Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

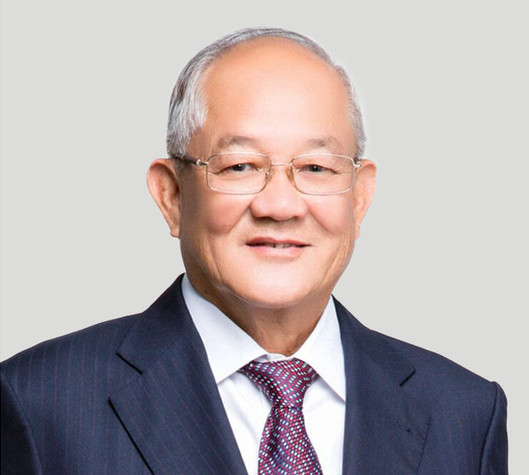

View all search resultsLow Tuck Kwong is Indonesia’s new richest person

With net worth of $31 billion, coal tycoon surpasses Hartono brothers.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia coal-tycoon Low Tuck Kwong has emerged as the country’s richest individual, coinciding with a boom in his business amid the surge of commodity prices, partly due to geopolitical conflict, energy crisis and supply disruption in many parts of the globe.

Low Tuck Kwong has a net worth of US$31 billion as of Dec. 27, according to Forbes' Real-Time Billionaires rankings, which tracks the daily ups and downs of the world’s richest people.

The same data also show that Low now tops the billionaires ranking, overthrowing R. Budi Hartono and Michael Budi Hartono, who hold $22.4 billion and $21.5 billion in net worth respectively.

For many years, each of the Hartono brothers topped the list with their combined tobacco and banking businesses.

Low is a controlling shareholders of Indonesia’s third-largest coal miner PT Bayan Resources, also known by the stock ticker of BYAN, with ownership of more than 60 percent of the company’s shares.

According to the company’s profile, BYAN has 12 direct subsidiaries that are engaged in the coal mining and tire industries. In the third quarter this year alone, it booked a Rp 24.8 trillion (US$1.55 billion) of net profit, which saw almost a twofold increase from the same period last year.

Low’s wealth is said to have increased significantly partly due to a jump in BYAN share price in the Indonesia Stock Exchange (IDX) that surged by more than sevenfold as of Dec. 27 year-to-date to Rp 22,500 apiece.

Read also: Commodities boom sees surge in investment

This December, BYAN saw its market capitalization amount to Rp 745 trillion, becoming the second-largest publicly listed company by market cap, exceeding state-owned lender BRI that previously held the position. In December last year, BYAN’s market cap was only Rp 90 trillion.

Analysts have attributed the significant increase of the share price to soaring coal prices with the commodity in high demand among countries in the northern hemisphere, which were experiencing winter season and facing energy shortages such as natural gas due to war in Ukraine.

Furthermore, BYAN’s stock split with 1:10 ratio was said to propel its share price even further.

However, M. Nafan Aji Gusta, from senior investment information at Mirae Asset Securities Indonesia, told Kontan on Sunday that BYAN’s share price would be closely related to the movement of coal price, which might be susceptible to a potential downward trend in commodity price.

Next year, Nafan said that the coal price might decline as the world faces recession, while the current high-price trend would likely only stay as long as the winter.

Read also: We won't make it: Industries cast doubt on bauxite-export ban in mid-2023

Jonathan Guyadi, analyst at Samuel Securities, wrote in a report on Nov. 23 that he projected coal prices to remain high next year with a higher forecast of $220 per tonne, a 20-percent increase from his last estimates.

He attributed the upgraded forecast to geopolitical tension and La Nina, which would likely persist until the first half of next year, causing longer disruption in global-coal production.

Meanwhile, demand from China would also add to the boost with low inventory and high demand as well as a potential spike from easing of COVID-19 restrictions.

However, he added the sector could still face a downside if the world has another economic slowdown and oversupply of the commodity.