Indonesian superapp Gojek has always been committed to supporting the digitalization of Indonesia’s micro, small and medium enterprises (MSMEs), primarily by providing them business solutions through technology and innovation.

This mission has become more important than ever during the COVID-19 pandemic, as many Indonesian MSMEs are dealing with economic adversity, including an up to 39 percent revenue decline, due to the large-scale social restrictions (PSBB) in place.

Therefore, Gojek has partnered with one of the biggest private banks in Indonesia, PT Bank Central Asia (BCA), to launch GoBiz PLUS, a hardware solution with advanced features and functions to support the day-to-day operations of MSMEs.

The new hardware has been designed to support the digitalization of Indonesian MSMEs. It is also the first techware in Indonesia capable of accepting all types of cashless payments.

This new innovation seeks to accommodate the needs of local businesspeople to make efficient transactions that still focus on the needs of customers, while also implementing the government’s calls for its citizens to minimize physical contact amid the pandemic, thanks to the comprehensive digital payment options it is offering.

GoBiz PLUS also underlines Gojek’s commitment to helping MSMEs Go Forward with Gojek (#MelajuBersamaGojek in Indonesian) in digitalizing all their operations.

Gojek co-chief executive officer Andre Soelistyo said Gojek’s mission to support the growth of local MSMEs remained the same, if not stronger. “We’re aware that MSMEs serve as Indonesia’s economic backbone.”

Data from the Cooperatives and MSMEs Ministry revealed that MSMEs account for 99 percent of Indonesia’s business entities, accounting for 97 percent of the total number of employers in the country and employing about 133 million workers.

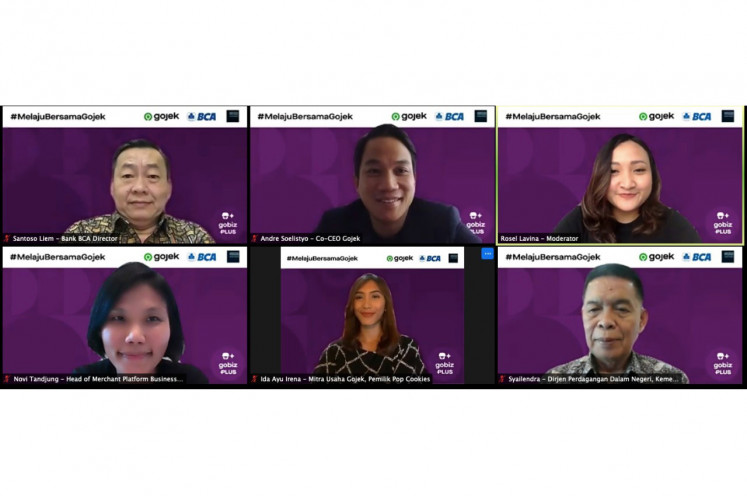

“Here, Gojek plays a role in supporting our business player peers to get access to go digital, especially during the pandemic, when people tend to prefer making cashless transactions to minimize direct physical contact,” Andre said during a virtual launch event for the new hardware on Dec. 15.

“We’re proud to be able to collaborate with BCA, another homegrown company, to develop the most holistic cashless payment technology innovation via GoBiz PLUS,” he continued.

“This collaboration makes the hardware different from other business tools in Indonesia in terms of its capabilities, especially in the open platform it possesses, making it possible to make cashless payments of all sorts to boost the efficiency of all transactions,” he said.

Since 2018, Gojek, which has partnered with 900,000 business partners across Southeast Asia, has been developing the GoBiz superapp to help its partners manage their business operations.

This time, Gojek and BCA have developed the superapp into hardware, seeking to boost business operation efficiency and take their enterprises up to the next level thanks to its features.

First of all, the new GoBiz PLUS is able to accommodate different types of non-cash transactions among Gojek business partners, ranging from debit and credit cards to transactions using e-wallet platforms like GoPay and LinkAja.

The new hardware also accommodates the Quick Response Code Indonesian Standard (QRIS) system, which integrates all QR systems by different payment service providers in Indonesia.

Secondly, the new hardware solution can also record and recapitulate all the transactions made by Gojek business partners, storing all the information in an integrated digital storage system at its point of sales (POS) service.

The new POS service makes it easier for Gojek’s business partners to keep a record of all the orders they have received, how the kinds of goods and services they offer change overtime and item prices.

“Furthermore, the POS service also allows MSMEs to follow consumer trends in terms of the products and services they prefer, to help them make their business innovation efforts more efficient,” Gojek Business Platform Merchant Head Novi Tandjung said.

Finally, the new hardware solution also helps business partners print physical receipts of the transactions they have made thanks to its built-in printer.

A Gojek business partner named Irena, who owns the Pop Cookies business, said she felt the benefits and convenience of using GoBiz PLUS for her business operations right away.

“The digital recapitulation made possible by the hardware has made doing business much easier and more convenient for me,” Irena said.

Meanwhile, BCA director Santoso Liem said the bank had chosen to work with Gojek because of their aligned vision to give local MSMEs a push, a contribution that they wanted to make as two homegrown companies built by Indonesians.

“BCA has contributed its advanced payment technology which allows GoBiz PLUS users to choose from a wide range of payment options. We will also give Gojek’s business partners an open transaction access to BCA’s more than 10 million debit card accounts and more than four million credit card accounts,” Santoso said.

At the same time, Santoso said, the collaboration with BCA had opened doors to new customers for the bank.

“All this time, our operations have served customers in major Indonesian cities, but we hope to serve more customers in underserved areas, supporting a more equal digitization even further,” he said, adding that the partnership with Gojek could help the bank access new customers beyond Indonesia’s major cities.

On a national level, Santoso continued, the collaboration was also expected to push payment efficiencies to make the national dream of achieving a cashless society ecosystem come true.

Trade Ministry National Trade Director General Syailendra applauded the collaboration as very helpful in giving the local MSMEs a much-needed boost amid the hardships they faced during the pandemic.

“The launch of the new hardware can mark the beginning of a synergy that can benefit the MSMEs in terms of boosting their competitiveness, all the while meeting Indonesia’s national financial inclusion target,” Syailendra said.