Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBumi Plc’s battle heats up ahead of meeting

Ahead of a boardroom meeting on Wednesday, British financier Nathaniel Rothschild is attempting to show that he has better commitment for Bumi Plc than his rival business dynasty, Bakrie Group

Change text size

Gift Premium Articles

to Anyone

A

head of a boardroom meeting on Wednesday, British financier Nathaniel Rothschild is attempting to show that he has better commitment for Bumi Plc than his rival business dynasty, Bakrie Group.

Bumi Plc, the owner of a 29.2 percent stake in Indonesian major coal miner PT Bumi Resources and a 84.7 percent stake in PT Berau Coal Energy, announced on late Monday that it had received a “further letter” from Rothschild’s company NR Investment. The letter followed previous correspondence from November, submitted as an alternative to a proposal presented in October by Long Haul Holdings Limited — a part of Bakrie Group, which holds a 23.8 percent indirect stake in Bumi Plc.

In the letter, Rothschild stated that he and other investors were committed to investing new equity capital worth US$342.5 million into Bumi Plc, according to a statement sent to Bloomberg. The investment, the statement says, is expected to be able to remove the Bakries and their allies in Bumi Plc.

Rothschild says he has secured back-up from Bumi Plc’s minority shareholders for his proposal, including Schroder Investment Management Ltd., Standard Life Investments, the Abu Dhabi Investment Council, Artemis Investment Management LLP and Taube Hodson Stonex Partners LLP.

“Neither the investor group nor myself are trying to take control of Bumi Plc or its assets. The investor group is made up of minority investors, non-conflicted, and independent from each other. They are merely putting up additional capital to solve the ‘Bakrie problem’,” Rothschild said in an email to The Jakarta Post.

Rothschild — a scion of the banking dynasty that helped bankroll Britain in its war against Napoleonic France — and Bakrie Group — the politically connected Indonesian conglomerate whose chief patron will run in the 2014 presidential election — agreed to develop Bumi Plc as a joint venture in 2010.

However, relationship soured last year after Rothschild made public a letter he directed to Bumi Plc’s CEO, asking for a “radical cleaning up” of Bumi Resources’ financial management.

Tension continues as various reports have gone viral since then, including whistle-blower report alleging misuse of development asset and development funds in Bumi Resources and Berau. Bumi Plc has begun an investigation into the allegations.

Bumi Plc’s head of corporate affairs and investors relations confirmed that there would be a board meeting on Wednesday. However, the meeting was said to be “a normal board meeting” instead of a meeting to discuss the progress of the investigation.

Following allegations against its main source of wealth Bumi Resources, Bakrie Group tendered a proposal to end its journey with the London financier by proposing to swap its shares and make cash payment worth around $1.2 billion to takeover Bumi Resources and Berau.

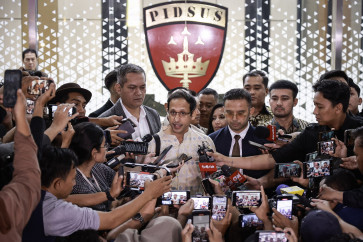

The Bakrie Group side seemed to remain confident in its offer, despite Rothschild’s counterproposal. Bakrie Group vice president Christopher Fong said that the group was skeptical that Rothschild had secured the support he claimed.

“The only thing that was certain about the financier’s proposal was that about half the votes he claimed to have assembled arise from bonus shares he and his acolytes were given for creating Bumi [Plc] – something which has been a manifest disappointment,” Fong said on Tuesday.

“Mr. Rothschild should surrender the shares voluntarily rather than attempting to parlay his limited economic interest into a blocking or controlling stake,” Fong added.

Rothschild holds 10 percent stake in the company with voting rights of 11.92 percent, according to the company financial report of 2011. He resigned from his post in October, saying he would keep fighting outside the board.