonesian stocks, and the LQ45, which reflects large-cap stocks, over a 10-year period.

From Jan. 31, 2011, to Jan. 29, 2021, the SRI-KEHATI index generated a return of 106.20 percent, beating the 71.96 percent and 52.24 percent returns generated by the IDX Composite and the LQ45 index, respectively.

The SRI-KEHATI index tracks the shares of 25 publicly listed companies. The index shows higher return than the Indonesia Composite Index (IHSG) and the LQ45 index. (Indonesian Stock Exchange (IDX)/-)Read also: Explainer: The progress and challenges of sustainable financing in Indonesia

IDX development director Hasan Fawzi said at a press conference on Dec. 7 that 153 issuers, or around 25 percent of all publicly listed companies, had submitted sustainability reports last year.

Maybank Investment Banking Group ESG Research head Jigar Shah said that, while ESG adoption, reporting and disclosures were still at a nascent stage in most parts of Asia, publicly listed companies in particular were rapidly increasing their ESG disclosure due to demand from their institutional shareholders, lenders, rating agencies and multinational customers.

“Globally, the subject of climate change is one of the most critical for investors and asset managers, because companies are getting affected by physical risks of floods, heat waves, storms and droughts; hence a large number of professional investors are committing to the principles of responsible investment [PRI],” he told The Jakarta Post in an email.

Read also: Sustainable companies 'attract' investors, talents to Indonesia

The ESG Sector Leaders IDX KEHATI consists of 48 companies, including mining firm PT Vale Indonesia, state-owned lenders Bank Negara Indonesia (BNI) and Bank Mandiri as well as consumer goods companies Unilever and Indofood.

Meanwhile, conglomerate PT Astra International and state-owned telecommunication company PT Telkom Indonesia are among the companies included in the ESG Quality 45 IDX KEHATI index.

“The companies on the two new indexes have good performance and high liquidity,” Sucor Sekuritas analyst Paulus Jimmy told the Post on Monday. “As interest in ESG investing continues to grow, companies on the indexes should see more investment and hopefully also provide attractive returns.”

However, a Maybank Sekuritas report from July notes that consumer goods have high-to-severe ESG risks, as the manufacturing of consumer goods involves extensive use of natural resources. The firm noted that mining also carried high ESG risk stemming from coal extraction and fossil fuel use.