Electrifying RI’s two-wheelers to catch biggest opportunities

Change text size

Gift Premium Articles

to Anyone

T

he kind of growth we are about to see in the electric two-wheeler sector only comes along once in a generation. If investors and policymakers don’t catch the wave now, they will miss out on one of the world’s biggest opportunities.

There is no doubt that electric vehicles are the future for Indonesia’s automotive industry. Already, we are seeing widespread adoption, with battery-powered cars and motorbikes set to spread across the country at an unprecedented pace.

The current administration is taking our nation’s energy transition very seriously, which is encouraging. Electric vehicles are an important national priority for Indonesia, promoted in a presidential decree and other key national plans, with profound socioeconomic and environmental benefits for the nation.

Indonesia rightly aspires to be a leading market and manufacturing powerhouse for electric vehicles in the region. Two-wheeled transport will be at the heart of the opportunity.

The country has made clear its ambition to see electric two-wheelers grow to 25 percent of total two-wheeler sales by 2030, reaching an annual production capacity of 2.5 million units. But beyond aspirations, the government has also begun introducing key policies and regulations to turn the ambition into reality.

President Jokowi recently announced that government agencies and state-owned enterprises should electrify their fleets. This was done via Presidential Instruction No. 7/2022, designed to drive usage and acceptance across society.

In its latest report titled, Electrifying Indonesia’s Two-Wheeler Industry, Boston Consulting Group, in partnership with the Electric Mobility Ecosystem Association, explores the remarkable value at stake from getting this complex maneuver right and what the key catalysts are to power up Indonesia’s transformation.

A trove of benefits

As the largest automotive market in Southeast Asia, accounting for up to half of the region’s total two-wheeler sales, Indonesia already offers an attractive petri dish for electric two-wheeler proliferation. Approximately 70 percent of households own a two-wheeled vehicle, and it is the transport mode of choice for the masses. The archipelago is unquestionably a fertile landscape.

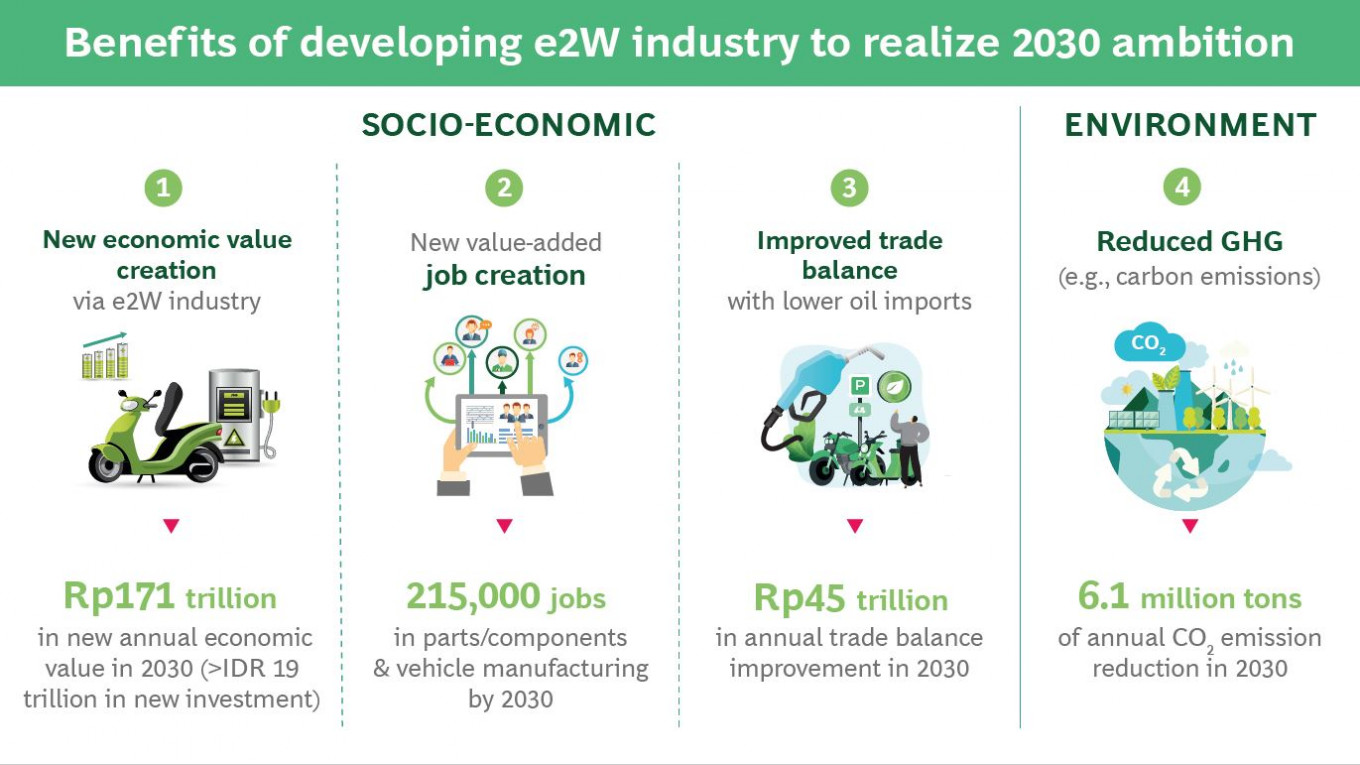

Realizing Indonesia’s electric two-wheeler ambitions can unlock a range of socioeconomic benefits, while also reducing pollution. Widespread electric two-wheeler adoption and manufacturing in-country will deliver an annual economic value creation of Rp 171 trillion (US$10.9 billion) by 2030, with cumulative economic value creation coming in at Rp 746 trillion.

The sector will create an additional 215,000 jobs in parts, components and vehicle manufacturing. It will add approximately Rp 45 trillion annually to the national trade balance via reduced fuel imports, while simultaneously reducing CO2 emissions by 6.1 million tonnes per year.

Accelerating adoption

Global market experiences were benchmarked in order to identify the potential accelerants for electric two-wheeler growth in Indonesia.

There are three important areas: demand stimulation, production localization support and infrastructure support.

In markets around the world, pricing incentives for electric two-wheelers plays an important role in nudging consumers to switch to electric. For example, in neighboring Thailand, eligible purchasers enjoy a 24 percent reduction on average prices. Similar scenarios play out in India (22 percent), mainland China (40 percent), South Korea (35 percent) and Taiwan (15 percent).

In the case of India, pricing incentives were linked to the battery size of an electric two-wheeler (approximately $185 per kilowatt-hour). This helped reduce costs to become roughly equivalent to those of non-electric models.

Financial support for manufacturers can also help spur growth, ensuring Indonesia’s automotive industry can keep its leading position in two-wheeled manufacturing amid a rapid regional mobility transformation. The benchmarking exercise found that grants and loans are a major factor driving the choice of where auto companies choose to produce across the value chain.

Charging and battery swapping station infrastructure support is another area that must be addressed. Having battery swapping stations be ubiquitous is a critical enabler for mass adoption. Having enough of these stations mitigates what’s known as “range anxiety” for electric vehicle drivers.

In Indonesia, the most suitable solution comes in the form of incentives. While there are already small pilot projects for battery swapping stations, the monthly subscription fee to join is almost double the fuel cost for a 100 cubic centimeter non-electric vehicle.

It was simulated that if the investment required was reduced by about one battery per rider on the network and the electricity costs of battery swapping stations were to be discounted to electric vehicle charging stations (SPKLU) rates (Rp 714 per kilowatt-hour) the price gap for consumers could be closed while still maintaining commercial viability for station operators.

Indonesia is just a few steps away from realizing its electric two-wheeler vision and unlocking a Rp 746 trillion boost to the nation. The upside is compelling with clear benefits for the economy, society and the planet.

It’s time to invest

The higher cost of electric two-wheelers compared to non-electric ones has been a historical challenge for adoption. This was in addition to other supply and demand-related obstacles.

But due to the recent decline in battery costs — and in turn overall costs — in recent years, the price gap between an electric two-wheeler and gas-powered motorbike has narrowed in a meaningful way.

In 2022, the price gap in the mass market segment has come to approximately Rp 5 million to Rp 11 million. This value is roughly equivalent to the value of subsidies spent on fuel over the six-year lifetime of a typical gas-powered vehicle.

These stats alone should help investors and policymakers clearly see the writing on the wall. We’re on the brink of a revolution, and the time to invest in Indonesia’s electric vehicle industry is now. The kind of growth surge we’re about to see in this industry only comes along once in a generation. If stakeholders don’t catch the wave now, they’ll miss out yet again on one of the biggest opportunities in the world.

*****

Nicolas Meyer is managing director and partner at Boston Consulting Group and Pandu Sjahrir is chairman at the Electric Mobility Ecosystem Association (AEML)