Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsParticipants turned off by unattractive products

Change text size

Gift Premium Articles

to Anyone

T

he government and the country’s financial regulator are being urged to offer a greater variety of financial instruments and other outlets in a bid to attract overseas-stashed funds repatriated through the tax amnesty program.

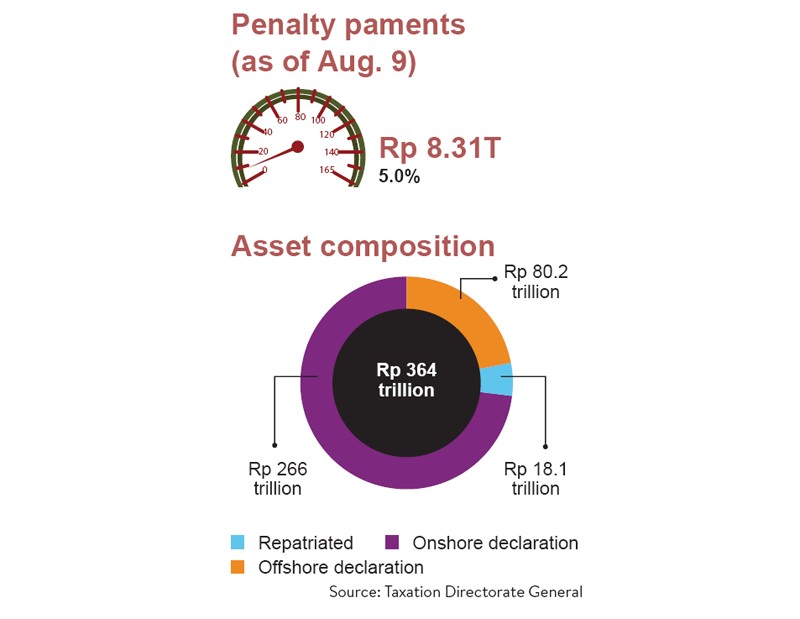

Data from the Directorate General of Taxation show that the amount of repatriated funds only reached

Rp 18.1 trillion (US$1.3 billion) as of Friday evening, far below the targeted Rp 1 quadrillion.

A major reason why so few funds are coming back to the country is a lack of attractive investment products at banks and in the overall financial industry, particularly US dollar-based instruments, bankers have said.

HSBC Indonesia managing director and global markets head Ali Setiawan said the government and the Financial Services Authority (OJK) should have been more ready to create new kinds of financial products to accommodate the repatriation.

“The government should take this opportunity to prepare instruments that can be provided and an assurance of returns that can be given if it really wants to facilitate the repatriation of funds,” he said recently.

Ali said the program should have been complemented by attractive US dollar-based instruments since all of the incoming assets would be in US dollars. There is a small chance that the big taxpayers would convert their funds into rupiah as there is no conversion requirement under the Tax Amnesty Law.

There is only a few of foreign currency-based instruments available to absorb the funds, such as the regular US dollar time deposits at banks, the exceedingly rare US dollar mutual funds and US dollar corporate bonds, which are basically “plain vanilla” compared to the investment instruments that taxpayers use overseas that offer more sophisticated structured products with higher yields.

He added that the big taxpayers would be less likely inclined to directly invest in infrastructure projects, like those offered by the State-Owned Enterprises (SOE) Ministry, because the government did not offer clear yield calculations to compensate this type of high-risk and long-term investment.

“Investors are not very complicated people because they think in simple terms of investing their money and calculating the returns. If they don’t think the return is profitable enough, why would they consider investing in infrastructure?”

(-/-)

(-/-)

Moekti P. Soejachmoen, the head of strategic research at the Mandiri Institute, which is a think tank owned by Bank Mandiri, said a casual survey conducted by

banks prior to the implementation of the amnesty law actually showed many taxpayers were reluctant to invest in the financial sector because of the limited options in instruments and the non-competitive yields compared to what were offered abroad.

Meanwhile, OJK deputy chairman Rahmat Waluyanto said during a recent event in Surabaya, East Java, that gateway banks should prepare their liquidity management as members of the Indonesian Employers Association (Apindo) had promised to repatriate Rp 1 quadrillion-worth of assets.

There are now 19 banks that have been appointed as “gateways” to handle the repatriated funds, including HSBC Indonesia, Bank Mandiri and CIMB Niaga.

“It is predicted that the funds will seek foreign currency-based instruments, so banks should provide better management in foreign exchange. There will be more big banks, asset management firms and securities houses involved in the future,” he said.

In an attempt to stand out from the crowd, private lender CIMB Niaga, part of the Malaysian CIMB Group, now offers a structured product called “market linked deposits” (MLD), which has become its flagship product to attract repatriated funds, in addition to other treasury and capital market instruments, such as “SWAP Depo”, strike currency and bonds.