Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFirst BTN now BRI, Bank Mandiri eye Pegadaian's assets

State-owned lenders Bank Rakyat Indonesia (BRI) and Bank Mandiri are continuing their mano-a-mano race in expanding their businesses through acquisitions

Change text size

Gift Premium Articles

to Anyone

S

tate-owned lenders Bank Rakyat Indonesia (BRI) and Bank Mandiri are continuing their mano-a-mano race in expanding their businesses through acquisitions.

While the two are currently competing to acquire another state lender, Bank Tabungan Negara (BTN), they also reportedly have their eyes fixed on state-owned pawn shop PT Pegadaian.

According to a source at BRI, Pegadaian will be an ideal complement to BRI's primary business.

'Both BRI and Pegadaian have strong footholds in rural areas and target the same kind of customers ' micro and small customers,' said the source, who was speaking on condition of anonymity because he was not authorized to discuss the matter.

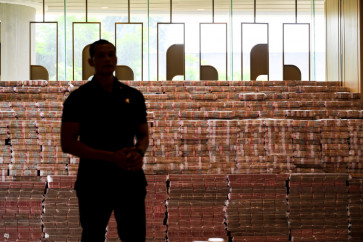

At the moment, Pegadaian runs more than 5,000 branches and outlets across the country.

Apart from providing pawn services, it also offers gold sales, financing or credit services and gem certification services.

Last year, Pegadaian reaped more than Rp 8 trillion (US$699 million) in revenue and Rp 1.92 trillion in net profit. Its assets amounted to around Rp 33 trillion as of December 2013.

Pegadaian's assets are much higher than those recorded last year by any of BRI's subsidiaries, namely BRISyariah, BRI Agroniaga and BRI Remittance Co. Ltd. Hong Kong.

By the end of 2013, BRISyariah had Rp 17.21 trillion worth of assets, while BRI Agroniaga and BRI Remittance had Rp 5.12 trillion and Rp 4.12 billion, respectively.

If BRI succeeds in taking over Pegadaian, its total assets will surge to Rp 659.18 trillion from the current Rp 626.18 trillion.

However, The Jakarta Post's source said that BRI ' now the most profitable bank in Indonesia ' would first focus on its bid to acquire BTN before moving onto Pegadaian.

The planned acquisition of BTN is part of the government's road map to consolidate state financial institutions.

Both BRI and Mandiri have submitted their proposals to the State-Owned Enterprises Ministry.

The ministry's deputy for business services, Gatot Trihargo, said that the government had anticipated the consolidation of Pegadaian and BRI.

'They would be ushered into it [the consolidation] because of the nature of their businesses,' he said recently.

He acknowledged that Mandiri had also expressed interest in taking over Pegadaian, but no decision had been made by the Ministry.

'We, including BRI and Mandiri, are going to arrange a meeting as soon as BRI completes its annual general shareholders meeting,' Gatot added.

BRI is scheduled to hold the meeting on March 26.

Meanwhile, a Mandiri source, who wished to remain anonymous due to his familiarity with the issue, said that the Pegadaian acquisition was not actually part of Mandiri's 'consolidation allocation' as laid out in the road map.

'The initial plan was to see BTN join Mandiri and Pegadaian join BRI,' the source said.

'However, BRI then became interested in acquiring BTN, too. We have no problem with that. It's just that if BRI wants to acquire BTN, we want to take over Pegadaian,' he said, adding that Pegadaian's profits seemed very promising.

As of now, Mandiri, the largest bank by assets in Indonesia, has six subsidiaries that operate in investment banking, sharia banking, insurance, micro business and multifinance.

Last year, the subsidiaries ' excluding InHealth, which was acquired only recently ' contributed to a combined Rp 2.04 trillion to Mandiri's total net profits.

In a document obtained by the Post, Mandiri claims that integrating with Pegadaian will potentially complement and boost its micro business segment, which currently holds around 4.4 percent share in the domestic micro business.

As of now, BRI remains the country's biggest player in the micro business segment with 21.7 percent market share.

The document also says that Mandiri is ready to provide the necessary funding to finance Pegadaian's business growth.

Mandiri's assets are projected to climb to Rp 766.1 trillion if it is able to acquire Pegadaian.

Contacted separately, Pegadaian president director Suwhono, who goes by one name only, said the company would welcome any party willing to help spur its business growth.

'We need around Rp 5 trillion to Rp 7 trillion to finance our business this year,' he said.

'We have already secured around Rp 3.5 trillion and Rp 4 trillion from previous loans commitment. We are going use those funds first and think of a strategy to generate the rest of the funds,' he added.

However, despite the shortfall in funds, Suwhono said that Pegadaian was optimistic it would be able to gain at least Rp 2.2 trillion in its bottom line by year-end, driven by higher gold prices and wider business coverage.