Edtech start-ups return to conventional path as revenue fizzles

Online learning platforms have begun to transition back to physical classroom learning amid online fatigue and declining revenue streams, according to experts.

Change text size

Gift Premium Articles

to Anyone

E

ducation technology (edtech) start-ups enjoyed blistering growth during the longest school shutdowns in history caused by the COVID-19 pandemic. However, as the world began to revive in-person learning, coupled with a reduction in government-backed program funding, start-ups were forced to cut their workforces and tighten their belts.

“Online edtech revenues used to come mostly from government programs,” Edward Ismawan Chamdani, treasurer of the Indonesian Venture Capital and Startup Association (Amvesindo) told The Jakarta Post on Thursday, adding that state budget funds would go directly to program beneficiaries, avoiding reliance on intermediary platforms.

As an example, he referred to the Merdeka Mengajar program launched by the Education, Culture, Research and Technology Ministry in 2019, in which students were given funds to subscribe to online training courses of certain edtech platforms and content providers.

“Now, edtech needs to reassess and seek different sources of revenue beyond government-backed programs,” Edward continued.

Nailul Huda, an economist with the Institute for Development of Economics and Finance (INDEF), meanwhile, said edtech firms partly had themselves to blame for their current plight.

“Many edtech [platforms] are in turmoil due to management issues, limited funding and [excessive] dependence on pre-employment programs,” he added.

Read also: As pandemic recedes, preemployement card prioritizes upskilling workers

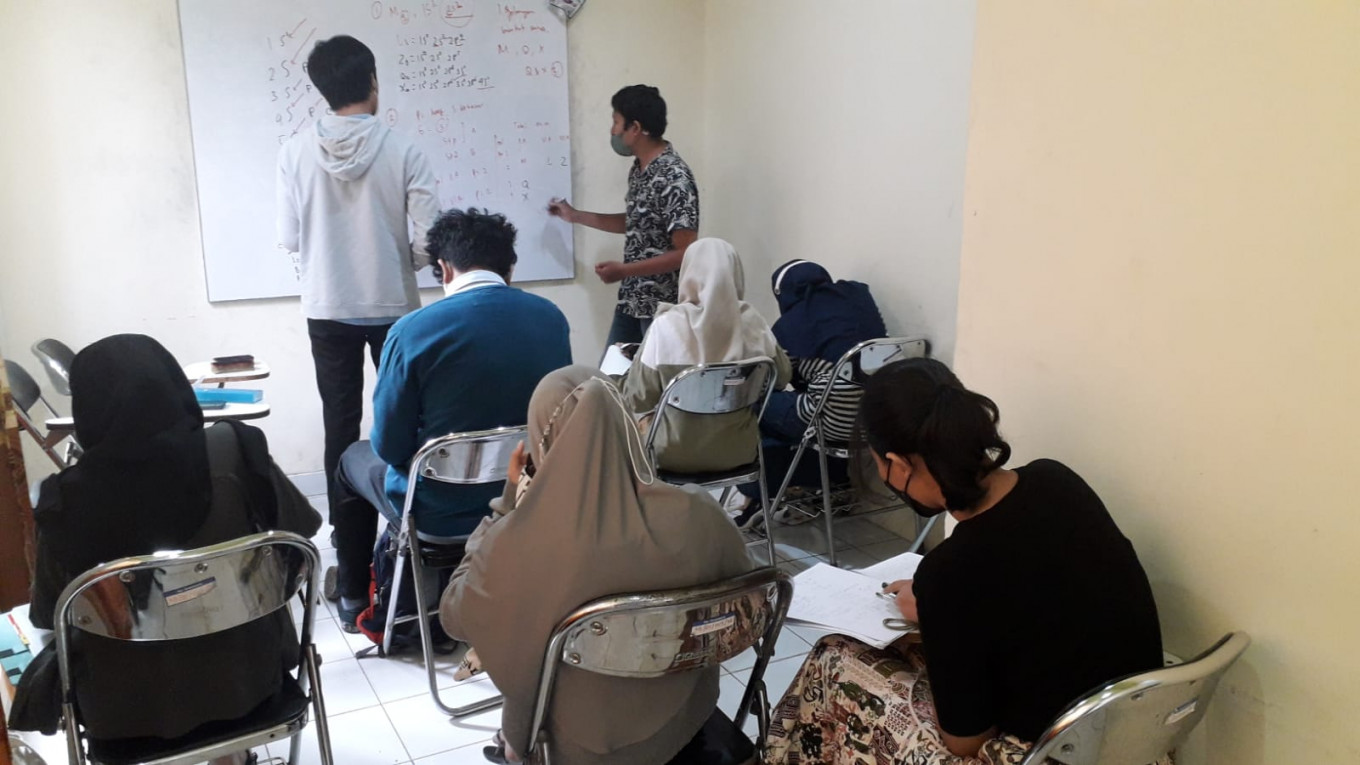

Reduced funding and financial losses prompted rounds of layoffs in 2022 and forced edtech platforms to look for users in the country’s network of tutoring centers and cram schools, which has existed for decades and provides services to students at all levels, from primary school to university.

In a move away from the online-only approach, some edtech firms have acquired offline platforms, such as Ruangguru with Brain Academy and Zenius with Primagama.

Edward said this made sense, as the offline market was still “a proven conventional successful business model”.

The conventional education sector in Indonesia has attracted many prominent institutions, he said, noting huge demand for academic and vocational programs.

He added that regional and global edtech platforms were tapping into that market through collaboration, creating distance learning programs for certain degrees and certificates.

“By combining and transforming their products and services to better fit the digital world, edtech start-ups have positioned themselves within a more strategic value chain,” said Edward.

As an edtech business insider, Zenius cofounder and CEO Sabda Putra Subekti disputed that view.

“The online usage and business traction [of digital education] are two different things,” Sabda told the Post on Friday, admitting that his firm had had to make some changes to stay afloat.

While the firm had to cut its staff a few times, Zenius acquired Yogyakarta-based learning network Primagama in 2022 to actualize its vision of becoming the leading learning network in the country.

Last month, they conducted an audit of all Primagama branches and revoked the licenses of several branches.

“Our strategy from the start was digital learning,” Sabda explained. “[Primagama] is our offline network, our partner to reach schools and institutions within the country.”

Sabda explained that the acquisition was in line with Zenius' vision, which had been in place since 2017, but only materialized now. He said the pandemic, while a catalyst for ed-tech growth, had derailed the firm’s growth strategy.

To become a great network, Sabda explained, Zenius had to establish an online presence with its digital assets and an offline presence through Primagama as a partner for students, schools and institutions.

"From the get-go we realized that the [business-to-consumer] market is not big," Sabda admitted, "the big one is systematic adoption in tutoring centers, in schools."

For business-to-business (B2B) services, meanwhile, he sees big growth potential in Indonesia’s education market, arguing that there is a need for extra programs to improve the quality of education, along with the effort to bring in revenue.

“I'm optimistic that this year will go well,” said Sabda, adding that a hybrid education model could enhance the growth of his company.

Read also: BUKA program allows online learning to solve lack of quality in education

Hybrid learning is here to stay

While the nationwide switch to online schooling proved to be less permanent than some had hoped, the pandemic nevertheless changed the education landscape.

Education sector observer Ina Liem shares Sabda's confidence that hybrid learning will improve Indonesia’s education system.

“I believe online and offline [programs] can complement each other. By collaborating, they can grab a bigger market than when standing alone,” said Ina on Friday.

Ina opined that digital learning could not completely replace traditional education. Rather, it “fills the gap” that is left when students fail to fully grasp concepts imparted by teachers or when finding offline tutors is challenging.

“While online platforms provide flexibility in terms of their schedules, some students need external motivation, discipline, human interaction and group discussion, which offline centers can provide,” said Ina.