Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAsian shares slip, bond yields rise as investors await ECB

Change text size

Gift Premium Articles

to Anyone

A

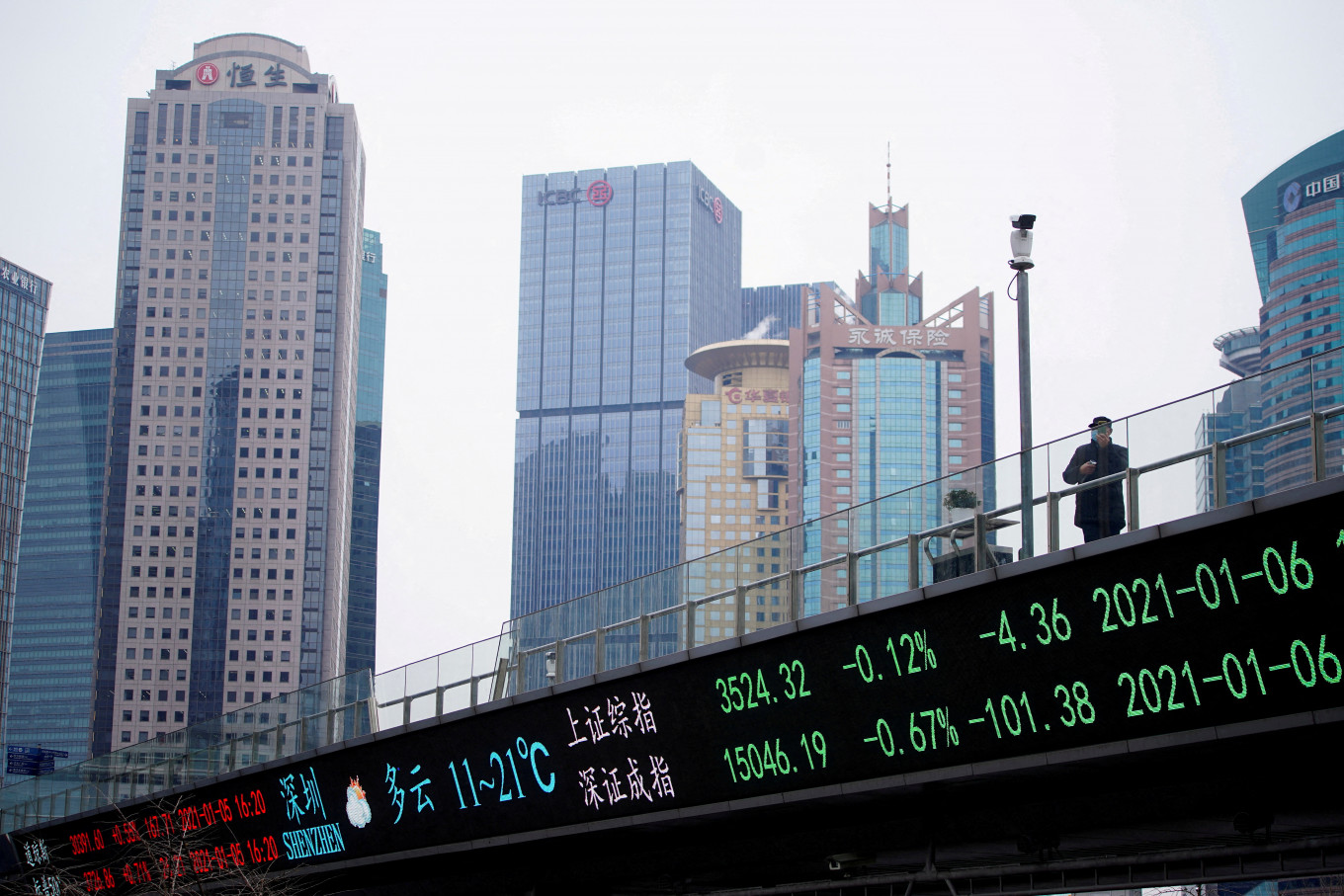

sian stocks fell, US bond yields rose and a soaring dollar pushed to a two-decade high against the yen on Thursday as investors worried about the outlook for more rate rises ahead of a key meeting of the European Central Bank later in the day.

But before the meeting, at which the ECB is set to bring to an end its asset purchase program and signal rate hikes to combat rising inflation, moves in the Asian session were relatively muted as many investors kept to the sidelines.

"It's classic pre-central-bank-meeting price action. To speculate now on anything other than an hourly timeframe, or an intraday timeframe, doesn't make a whole lot of sense at the moment," said Matt Simpson, senior market analyst at City Index in Sydney.

"It's the most exciting meeting since [Christine Lagarde] has been at the helm, since Draghi was here - 'whatever it takes'."

Adding to concern over European inflation, data showed the euro zone economy grew much faster in the first quarter than the previous three months, despite the war in Ukraine.

As investors guess at the size and pace of ECB tightening, they are also awaiting US consumer price data on Friday that the White House has said it expects to be "elevated". Economists expect annual inflation to be 8.3 percent, according to a Reuters poll.

While Asian share markets have risen around 8 percent from nearly two-year lows touched last month, investors remain worried that central bank policy tightening to control inflation could spark an economic slowdown.

In morning trade, MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.39 percent, tracking losses in US stocks in the previous session.

Australian shares were down 1.19 percent and Seoul's KOSPI slipped 0.64 percent, though Hong Kong's Hang Seng eked out a gain of less than 0.2 percent and Chinese A-shares were flat.

In Japan, the Nikkei stock index was also unchanged.

Overnight, the Dow Jones Industrial Average fell 0.81 percent, the S&P 500 lost 1.08 percent and the Nasdaq Composite dropped 0.73 percent.

"Over the last two weeks, trading has been in a very narrow range and also based on very low volumes," analysts at ING said in a note.

"Previous instances of this range trading on low volumes have usually preceded a sharp down-shift," they cautioned, adding that the ECB meeting and Friday's US price data were likely "catalysts for a more bearish outlook."

The wait for US price data also weighed on US Treasuries, which saw yields rise following a weak auction of 10-year notes on Wednesday.

The US 10-year yield edged up on Thursday to 3.0548 percent from a US close of 3.029 percent on Wednesday and the two-year yield climbed to 2.8027 percent compared with a US close of 2.774 percent.

Rising yields supported the dollar, particularly against the yen, which dropped to a 20-year low of 134.56. The Japanese currency has been weighed down by a widening policy divergence, with the Bank of Japan remaining one of the few global central banks to maintain a dovish stance.

The global dollar index was slightly higher at 102.6, and the euro was flat ahead of the ECB meeting at $1.0712.

Crude oil prices extended gains, rising to their highest levels in three months on hopes for strong US demand and a recovery in China as COVID-19 curbs are eased.

Global benchmark Brent crude was last at $123.83 per barrel, up 0.2 percent on the day. US crude added 0.17 percent to $122.32.

Gold, sensitive to rate hikes but seen as an inflation edge, was weaker. Spot gold lost 0.1 percent 1,851.35 per ounce.