S&P rates Indonesia's US Dollar-denominated global senior unsecured bonds 'BB+'

Standard & Poor's (S&P) Ratings Services assigns 'BB+' long-term foreign currency issue rating to Indonesiaâs latest issuance of US Dollar-denominated global senior unsecured bonds

Change text size

Gift Premium Articles

to Anyone

S

tandard & Poor's (S&P) Ratings Services assigns 'BB+' long-term foreign currency issue rating to Indonesia's latest issuance of US Dollar-denominated global senior unsecured bonds.

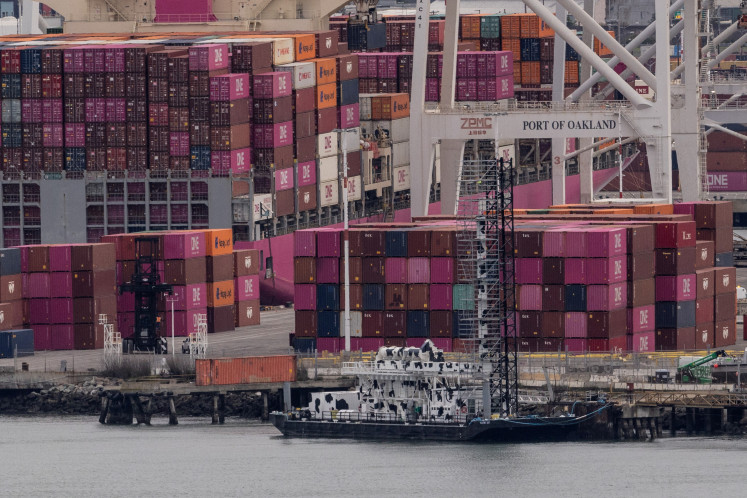

The issue consists of one bond with 10-year maturity and another with 30-year maturity. These bonds are part of the country's global medium-term notes program, which has been increased to US$25 billion.

The bonds will constitute the direct, unconditional, and unsecured obligations of the sovereign, and will rank equal with Indonesia's other unsecured and unsubordinated external debt. All bonds under the global medium-term note program are backed by the full faith and credit of the Republic of Indonesia.

'The sovereign credit ratings on Indonesia reflect the economy's low per capita income, developing structural and institutional foundations, weak policy environment, and high and rising external leverage. These rating constraints are weighed against the country's well-entrenched cautious fiscal management and resultant modest general government debt and interest burden, which make for a favorable debt profile,' S&P said in an official release Tuesday.