Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsExecutive Column: RI remains big market despite growing local firms: Merck

Martin Feulner

Change text size

Gift Premium Articles

to Anyone

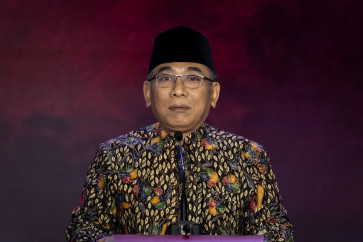

Martin Feulner. Merck Indonesia

Merck Indonesia, the local arm of German pharmaceutical giant Merck KGaA, has had a presence in the country since 1970 and remains one of the major players in the sector despite the growth of local pharmaceutical companies.

The Jakarta Post's Khoirul Amin recently met with Merck Indonesia president director Martin Feulner at Merck's office in the TB Simatupang area, South Jakarta, to discuss the challenges and opportunities facing the company. Below are excerpts from the interview:

Question: How do you see Indonesia's pharmaceutical industry in general and have you met any obstacles in developing your business in the country?

Answer: Indonesia is a very interesting market, with a 245-million population and you have a growing pharmaceutical industry.

But in general there is a problem when you want to expand your business. The government tries to support companies settling down, but it is rather complicated.

For example, on May 12 in 2012, we lost a business license and we had to open a company which had a general-importer identification number [API-U]. But it was only on Aug. 8 this year that we got the license granted.

It is not about the investment, it is not about the money you have to invest, but it is about the time that you need to set it up. It is quite long.

Now we can see that we are 40 years here, we have a lot of people, we have a relationship with the government, we have good lawyers and even then it takes a considerable amount of time [to get a license].

Under the revised negative investment list, the government is increasing the permitted foreign ownership of pharmaceutical businesses to 85 percent from the previous 75 percent. What is your opinion about that?

In general, it is always good to see the possibility that ownership by foreign companies can increase.

However, we have not used this kind of option due to the fact that we are actually a combination of our outside shareholders and Merck KGaA. We are satisfied [with our ownership situation] right now.

Additionally, there is a new regulation that allowed a short window last year when we could own 100 percent ownership, because we founded a new company in the chemical business, called Merck Chemical and Life Sciences.

If you remember in May 2012, there was a regulation coming up that ruled that you can only own one business license, either an API-U or an importing-producer classification [API-P]. We already had the API-P by producing pharmaceuticals and we were also allowed to sell complimentary pharmaceutical products but we could not sell our chemicals anymore.

Therefore, we needed a company that had an API-U license, that was granted this year on August 8, and now we have these two companies under one roof. Under Merck Indonesia, we have two companies, one is a public company the other one is 100 percent foreign-owned.

How do you see the business competition with local players as they very much dominate the market?

We have a very interesting business competition, because our main customers are actually local pharmaceutical companies, such as Bio Farma, Kalbe Farma, and also Indofood in the food sector.

They are our main customers when it comes to chemicals. So, as a chemical pharmaceutical company, we are very glad that Indonesia has an outstanding local pharmaceutical industry, which is unique based on my experience that I've gained in other countries in Southeast Asia.

You will not find so many and such well-developed pharmaceutical industries in Thailand, the Philippines or Malaysia.

In the first six months of the year business was quite good. How do you see your business performance in the second half?

For the second half, in general we do not see any kind of difficulties coming at this moment in the market. We are growing above market in all three areas. We've had growth above our internal plan in two or four business fields and when I look at, for example, our chemicals, we've grown at double the gross domestic product [GDP]. That is remarkable.

In this country, our pharmaceutical division grew by 13 percent as of July, outperforming the country's global pharmaceutical market growth of 5 percent.

I am very positive about the outlook here, this year I think it will be a successful year like we had last year, but more importantly is what will happen in the next three to five years. In general, we have a very long-term engagement. We have a good future. In Indonesia, anyhow, there is a future.

The government started its national health insurance program [JKN] as of January this year. Has it had a positive impact on prescription drug sales?

As of right now, I have no background information as to whether it has been a big move for our prescription pharmaceuticals. I think there has been an impact, but it is minor.

One thing is clear, if more people buy pharmaceuticals, if more people have access to prescription pharmaceuticals, it is my strong belief that it will affect positively [...] but it will also depend on how many products we get listed because the listing is by disease. We currently have three products listed of I think about 600 or 800 products listed nationwide.

How much is the contribution of each business unit to your total revenues and how do you see the composition in the future?

On a global business, from the ¤11 billion [US$14.4 billion] that we are selling worldwide, ¤6 billion is from pharmaceuticals and ¤5 billion is from chemicals.

The ratio in Indonesia is more or less the same, we have 60 percent pharmaceuticals, half of which is prescription pharmaceuticals and half of it is consumer healthcare, like vitamins and other products called over-the-counter, and the other 40 percent is chemicals.

So, the chemicals business is an important business for us worldwide and an important business for us in Indonesia as well. In the global chemical market, we are the world's market leader in liquid crystals.

If there is no Merck, there is no iPhone, BlackBerry, or flat-screen TV, because those products need these small molecules [liquid crystals]. I think we have 80 percent worldwide market share on this. Besides that, we sell pigments for car paints. And we are also the market leader here [in Indonesia] when it comes to our chemicals.

I think the composition will largely remain the same, but I would say that the chemicals will slightly increase.