Bakrie Group's EVs arm eyes expansion of assembly line after IPO

VKTR plans to use almost 40 percent of the money raised in its initial public offering (IPO) to build assembly facilities for four-wheelers, two-wheelers and EV battery packs.

Change text size

Gift Premium Articles

to Anyone

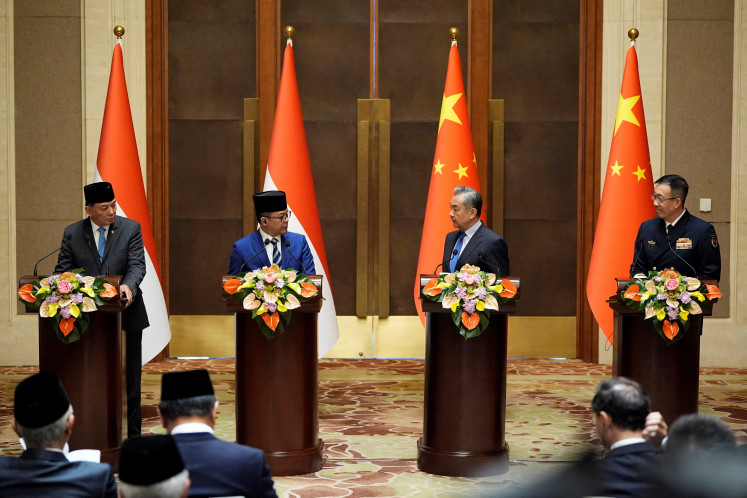

Tri Saktir carrosserie director Andi Widodo (left), BYD Indonesia and Malaysia managing director Eagle Zhao (second left), and PT Bakrie and Brothers president director and CEO Anindya Novyan Bakrie (second right) stand in front of a VKTR electric bus parked in a warehouse in Magelang, Central Java, on Feb.17, 2022. (Courtesy of Vektr Mobiliti Indonesia (VKTR)/-)

Tri Saktir carrosserie director Andi Widodo (left), BYD Indonesia and Malaysia managing director Eagle Zhao (second left), and PT Bakrie and Brothers president director and CEO Anindya Novyan Bakrie (second right) stand in front of a VKTR electric bus parked in a warehouse in Magelang, Central Java, on Feb.17, 2022. (Courtesy of Vektr Mobiliti Indonesia (VKTR)/-)

P

T VKTR Teknologi Mobilitas, an electric vehicle (EV) subsidiary of local conglomerate Bakrie and Brothers, is looking to raise up to Rp 1.1 trillion in its initial public offering (IPO) on June 16.

The company, which will be listed under stock ticker VKTR, plans to sell 8.75 billion new shares or 20 percent of its total shares in the stock market.

VKTR's main business revolves in selling new commercial EVs, such as buses and trucks, as well as spare parts through a subsidiary.

Gilarsi W. Setijono, president director of VKTR said 52 of China-made BYD buses operated by city bus operator TransJakarta were purchased from the company, which it imported directly from BYD's factory in Shenzhen, China.

“For the next step, we would like to start building assembly facilities in Indonesia with local partners," Gilarsi said in a statement on Monday.

Anindya Novyan Bakrie, VKTR's president commissioner who is also president director of Bakrie Group, said the company saw that Indonesia’s EV ecosystem had huge prospects and it became a major factor that pushed VKTR to go public.

"The bus necessity in Jakarta will reach more than 10,000 units in 2030. For the whole of Indonesia, it could be 20 times larger from that number," Anindya said in the same statement.