Sri Lanka clamps down on remittances as it battles forex crisis

The pandemic has wreaked havoc on the island's economy, and the government has banned imports of food, vehicles and other items in an effort to shore up its stockpile of foreign currency.

Change text size

Gift Premium Articles

to Anyone

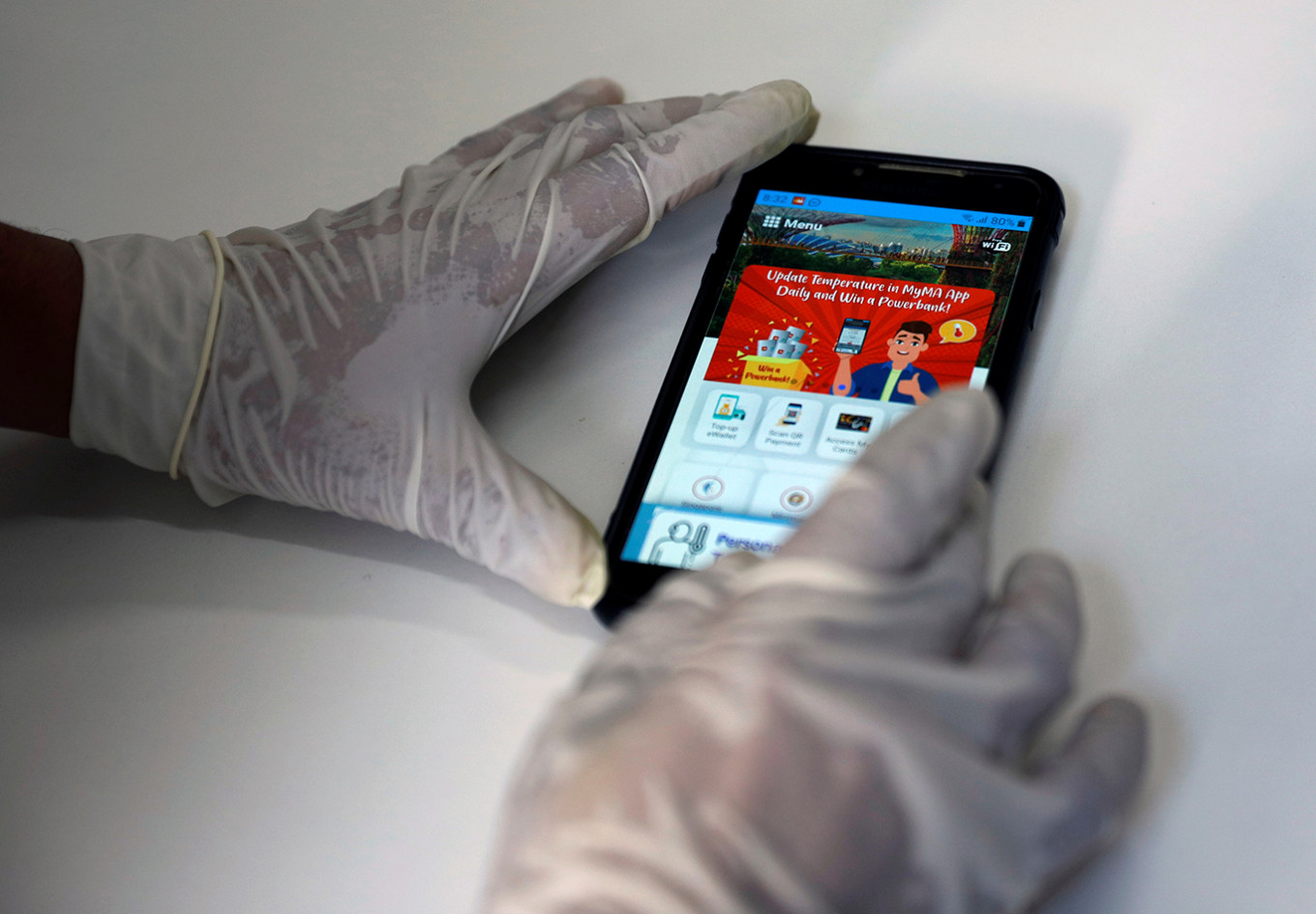

A migrant worker shows the MyMA app in his dormitory, amid the coronavirus disease (COVID-19) outbreak in Singapore May 15, 2020. The app caters to the needs of migrant workers and domestic helpers in Singapore. It provides news updates, electronic remittance, monitoring of daily temperatures and streaming of movies in Hindi and Bengali. (REUTERS/Edgar Su)

A migrant worker shows the MyMA app in his dormitory, amid the coronavirus disease (COVID-19) outbreak in Singapore May 15, 2020. The app caters to the needs of migrant workers and domestic helpers in Singapore. It provides news updates, electronic remittance, monitoring of daily temperatures and streaming of movies in Hindi and Bengali. (REUTERS/Edgar Su)

C

olombo threatened Thursday to freeze the bank accounts of Sri Lankans working overseas who send money back to the country using informal money changers, as depleted foreign exchange reserves drive a thriving black market for dollars.

The pandemic has wreaked havoc on the island's economy, and the government has banned imports of food, vehicles and other items in an effort to shore up its stockpile of foreign currency.

These restrictions have led to severe shortages of food, cooking gas and cement, and Sri Lanka was forced to shut its only oil refinery last month as the country ran out of dollars to import crude.

The official exchange rate of 202 rupees to the dollar, offered by commercial banks that have run out of foreign currency, is well below the 240-245 rupees offered by informal money changers now in the central bank's crosshairs.

The bank's governor Ajith Nivard Cabraal said that migrant workers and others would face consequences if they sent their earnings home outside of official channels.

"Bank accounts of those who distribute and receive #money through #unlawful money transmission methods will be frozen with immediate effect," Cabraal said on Twitter.

He added that the central bank "urges all #migrant Sri Lankans to use only #legal channels to #repatriate their earnings".

The bank has also offered to pay a 10 rupee incentive to overseas workers who send money back through official channels, up from two rupees before.

Sri Lanka is struggling to service its foreign debt and forex reserves had fallen to $2.26 billion at the end of October, around a third of the levels when the government took office two years ago.

Ratings agency Moody's downgraded Sri Lanka's foreign debt rating in October and the government unveiled a drastic austerity budget last month in an attempt to rein in its runaway deficit.

Central bank officials have said the country is facing its worst foreign exchange crisis since the advent of a free economy and have demanded all exporters turn over their foreign exchange earnings to the government within six months.

Sri Lanka recorded its worst-ever economic performance last year with a 3.6 percent contraction, fueled largely by the fallout from the pandemic on tourism.