Palm oil's premium to be short lived, to fade with Indonesian supply

The premium has slowed down palm oil FCPOc3 purchases for April shipments by key importers in Asia, Africa and Europe as refiners were replacing palm oil with rapeseed and sunoil, they said.

Change text size

Gift Premium Articles

to Anyone

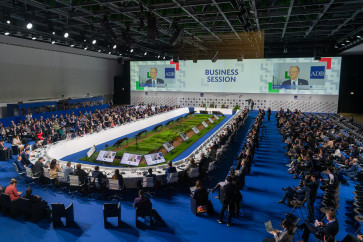

Worker loads palm oil fresh fruit bunches to be transported from the collector site to CPO factories in Pekanbaru, Riau, on April 27, 2022. (Reuters/Willy Kurniawan)

Worker loads palm oil fresh fruit bunches to be transported from the collector site to CPO factories in Pekanbaru, Riau, on April 27, 2022. (Reuters/Willy Kurniawan)

P

alm oil's rare premium over rival rapeseed oil and sunflower oil is likely to be short-lived and it should start trading at a discount once top producer Indonesia eases export curbs after Ramadan, industry participants told Reuters.

The premium has slowed down palm oil FCPOc3 purchases for April shipments by key importers in Asia, Africa and Europe as refiners were replacing palm oil with rapeseed and sunoil, they said.

Sunflower oil and canola oil prices have fallen by more than $250 per tonne so far in 2023 on higher supplies in Europe and north America. Palm oil prices during the period rose by $20 per tonne as supplies were disrupted in Indonesia and Malaysia, the world's largest and second-longest producers, respectively, because of heavy rainfall.

"As long as Indonesia is restricting exports, palm supplies will be artificially tight. When Indonesia returns in force as an exporter, palm will return to a discount," James Fry, chairman of commodities consultancy LMC International, told Reuters.

Last month, Indonesia suspended some palm oil export permits until April, to encourage exporters to increase domestic supply and secure new permits.

Exporters must now sell a portion of their palm oil products at home at a capped price under a domestic market obligation (DMO) scheme. Indonesia raised the DMO volume by 50 percent for February-April, anticipating a jump in cooking oil demand ahead of the Islamic holiday of Ramadan, during which large meals are prepared at night for Muslims that fast during the day.

Indonesia's export curbs prompted buyers to switch to supplies from Malaysia, but they face output problems from heavy rains and flooding earlier this year, said Anilkumar Bagani, research head of Mumbai-based vegetable oil broker Sunvin Group.