Indonesian banks take ESG approach with grain of salt

The domestic banking industry is still reluctant to jump on the ESG financing bandwagon, citing challenges across the board in adopting the global principles, despite the OJK publishing a sustainability plan as far back as seven years ago.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s banking sector is facing difficulties implementing the full spectrum of environmental, social and governance (ESG) standards, viewed as a bare minimum among investors from many advanced economies.

While banks generally acknowledged that most international investors were concerned about ESG compliance in potential investments, they also realize the standards also catered to the “voices of stakeholders and regulators”, Indonesian Bankers Association (IBI) chairman Haryanto Tiara Budiman said on Wednesday.

The government is pursuing a significant increase in investment this year to spur economic growth and to compensate for a projected slowdown in export earnings and household spending, with multiple financial institutions expecting spillover from a troubled global economy.

A majority of investors from advanced economies require recipients to meet ESG standards as a path to sustainable development.

“Banks should support sustainability efforts, but we should also voice our concerns,” said Haryanto, who is also a director at the country’s largest private lender, Bank Central Asia (BCA).

Read also: ESG investing: Will it prevail in 2023?

Foreign investors generally require that all Indonesian banks and their corporate clients meticulously follow the ESG principles, including reporting their progress on carbon emissions, social issues and anticorruption measures.

Haryanto said following the principles presented “operational challenges”, especially in the country’s huge micro, small and medium enterprises (MSMEs) segment, as Indonesia was still a developing country.

Data from the Cooperatives and Small and Medium Enterprises (SME) Ministry show that only 20 percent of MSMEs nationwide took out bank loans, even though the segment accounts for 61 percent of GDP.

“The rigid mandatory reporting in advanced economies cannot be implemented in Indonesia without significant adjustment,” Haryanto continued.

Global governance organizations, including the Bank for International Settlements (BIS), had “mainstreamed” climate change issues, forcing the financial sector to adopt new policies to survive, Finance Minister Sri Mulyani warned bankers.

Aside from financing ESG businesses, banks should also take climate risks into account in making financial decisions and incorporate climate risk assessments in the procedure for all lending activities, rather than treating ESG financing as a separate activity.

“We are lucky if the bankers are millennials. Millennial bankers might be more sensitive to climate change,” Sri Mulyani said on Monday.

ESG compliance was a “complex issue”, said BCA president commissioner Djohan Emir Setijoso. While the principles were “a must for the future”, the path to that future, including net-zero emissions, was still “debatable”.

“Should we finance only electric vehicles? Practically impossible, as the market is small,” Djohan quipped. “From the banks’ point of view, what matters is that we don’t get concentrated risks and [don’t] take risks beyond what we can absorb.”

“Probably this is not a millennial’s view, because I’m from the colonial generation. I admit that,” he added.

Banks maintain that it is not feasible for them at this juncture to exclusively finance businesses that support the ESG agenda.

For now, Djohan said, banks should prepare an “infrastructure framework” for the transition to embracing ESG businesses while at the same time continuing to do business outside of ESG projects. He also warned that preventing banks from financing environmentally unfriendly projects would have massive economic repercussions, because ESG projects only accounted for a limited portion of lenders’ portfolios.

BCA recorded 18.6 percent year-on-year (yoy) growth in ESG financing to Rp 172.7 trillion (US$11.4 billion) from January to September 2022

Forests and Finance, an initiative by the eponymous global coalition of environmental campaign and research organizations, has given BCA an ESG score of 4.1 out of 10. It also noted that the lender’s list of ESG-risk clients included Sinar Mas Group, Salim Group and Royal Golden Eagle Group.

Read also: Anticipating the global convergence in ESG reporting framework

Agus Martowardojo, president commissioner of Bank Negara Indonesia (BNI) and a former central bank governor, said separately that ESG would remain a priority for the banking industry in both current and future market conditions. He added that the domestic banking industry lagged behind the road map set out by the Financial Services Authority (OJK).

The OJK published the Sustainable Finance Action Plan in 2015 and the Indonesia Green Taxonomy Edition 1.0 – 2022 in January that year to boost ESG financing through the banking sector.

As climate change issues were now a “serious problem” for intergovernmental organizations, including the Group of 20 and the Financial Stability Board (FSB), Agus said lenders should take note of businesses that were striving for clean energy, low emissions and sustainable fuels as a “new generation” of revenue sources.

Mainstreaming sustainable finance was also predicted to limit the options for businesses that failed to comply with ESG principles, added Agus, who urged banks to accelerate ESG-friendly business practices.

BNI recorded 26 percent yoy growth in sustainable financing to Rp 176.4 trillion from January to September 2022. The state-owned lender had a Forests and Finance ESG score of 1.1 out of 10, with ESG-risk clients that included Sinar Mas Group, Tanjung Lingga Group and Rajawali Group.

“We should really give our utmost attention, resources and focus” to ESG, Agus emphasized.

Blaming MSMEs for their inability to adopt ESG principles was a “usual ruse” to shift responsibility to debtors, TuK Indonesia executive director Rahmawati Retno Winarni told The Jakarta Post on Friday.

TuK Indonesia is a member of the Forests and Finance Coalition.

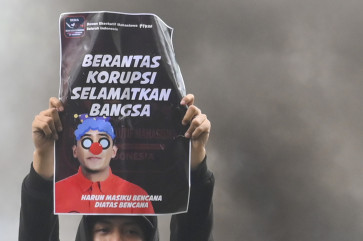

Instead of pointing fingers at MSMEs, she continued, one of the main factors behind banks’ low ESG scores was financing environmentally unfriendly businesses in sectors like crude palm oil, timber and pulp that severely damaged forest areas and were rife with corruption.

The failure to meet ESG standards in these sectors could be attributed to a lack of mandatory ESG due diligence and weak government oversight, as well as a focus on unsustainable economic growth.

“If regulators are not strict, then [banks] feel unthreatened, as they only receive ‘love letters’ instead of penalties,” she noted.