Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTax authority eligible for semi-autonomous status: Observers

After the “success” of the tax amnesty, the Directorate General of Taxation should be eligible for a golden ticket to become a semi-autonomous body, despite worries with regard to its track record on integrity and transparency

Change text size

Gift Premium Articles

to Anyone

A

fter the “success” of the tax amnesty, the Directorate General of Taxation should be eligible for a golden ticket to become a semi-autonomous body, despite worries with regard to its track record on integrity and transparency.

Ten watchdog organizations, including Perkumpulan Prakarsa (the Center for Welfare Studies), Indonesia Corruption Watch (ICW) and Transparency International Indonesia, gathered under the Just Tax Forum, are of the view that the government should accelerate the establishment of a semi-autonomous tax body.

The mandate is outlined in the 2009 General Taxation (KUP) Law, which is now under revision with the draft being sent back to the Finance Ministry for improvement to clear up several issues as part of long-term tax reform.

Center for Welfare Studies executive director Ah Maftuchan said now was the right time to launch a tax “superbody,” as part of tax reform. The government must carry out institutional reform given the fact that various tax laws exist but there is nothing specific on the tax office.

“The finance minister says the current [tax office’s authority] is enough because she doesn’t see [the need for it] in the next 10 to 15 years. I think she also doesn’t want to get busy because this task will add a load of work to the ministry,” he said during a discussion in Jakarta on Tuesday.

The government, he continued, was in a less confident position to launch massive reform despite popular support for the tax amnesty. “A sharp increase in public faith in the tax office is the most important lesson garnered from the tax amnesty,” he said.

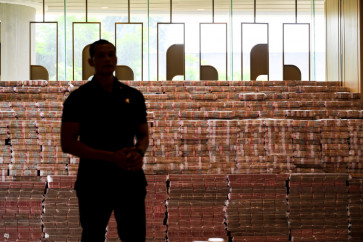

The government has deemed the tax amnesty program a success, underscoring the Rp 4.8 quadrillion (US$355.5 billion) worth of previously unreported assets declared by almost 1 million taxpayers and raking in more than Rp 114 trillion in penalty fees in the process, albeit lower than the targeted Rp 165 trillion.

However, it failed to achieve some of its targets such as a lower than expected amount of repatriated funds.

Although more than Rp 1 quadrillion worth of foreign assets were declared during the amnesty, only Rp 147 trillion in funds stashed abroad were repatriated.

In response to the government’s plan to issue a regulation in lieu of law (Perppu) that will allow the tax office to access banking data easily, Corruption Eradication Commission (KPK) cooperation specialist Putri Rahayu Wijayanti said such a practice was acknowledged in international best practice.

“However, we have yet to issue such authority,” she said. “It is now possible to provide the access, but with a checks-and-balances mechanism in place.”

Internal reform was also needed so that no tax officials could abuse their authority in the future, Putri said.

As many as five corruption cases involving tax officers have been prosecuted by the anti-graft body so far.

The KPK is currently working with the Finance Ministry, the Directorate General of Taxation, Bank Indonesia (BI) and the Financial Services Authority (OJK) to carry out an assessment as a part of its roadmap to provide a database on companies’ beneficial owners.

The government appointed a tax reform team last year to improve the performance of the tax authority.

It is expected to dig into potential sectors that remain untapped by tax collection and enhance data and information sharing between regional offices and tax service branches.

Tax office examination planning sub-directorate head Tunjung Nugroho said there should be an effort to strengthen the tax authority’s function, not limited only to raising state revenue.

“Why do we see bribes? It’s because of the absence of a link to a tax database. If the tax office is able to control taxpayers and tax data, we can run the checks and balances […] Our reform in the near future will focus on elementary issues, such as transparency and data access,” he said.

Currently, the tax office has only around 40,000 officials across the archipelago, handling around 30 million individual and institutional taxpayers, of whom approximately 21 million are obliged to file tax returns (SPT).

“From the capacity side, it is still far behind for a country such as Indonesia,” Tunjung said, pointing to the fact that not all regencies in the country had a tax office.

Indonesia has a tax officer, population ratio of around 1:3,700, compared with Japan’s 1:1,000. “The problem is whether we want to increase the number of taxpayers or not. If yes, then it is important to add tax officers,” he said.