OJK to launch first green bond mechanism

Change text size

Gift Premium Articles

to Anyone

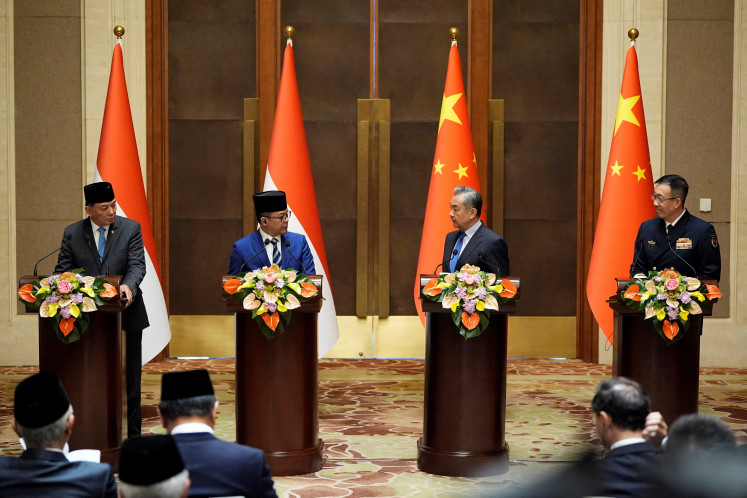

Sustainable banking: The Financial Services Authority (OJK) says Indonesia's banks and other financial service providers must play a greater role in supporting the achievement of the country's Sustainable Development Goals (SDGs). (JP/File)

Sustainable banking: The Financial Services Authority (OJK) says Indonesia's banks and other financial service providers must play a greater role in supporting the achievement of the country's Sustainable Development Goals (SDGs). (JP/File)

The Financial Services Authority (OJK) will launch a framework and regulation for green bond issuance in Indonesia this year.

“In 2017, the OJK has to have a regulatory product that regulates green bonds,” OJK capital market management director Luthfi Zain Fuadi said on Wednesday.

Green bonds are created to fund projects that have positive environmental and/or climate benefits.

The plan, therefore, signals significant progress in the establishment of financial markets that support sustainable development.

Luthfi said that last year the agency had studied how green bond mechanism could be implemented in Indonesia. However, it still needed to examine the infrastructure readiness of financial market, the benefits of issuing green bonds and what types of projects could be categorized as “green,” he added.

(Read also: In the bond markets, green is the new black)

The Indonesian Biodiversity Foundation (Kehati) has urged the OJK to be serious about its plan to develop the first green bond mechanism in Indonesia.

Kehati held a Forum Group Discussion (FGD) with the OJK on Wednesday to discuss the development of the green bond mechanism.

“Kehati is very enthusiastic about participating in the initiation [of the green bond mechanism] because it implements development values that are environmentally friendly,” Kehati executive director M.S. Sembiring said. (ary)