Within the last five years, startups have become a part of our daily lifestyle, alongside the increase in internet access penetration among Indonesians.

Current data from the Indonesian Internet Service Providers Association (APJII) indicates that the number of Indonesian internet users in 2016 reached 132.7 million from a total population of 256.2 million. The number of smartphone users in the country in the same period reached 63.1 million.

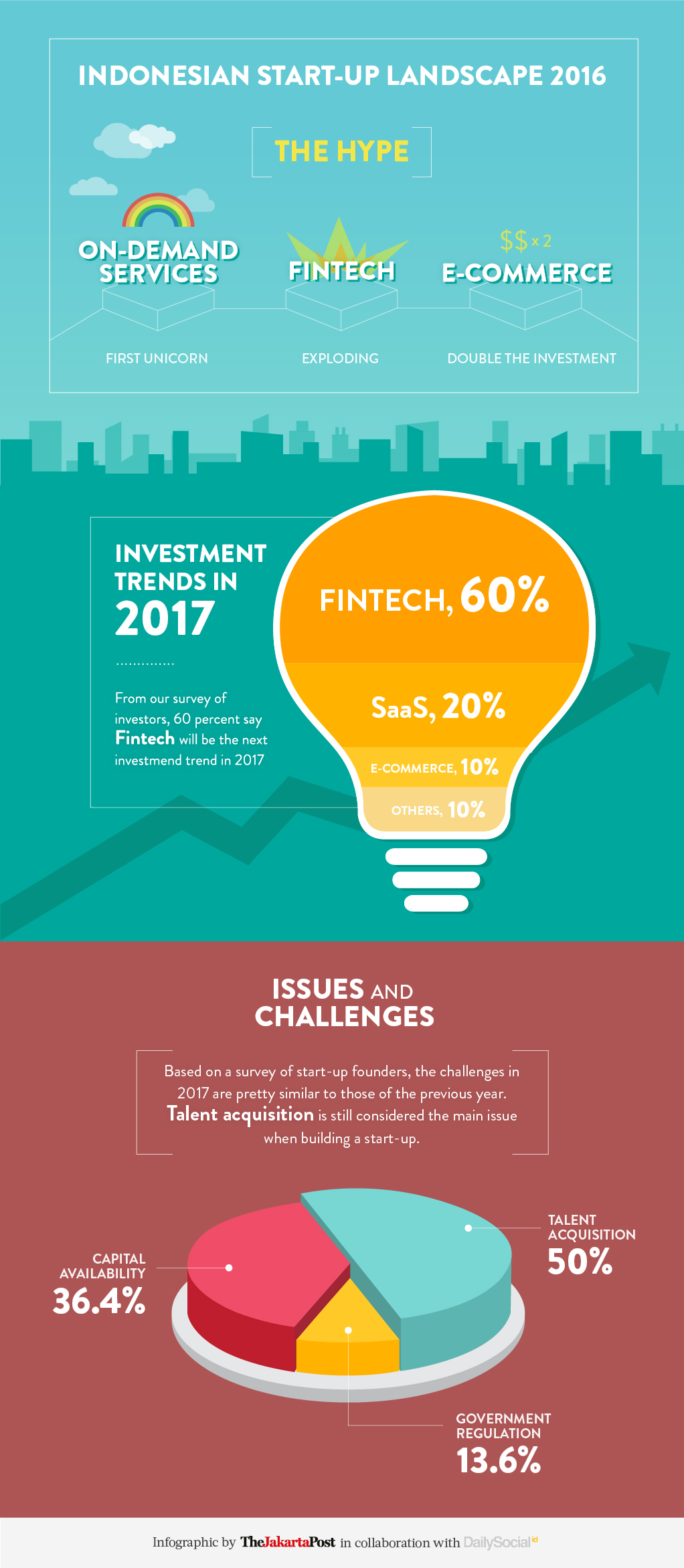

As Indonesians are becoming accustomed to shop and even order transportation online, the new habit propelled one of the most popular on-demand startups, Go-Jek, to reach the seemingly untouched startup realm: the unicorn stage. In layman’s terms, this means the company has a valuation of more than US$1 billion.

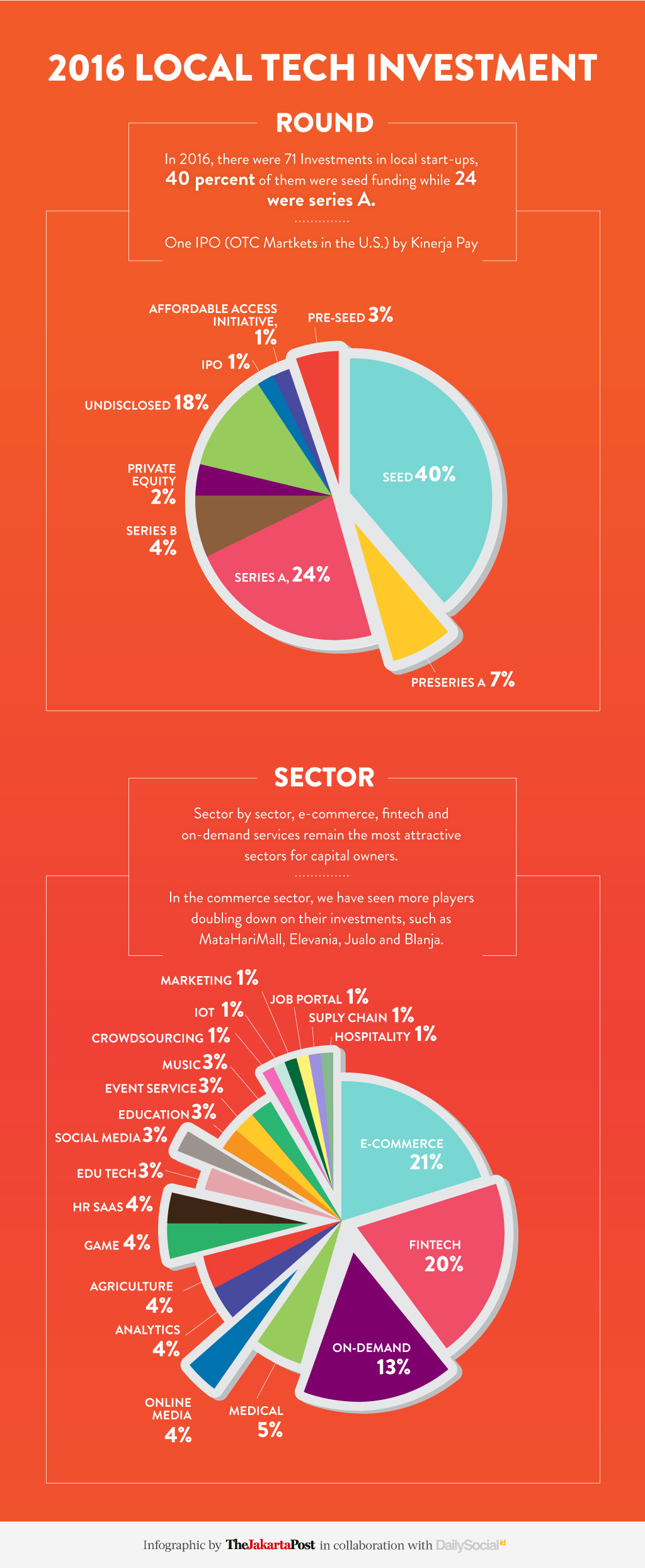

In the Indonesian Tech Startup Report 2016, DailySocial conducted a survey with a number of investors about which sectors are going to be hot, and what their focus in 2017 will be. Based on the compilation, the four sexiest sectors that are predicted to steal the spotlight in 2017 are financial technology (fintech), e-commerce, Software-as-a-Service (SaaS) and on-demand or service marketplace.

Fintech

Fintech is a further development of the financial services industry, which majorly depends on the internet and digital innovations.

C88 Group CEO, John Patrick Ellis, proprietor of CekAja services, a financial e-commerce site in Indonesia, said last year that Indonesia experienced major growth in the fintech field. A large number of businesses in fintech developed significantly; some have even dominated the field and become big players that have contributed to the development of the financial services industry.

According to Ellis, CekAja is confident in the Indonesian fintech scene due to the reality of the country’s low fintech market penetration, reflected in the fact that fintech has yet to reach all regions in Indonesia. He refers to this condition as a ‘double growth factor’, where financial services grow alongside technology.

“Both industries are complementary, and this is why the Indonesian fintech sector will have three to five unicorn companies by the year 2020.”

~John Patrick Ellis,

CEO C88 Group

Founder and CEO of Modalku, Reynold Wijaya, also expresses positivity about fintech’s potential, mainly peer-to-peer lending (P2P lending), which is Modalku’s main service. He said the release of Financial Services Authority (OJK) regulation no. 77/POJK.01/2016 regarding Information Technology-Based Money Lending Services at the end of 2016 had been a major boost for P2P lending businesses.

The issuing of the regulation, he said, built stronger trust among Indonesians toward P2P lending as the industry is recognized by OJK and under its supervision. Modalku claimed that it has distributed Rp 60 billion ($4.496 million) loans with zero percent bad credit rate.

“We are not really concerned about business volume; we care about scaling the business properly. Today, we want to focus on smartphones so the process can be faster. We want to convert conventional users to smartphones,” Reynold said.

President director of venture capitalist Mandiri Capital Indonesia (MCI) Eddi Danusaputro voiced a similar sentiment to Reynold’s statement. Eddi notes the importance of the regulations to ensure customer protection that eventually leads to help in maturing existing fintech businesses and stimulating the rise of new players in the industry. From a value standpoint, he forecasts that the investment in fintech industry will grow to at least 50 percent, even more than 100 percent.

Regarding fintech’s dependence on digital technology developments, both CekAja and Modalku stress the importance of digital signature use. According to Reynold, digital signatures are the main component of the ‘know your customer’ (KYC) process that will enable fintech players to reach out to more customers throughout Indonesia.

Although the government has issued digital signature use, OJK as the certificate authority party (CA) has yet to appoint any institution to execute the mandate. Reynold thinks the roll-out of the program has to be enforced.

“The fintech infrastructure has to be strong so it can reach every part of Indonesia. The only way is to do everything digitally, and this is why awareness about digital signatures must be increased. This is a part of KYC.”

~Reynold Wijaya,

CEO Modalku

Ellis weighs in on the digital signature roll-out, “Digital signature implementation by the government in 2017 will bring fintech forward based on financial inclusions that are aimed to better the people’s lives and Indonesian businesses. We hope other regulations that are issued with it will also support and provide ease for fintech services companies.”

The emergence of Indonesian Fintech Association (AFI), Ellis said, can be a learning place for other local fintech players. The association plays a part in facilitating communication between these players and OJK and Bank Indonesia. The openness among members of the association enables them to engage in dialogues about existing regulations.

“The challenges found in the fintech sector is actually no different than those found in other sectors, and this is why we founded the Indonesian Fintech Association, so there will be an institution within the fintech industry that can represent [these fintech startups] and describe the challenges [found in the industry]. These challenges are better faced with solutions that are made collectively, rather than facing them individually,” he added.

E-commerce

Reports from various sources noted that in 2017, the e-commerce industry in Indonesia is predicted to be valued at $9.3 billion. The rather large potential is in line with the development of general and niche e-commerce services in Indonesia.

“From year to year, e-commerce services and online transactions will become part of Indonesians’ day-to-day activities".

~William Tanuwijaya,

CEO Tokopedia

William also adds that marketplace services will also branch out to the fintech sector this year. “Other than to get daily goods, marketplaces will also evolve into payment gateways and give inclusive financial services. In 2017, open marketplaces will also be home to both local and international brands to market their products for the Indonesian people,” he said.

The ease of payment for any purchase has become crucial and according to William, the evolution of e-commerce into inclusive financial services will help reach every part of Indonesia.

“E-wallet products will see growth in 2017 as they will foster digital economy distribution. Courier business will grow in line with this as they are needed to deliver the products sold on marketplaces,” he said.

The forecasted trend includes hyperlocal purchases where, for instance, customers in North Sumatra will have the inclination to buy products from Medan-based sellers compared to Jakarta. Even if the goods’ price is slightly higher, delivery fees will make the prices stay competitive and the promise of fast-delivery is also appealing to locals.

Contrary to William’s optimism, Convergence Ventures Managing Partner Adrian Li expresses concern about the brewing plan of Alibaba and Amazon’s entrance into Indonesia.

“I think every e-commerce service in the country can expect hardships in 2017, especially with Amazon and Alibaba’s arrival in Indonesia. Both global giants will threaten the existence of local e-commerce services that have become market leaders these days. I think there will be consolidations, just like what has happened in India,” he said.

Adrian also predicts that brands will opt for either direct selling or multichannel, and this strategy is seen as a long-term activity.

While hardships are expected, Adrian thinks more fashion commerce businesses will start flourishing, and the sector mat even dominate the year 2017 in Indonesia. “By integrating design, manufacture and supply chain, fashion commerce businesses will be able to provide trendy clothes, competing with the general retail costs."

Surprisingly, trust factor in e-commerce is still a huge concern this year. “As reported by Google and Temasek, orders from Indonesia have a fraud risk 12 times higher than the global average,” Adrian added.

SaaS (Software-as-a-Service)

Founder and CEO of Talenta, a SaaS platform for human resources management, Joshua Kevin, said that SaaS startup players in Indonesia are similar to those in e-commerce back in the year 2010-2011. It was a period when Indonesian people still had trust crises and were not familiar with the upsides of buying goods online.

“We believe the SaaS industry will see rapid growth, and the decision-makers will fall into a generation who believes that internet and smartphone are a default.”

Joshua Kevin,

CEO and Founder, Talenta

Regarding the ever so crucial issue of cloud-computing security for SaaS players, Joshua revealed that not all SaaS players in Indonesia use solutions or servers from outside Indonesia. He calls for more incentive from the government and cloud companies to make these businesses return to local servers.

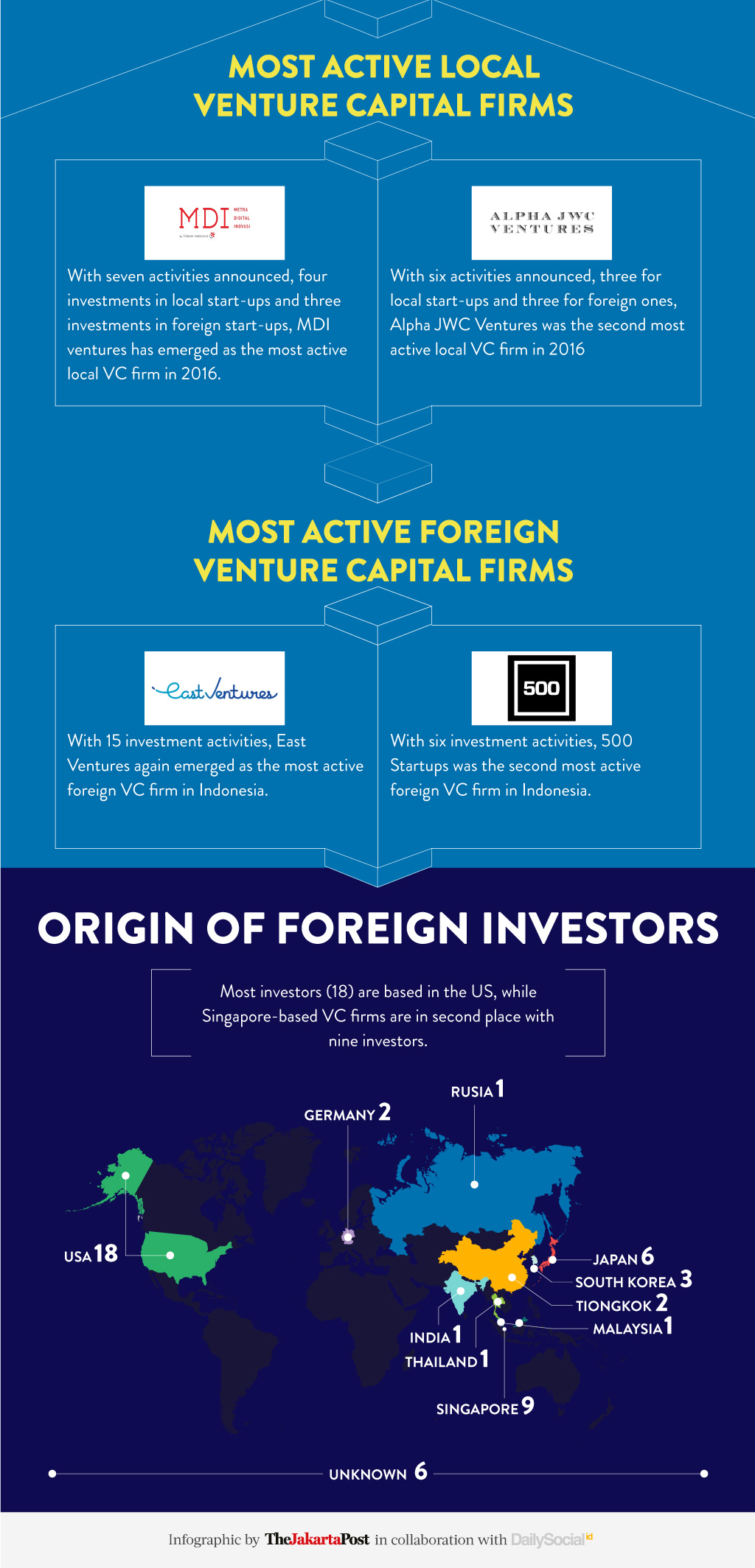

Co-founder and managing partner of East Ventures, Willson Cuaca, adds that the SaaS business movements are starting very well. The venture capitalist has been investing in SaaS startups throughout 2016 and saw tens of thousands of UKM (Small Medium Enterprises) using multiple solutions by several SaaS within their portfolios.

The challenge faced by SaaS players in Indonesia from investors’ point of view, according to Willson, is how users adopt the technology and how small medium enterprises value SaaS. A SaaS startup must be able to educate the market about the benefits of using SaaS, compared to traditional software and ultimately convert.

Moka, a mobile point of sales services (mPOS) startup that targets small medium enterprises, established itself as one of the rising Indonesian SaaS players. Its co-founder and CEO, Haryanto Tanjo, echoed Joshua’s sentiments and revealed that so far Moka still uses Singapore-based cloud services. For its data protection, Moka encrypts outgoing and incoming traffic using SSL plus installs several firewalls for the whole server.

Haryanto also adds that SaaS business in Indonesia can be still regarded as a blue ocean with a vast market. He’s convinced SaaS business competition between players is still not the main concern today.

On-demand

Go-Jek, Grab and Uber are still dominating the on-demand services industry and have successfully managed to convert people’s habit into daily routine.

MDI Ventures CEO Nicko Widjaja revealed what he believes is the hard truth. “It will be hard for new startups to even attempt competing with Go-Jek, Uber and Grab due to their positions as the dominating market leaders in Indonesia,” he said. “To be able to compete with ‘the big three’, a company that has been running its business conventionally, must already adopt the technology needed to compete with these tech-based companies.”

Nicko views collaborations like Blue Bird and Go-Jek have proven that a conventionally-run company will tend to opt to partner up with a startup that already has a product, talents and the ability to create tech-based products. These factors automatically cut down expenses to employ third party or outsourcing to create a new product from zero.

“There is an opportunity for startups, and it is to become ‘corporate enablers’, which offer system, products up to new technology to large corporations. This seems to have started growing from this year onwards,” Nicko said.

Go-Jek co-founder and CEO, Nadiem Makarim, noted that 2015 and 2016 were the years for services like Go-Jek and e-commerces to find their market and set up their marketing strategy. The year 2017 will be the defining moment for most on-demand service businesses.

“I think 2017 will be a key moment, not only for Go-Jek, but also other on-demand services in Indonesia. This year will be the year where everything goes mobile,” Nadiem stated.

Infrastructure challenges, according to Nadiem, are an opportunity for on-demand services like Go-Jek to grow. “Many challenges in the existing infrastructure are actually a challenge for Go-Jek in offering solutions for all Indonesian people. In this case, Go-Jek sees the weakness in infrastructure as an opportunity to provide appropriate solutions for all its users.”

Within the last two years, on-demand services have grown into several varieties, and have branched out beyond transportation services. They have offered domestic services that include housemaids, house cleaning and AC repair services. One of the most well-known on-demand services in this segment is Seekmi.

Seekmi CEO Clarissa Leung said, “We’re very lucky that smartphone penetration has experienced significant growth among our vendors and technicians just a year after Seekmi was launched. This enables Seekmi to manage about 10,000 personnel efficiently.”

“I think there will be more Indonesians who will utilize technology, in this case apps, to help them do daily chores from the simplest up to the heaviest with on-demand services this year. Trust will grow in on-demand services because they are proven to save expenses,” she adds.

Although offering convenience, on-demand services are still not convincing the older generations to give it them a go. But Clarissa is not ready to give in. “Seekmi still offers SMS and telephone customer service. Traditional approaches must still be utilized for tech companies offering these kinds of services."

The promising outlook of on-demand services does not dismiss the fact that these businesses are having a hard time scaling up due to their hyperlocal nature. Each city in Indonesia has its own tradition and habits, which is one of the biggest challenges in the industry.

Nicko weighs in: “On-demand services can never work alone. They need to partner with other tech companies, corporations and the government to overcome these challenges.”

This longform article is a collaboration between DailySocial and The Jakarta Post.

It is also published in Bahasa Indonesia on this page.

| DailySocial: | ||

| CEO & Founder | : | Rama Mamuaya |

| Editor-in-Chief | : | Amir Karimuddin |

| Editor-in-Chief | : | Wiku Baskoro |

| Writers | : | Yenny Yusra, Marsya Nabila |

| The Jakarta Post: | ||

| Managing Editor Life | : | Asmara Wreksono |

| Editor | : | Keshie Hernitaningtyas |

| J+ team | : | Jessicha Valentina, Masajeng Rahmiasri, Ni Nyoman Wira |

| Technology | : | Muhamad Zarkasih, Mustofa, Ega Agung Nugraha |

| Infographic | : | Sarah Naulibasa, Sandy Riady |

| Video & Multimedia | : | Bayu Widhiatmoko, I.G. Dharma J.S., Ahmad Zamzami,

Rian Irawan, Wienda Parwitasari |