Banks may have had enough with commodities as bad loans surge

Change Size

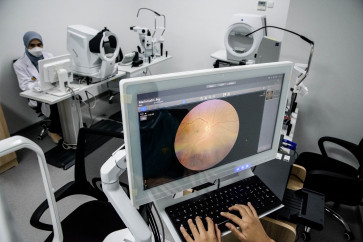

An employee is seen working at the Financial Services Authorityas (OJK) integrated financial consumer services center at the Bank Indonesia (BI) building in Jakarta.

(Antara/Fanny Octavianus)

An employee is seen working at the Financial Services Authorityas (OJK) integrated financial consumer services center at the Bank Indonesia (BI) building in Jakarta.

(Antara/Fanny Octavianus)

Bad loans in the commodities sector are hitting the nation’s banks, turning them away from what was once a booming industry.

An indicator of bad loans, the gross non-performing loan (NPL) ratio in the “mining and excavation” sector skyrocketed to 6.75 percent as of July, from 3.81 percent in the same period a year ago, according to the latest data from the Financial Services Authority (OJK).

That is higher than the 5 percent healthy NPL level set by financial regulators. Gross NPL surpassing 5 percent triggers special supervision from regulators.

Banks are reducing their lending to commodities-related companies as rising bad loans have forced them to set aside loan loss provision to cushion debt repayment failure, hurting their profits.

Loan growth in the commodity sector declined 13 percent to Rp 120 trillion (US$9.12 billion) by the end of July from the same month last year. That compares with overall annual loan growth of 7.73 percent in July, the lowest level in seven years.

“Bad loans in the mining sector occurred as many of our clients had no cash flow because of the ongoing slump in the mining business in the past few years,” said Roy A. Arfandy, president director of PermataBank.

The lender saw net losses of Rp 836 billion in the first half as its gross NPL rose to 4.6 percent. Bad loans for its mining clients surged to Rp 791.75 billion in July compared to December’s figure. It was forced to set aside a provision of Rp 283.79 billion in the sector, from Rp 62.11 billion, company data shows.

Indonesia’s economy, the largest in Southeast Asia, is blessed with abundant natural resources, including coal and tin. However, as the global economy slumped and remained weak for years, demand for commodities fell along with prices. The government’s raw mineral export ban has also shut down many businesses nationwide.

In the coal sector, persistently low coal prices have hit companies operating in the sector, resulting in loan repayment failure, according to the Indonesian Coal Mining Association (ICMA). Coal is now trading at half of peak value in 2011.

“Some of them went bankrupt,” ICMA executive director Supriatna Suhala said. “In Jambi, for example, there had been 33 coal companies operating in the area, now only two remain.”

Banks have become highly selective in disbursing loans to the commodity sector.

“We are selective in commodity loans because the risk of price fluctuations is our main evaluation factor,” said Royke Tumilaar, corporate banking director of Bank Mandiri.

Bank CIMB Niaga has also become more prudent and selective in disbursing loans to weakening sectors, including mining. Its gross NPL stood at 3.9 percent in the first half.

“We conduct a stress test at least once every six months” CIMB Niaga strategy and finance director Wan Razly wrote in an email to The Jakarta Post.

Overall in the nationwide domestic banking industry, gross NPL surged to 3.18 percent as of July from 2.7 percent in the same period a year ago, OJK data show.

Regulators and analysts seem to look at the glass half full. They believe domestic banks have strong enough capital to cushion rising bad loans and that the future will pan out better.

“NPL can decline at year-end if there is significant loan growth. Based on past experiences, loans always grow in the second half,” OJK commissioner for banking supervision Nelson Tampubolon said.

Global ratings agency Fitch Ratings said most Indonesian banks were sufficiently resilient to withstand weaker commodity prices, as the industry-wide capital adequacy ratio (CAR) stood above 23 percent, more than sufficient.

Pressure will be greater on medium-sized banks with larger mining exposure, but their buffers remain generally adequate with support from their foreign parents, the ratings agency wrote in a recent note.