Gojek and GoTo Financial have seen an increase in spendings from customers during the holy month of Ramadan for purchases ranging from parcels for loved ones and new culinary treats for iftar to new clothes for Idul Fitri.

While the rising trend of online transactions brings many advantages to Indonesia's micro, small and medium enterprises (MSME), especially during the holy month, the increasingly competitive market is inevitable. Hence, MSMEs must stay at the top of their game in responding to the rapidly shifting consumer habits and trends to be able to grow in the long run.

Highlighting their commitment to empowering MSMEs, Gojek and GoTo Financial has launched an e-book titled 5 #JosGandos Tips to Increase Sales During Ramadan 2022. The e-book can be accessed for free at gjk.id/josgandos.

Gojek and GoTo Financial merchant marketing group head Bayu Ramadhan said: “Business partners still have time to determine effective strategies during Ramadan by understanding data trends, including when and how to increase product and service sales across various channels, both in offline outlets and social media. As a growth partner for these businesses, Gojek and GoTo Financial are committed to providing holistic technology and non-technology solutions for MSME business partners in every phase of their growth. This effort also encourages economic recovery in Indonesia."

Looking back at last year’s Ramadan trend, Gojek and GoTo Financial found that online transactions dominated various lines of business, from payment systems, retail goods and services to food delivery.

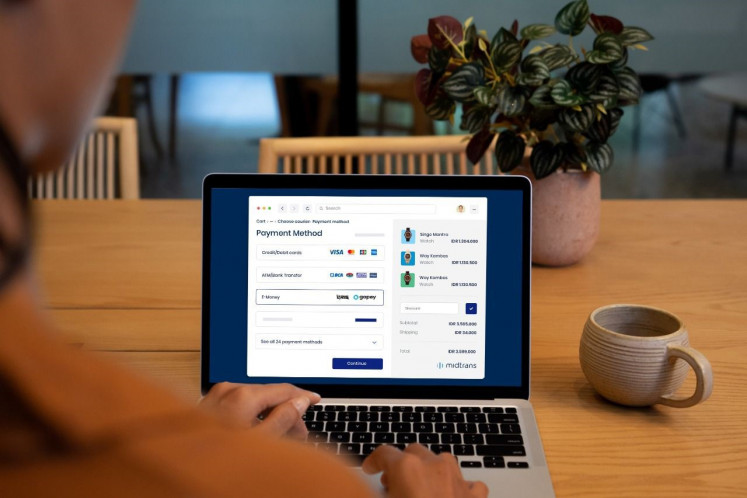

From their internal data, they found that e-wallets still retained their position as the most-preferred online payment method by consumers who paid through Midtrans. During Ramadan 2021, GoPay became the main payment method for more than 60 percent of consumers transacting online through leading payment gateway Midtrans, followed by bank transfers at 13.5 percent and credit cards at 10.5 percent.

However, in providing a more comfortable and convenient shopping experience, it is also important to provide offline payment options due to the return of offline activities. For those starting to focus on pursuing offline sales, GoBiz PLUS can be a solution.

Offline businesses are undergoing a resurgence following the relaxation of social restrictions. Fashion and beauty products experienced increased demand in the month of Ramadan by up to 285 percent, compared to the months before Ramadan in 2021. Despite the decline in sales after Ramadan 2021, the average income of business partners in the fashion and beauty retail sector is still 107 percent higher than before Ramadan.

To boost long-term sales, the Ramadan momentum can become a great opportunity to try various sales strategies, as success during Ramadan can serve as an important lesson for long-term survival and success.

Zyta, the founder of local fashion business Zytadelia that uses Midtrans, said Ramadan was a special month for her and for Zytadelia's business, where customers are often on the lookout for hijabs and other clothing products.

“Since partnering with Midtrans in 2019 for zytadeliastore.com, the insights from the payment side and consumer behavior that have been shared by Gojek and GoTo Financial during Ramadan and after can provide a big picture of transactions and common problems faced by sellers. With this insight on customer payment patterns, we can prepare for Ramadan 2022 with the right production and sales strategies," she said.

While in the food delivery area, promotions are key to reaching more customers. As promotions have become an integral part in the culinary business, the right deal shortens customers’ purchasing decisions in addition to quality and taste considerations.

During Ramadan, it is necessary to adjust the promotional hours and the type of dishes prioritized. For example, based on last year's Ramadan data, GoFood orders before sunset and dawn increased dramatically by 17 percent, providing a golden opportunity for MSMEs to gain more revenue.

In addition to adjusting the time, the type of dishes must also be adjusted accordingly. In addition to snacks and various drinks that are widely ordered as takjil (breaking-of-the-fast snacks), the favorite items during Ramadan comes in the form of staple foods, such as various rice dishes, ready-to-eat food and various chicken and duck dishes. Simultaneously, international dishes such as pizzas and various Japanese foods also receive high orders.

For those who prefer listening, the educational business podcast Lika Liku Laku can also be streamed through YouTube and Spotify.

All these insights and educational content provided by Gojek and GoTo Financial are part of the ecosystem’s commitment to encouraging MSMEs to grow together by providing them with holistic support to increase their income, even after Ramadan. (*)